Report to/Rapport au :

Corporate

Services and Economic Development Committee

Comité des services organisationnels et du développement économique

and Council / et au Conseil

03 November 2009 / le 03 novembre

2009

Submitted by/Soumis par : Nancy Schepers, Deputy City Manager/Directrice

municipale adjointe,

Infrastructure Services and Community Sustainability/Services

d’infrastructure et Viabilité des collectivités

Contact Person/Personne ressource : Johanne Levesque,

Director/Directrice, Community and Sustainability Services/Services de viabilité et des

collectivités

(613) 580-2424 x 12257 Johanne.Levesque@Ottawa.ca

REPORT

RECOMMENDATIONS

That Corporate Services and Economic Development

Committee recommend Council:

1. Approve

the Brownfields Rehabilitation Grant Application submitted by Clydesdale

Shopping Centres Limited, owner of the property at 1357 Baseline Road, for a

Brownfields Rehabilitation Grant not to exceed $3,442,184, payable to

Clydesdale Shopping Centres Limited over a maximum of 10 years, subject to the

establishment of, and in accordance with, the terms and conditions of the

Brownfields Rehabilitation Grant Agreement;

2.

Direct staff to enter into a Brownfields Rehabilitation Grant

Agreement with Clydesdale Shopping Centres Limited establishing the terms and

conditions governing the payment of the Brownfields Rehabilitation Grant, for,

and redevelopment of, 1357 Baseline Road, satisfactory to the Deputy City Manager,

Infrastructure Services and Community Sustainability, the City Clerk and

Solicitor and the City Treasurer; and

3.

That the terms and conditions referred to in Recommendation 2

include the retention of funding until such time as, where a single large

format store is located in the east portion of the site as part of the first

phase of development, that at least two of the six buildings shown on the

concept plan, submitted in support of this Application, are constructed also as

part of the first phase along either Baseline Road or Clyde Avenue frontage and

are completed for occupancy within three years of the commencement of the large

format store.

RECOMMANDATION DU RAPPORT

Le Comité des services

organisationnels et du développement économique recommande que le Conseil :

1.

Donne

son aval à la demande de subvention pour la remise en valeur des friches

industrielles présentée par Clydesdale Shopping Centres Limited, propriétaire du 1357, chemin

Baseline, en vue d’une subvention pour

la remise en valeur des friches industrielles d’au plus 3 442 184 $,

payable à Clydesdale Shopping Centres Limited pendant au plus dix (10) ans, sous réserve de l’adoption des

modalités de cette demande de subvention et conformément à celles‑ci;

2.

Confie

au personnel la tâche de conclure avec Clydesdale Shopping

Centres Limited une entente de

subvention pour la remise en valeur des friches industrielles, dans laquelle seront stipulées les modalités

du versement d’une subvention pour la remise en valeur des friches

industrielles, en vue du réaménagement du 1357, chemin Baseline, à la satisfaction de la directrice municipale

adjointe, Services

d'infrastructure et viabilité des collectivités, du directeur greffier municipal et chef du contentieux et de la

trésorière municipale; et

3.

Que les modalités auxquelles fait

référence la recommandation 2 comprennent las retenue du financement jusqu’à ce

qu’un magasin individuel de grand format soit installé dans la partie est du

site dans le cadre de la première étape du réaménagement, qu’au moins deux des

six bâtiments indiqués sur le plan conceptuel présenté à l’appui de la demande,

soient également construits dans le cadre de la première étape, soit le long du

chemin Baseline, soit en bordure de l’avenue Clyde et qu’ils soient prêts aux

fins d’occupation dans les trois ans suivant le début des travaux du magasin de

grand format.

BACKGROUND

On April 25, 2007 City Council adopted the Brownfields Redevelopment Community Improvement Plan (CIP). Brownfields are abandoned, vacant, or underutilized properties where past actions have resulted in actual or perceived environmental contamination and/or derelict or deteriorated buildings. The Brownfields Redevelopment CIP contains a comprehensive framework of incentive programs including the Rehabilitation Grant Program and the Building Permit Fee Grant Program.

Clydesdale Shopping Centres Limited, has filed an application for a Brownfields Rehabilitation Grant for the clean-up, demolition and redevelopment of 1357 Baseline Road, a 6.22-hectare property that contains a 19,245-square metre, two-storey above grade building (with a basement). The building is the former Laurentian High School built in phases between 1956 and 1997. The property was declared surplus by the Ottawa-Carleton District School Board in 2005. It was acquired by Clyde Baseline Development Inc. (now Clydesdale Shopping Centre Limited) in July 2007.

Phase I and II Environmental Site Assessments were prepared in 2007 by SEACOR Environmental Inc. for the school board in preparation for the sale of the property. SEACOR identified a number of environmental impacts from petroleum-based products under, and in the vicinity of the heating plant (boiler room) located at the east end of the building.

After the property was purchased by Clydesdale Shopping Centres Limited additional subsurface investigations were conducted by Paterson Group Inc. in July and September of 2008. The results confirmed the previous analytical findings and as well delineated the area impacted by petroleum hydrocarbons likely from former underground fuel oil storage tanks located on site.

The soil and groundwater test results are in excess of the applicable Ministry of the Environment (MOE) site standards for commercial development. The recommendations of the Paterson report state that the contaminated soil, bedrock and groundwater must be removed from the site during redevelopment, after the building is demolished.

The existing building, according to a “Designated Substance Survey” report prepared by SEACOR Environmental Inc., contains asbestos in a number of construction materials that must be removed prior to demolition. In addition, lead, mercury, silica, and minor quantities of polychlorinated biphenyls (PCBs) and Chloroflourocarbons (CFCs) were also identified in various parts of the building.

The site qualifies as an eligible "brownfield" under the City's Brownfields CIP.

The purpose of this report is to bring the Rehabilitation Grant application for 1357 Baseline Road before Committee and Council for approval.

DISCUSSION

The Rehabilitation Grant Program is a tax-increment based grant funded through the tax increase that results from redevelopment of the property.

Grants will equal 50 per cent of the City portion of the increase in property taxes that results from the redevelopment, payable annually for up to 10 years, or up to the time when the total grant payments equal the total eligible costs, whichever comes first. The City will only pay the annual grant after property taxes have been paid in full each year.

The Building Permit Fee Grant Program provides an additional incentive in the form of a grant equivalent to 30 per cent of building permit fees paid on a project that has been approved for a Rehabilitation Grant. This grant is paid as a component of the Rehabilitation Grant.

The Clydesdale Shopping Centres Grant Application

The required documents that are to be submitted to the City as part of a Rehabilitation Grant application are described in Document 2. Staff have reviewed the submissions and deemed the application to be complete. The original grant application was filed in November of 2008, but was amended in September of 2009 to reflect a revised site development proposal.

Proposed Remediation

All contaminated soil and bedrock will be excavated from the site for off-site disposal at a Ministry of the Environment licensed landfill facility. Paterson Group Inc. estimates that the amount of contaminated soil and bedrock to be removed from the site is 4,850 tonnes. Approximately 200,000 litres of hydrocarbon-impacted groundwater will be pumped during the excavation program. An MOE licensed pumping contractor will pump any groundwater encountered for offsite disposal.

All asbestos containing materials and, all other hazardous materials identified in the designated substance survey, will be removed and managed as part of the building decommissioning and demolition.

Proposed Redevelopment Scheme

Council approved an amendment to the zoning by-law with a holding provision on October 14, 2009 (Ref N°: ACS2009-ICS-PGM-0131) to permit development of the site as a predominately retail centre with some upper floor space for those buildings proposed to front onto Baseline Road and Clyde Avenue with future potential to accommodate residential and/or more intense office development. The proposed development is focused on providing a stand-alone large format retail store located in the northeast quadrant of the site. The remainder of the site would be framed with buildings with upper floors accommodating approximately 7,620 square metres of office space. The total retail area proposed for the site is approximately 20,400 square metres with the total density proposed reflecting a 0.5 Floor Space Index (FSI).

Part of the requirements to be satisfied for the lifting of the holding provision include a requirement to construct, along with the large format store, two street edge buildings within the first phase. This condition has been tied to the release of any approved brownfields grant funding. The specific requirements from the zoning report (Document 2, 20d as amended by Council and 20e) are:

“20 d) Where a

single large format store is located in the east portion of the site as part of

the first phase of development, that at least two of the six buildings shown on

the concept plan (included as Document 4) shall be constructed also as part of

the first phase along either the Baseline Road or Clyde Avenue frontage. And,

that these buildings be completed for occupancy within three years of the commencement

of construction of the large format store.

20 e) The City will retain brownfields grant funding until the street

edge buildings required by 20 (d) have been completed.”

These site development conditions are reflected in the recommendations of this report since they would require inclusion in the Brownfields Rehabilitation Grant agreement.

Under the Brownfields Rehabilitation Grant program guide the applicant is required to submit various technical documents to determine eligibility and costs eligible for the rehabilitation grant. Staff reviewed the submissions and have determined that the total costs eligible for a Brownfields Rehabilitation Grant are $6,884,368.

A breakdown of the eligible costs is shown in Document 3.

Calculating the Rehabilitation Grant

Because the Ottawa Brownfields CIP specifies that the total of all grants and development charge reduction shall not exceed 50 per cent of the cost of rehabilitating said lands and buildings, the cap on eligible costs is $3,442,184.

Based on the formulas contained within the approved CIP the Rehabilitation Grant is $3,442,184. The detailed calculations are shown in Document 4.

A project of this nature will see development occurring in phases dependent on market conditions. The applicant has indicated that the first phase of the project could commence next year. The whole project could take up to four years to complete. The first phase is to include a large format retail tenant and two retail use buildings comprising about 15,189 square metres of gross floor area in total. The second phase would be comprised of a retail and office component of approximately 8,488 square metres. The final phase would be comprised of an additional 4,849 square metres of retail and office uses.

For the purposes of estimating the possible future municipal tax

increment and the estimated pay-out period it has been assumed for illustrative

purposes that the first phase would be completed within three years as per the

stipulation regarding payment of the grant. The detailed assumptions and the

calculations are shown in Document 5.

The program period is a maximum of 10 years from the first payment or until all eligible costs have been paid by the annual grant, whichever comes first. It is possible that the pay-out would not occur within 10 years of the first payment if the first phase of the project is all that is built at which time the annual municipal payment would end even if the grant has not been paid in full.

Benefits to the Community

Economic Benefits

The overall economic impact of the proposed mixed-use development is estimated at $31 million in direct construction value. During the development of the site, direct and indirect economic benefits to the local economy will be experienced as a result of building demolition, site remediation and the construction period through payroll, purchased material supplies and services and equipment rentals. The economic benefits would span over a period of four years. The project is estimated to create approximately 300 construction jobs, 350 retail jobs and provide office space to accommodate approximately 425 employees.

Over $47 million in new commercial assessment would be added to the property tax assessment roll at full development. Staff estimates that over $134,000 per year in increased municipal property taxes, net of the Brownfields Rehabilitation Grant, can be expected by the end of the first phase of the project.

The project will earn the City nearly $200,000 in present value dollars in building permit fees and other development fees.

ENVIRONMENTAL IMPLICATIONS

The approval of this rehabilitation grant will assist with

the redevelopment of this brownfield property and ensure that this contaminated

site is properly remediated prior to development. A Record of Site Condition (RSC) will be required as per the

funding agreement. Brownfield redevelopment is identified as a key strategy for

promoting reinvestment in existing urban areas and for reducing the need to

expand into greenfield sites. The

remediation and redevelopment of brownfield sites assists in meeting the

Environmental Strategy’s goal of “clean air, water and earth”.

RURAL IMPLICATIONS

N/A

CONSULTATION

N/A

COMMENTS BY THE WARD COUNCILLOR(S)

The Ward Councillor is aware of this application and the staff recommendations.

LEGAL/RISK MANAGEMENT IMPLICATIONS:

There are no legal/risk management impediments to implementing any of the recommendations in this report.

CITY STRATEGIC PLAN

One of the City’s priorities, as a strategic direction, is planning and growth management. An important objective is to respect the existing urban fabric, neighbourhood form and the limits of existing hard services, so that new growth is integrated seamlessly with established communities (Code F2). The zoning amendment (with a holding provision) approved by Council for this site will ensure that this development meets this objective.

TECHNICAL IMPLICATIONS

N/A

FINANCIAL IMPLICATIONS

As per the Brownfields Redevelopment CIP, if this Rehabilitation Grant application is approved, the City would provide the owner with a grant equivalent to 50 per cent of the increase in municipal taxes. In this case, the total maximum grant is $3,442,184. The grant payment would be calculated annually and would be paid per year until the total eligible costs are repaid, or a maximum of 10 years, whichever comes first. At that time the City will begin to collect and retain the full municipal portion of the tax increment.

The City will retain 15 per cent of the municipal tax increment per year to coincide with the grant period until the total eligible costs are repaid. These monies will be deposited into the Municipal Leadership Account. This account would function as a revolving fund (capital account) to be used to support the Brownfields Redevelopment Strategy. The remaining 35 per cent of the municipal tax increment will be applied to the general City budget. No taxes will be rebated in 2010. As approved components of this project come forward the Revenue Division will review rebated tax calculations.

SUPPORTING DOCUMENTATION

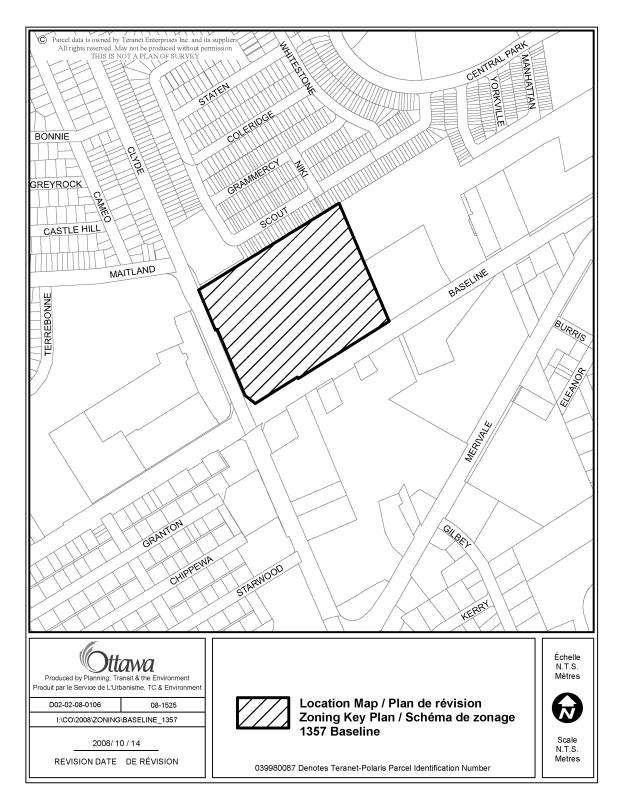

Document 1 General Location Map

Document 2 Rehabilitation Grant Application Requirements

Document 3 Rehabilitation Grant-Eligible Costs

Document 4 Calculating the Rehabilitation Grant and Development Charge Reduction

Document 5 Estimated Future City Property Tax Increment and Annual Municipal Grant Payable

DISPOSITION

City Clerk and Solicitor Department, Legal Services to prepare the Brownfields Rehabilitation Grant Agreement.

Community Sustainability Department and Finance Department, Revenue Branch to develop a general administrative approach to implement the Brownfields Redevelopment financial incentive program and more specifically for this application.

Community Sustainability Department to monitor the performance of this grant application and prepare a status report on this application as part of an annual Brownfields Redevelopment monitoring report to Council.

Community Sustainability Department to notify the applicant of Council’s decision.

REHABILITATION GRANT APPLICATION

REQUIREMENTS DOCUMENT 2

A Brownfields Rehabilitation Grant program guide was prepared as part of the administration of the Brownfields financial incentives program. This program guide provides the detailed requirements to an applicant in order to file a complete application with the City for consideration of financial assistance under this grant program. The applicant is required to submit various technical documents to determine eligibility and costs eligible for the rehabilitation grant. The following documents are required:

- All environmental studies (Phase I ESA, Phase II ESA and Remedial Action Plan);

- Detailed work plan and cost estimate prepared by a qualified person (as defined by the Environmental Protection Act and Ontario Regulation 153/04, as amended), for all eligible environmental remediation and risk assessment/risk management works;

- A cost estimate provided by a bona fide contractor for eligible rehabilitation/redevelopment and demolition costs;

- LEED (Leadership in Energy and Environmental Design) program estimated component costs: a) base plan review by certified LEED consultant; b) preparing new working drawings to the LEED standard; and c) submitting and administering the constructed element testing and certification used to determine the LEED designation;

- A set of detailed architectural/design and/or construction drawings; and

- An estimated post-project assessment value prepared by a private sector property tax consultant.

The applicant (registered owner) or agent acting on behalf of the registered owner is required to fully complete the application including all required signatures and complete the sworn declaration.

The costs eligible for a Brownfields Rehabilitation Grant for 1357 Baseline Road are estimated as follows:

|

|

Eligible

Costs

|

Actual/Estimated Cost |

|

1 |

Environmental studies |

$48,100[1] |

|

2 |

Environmental Remediation |

$700,000 |

|

3 |

Placing Clean fill and grading |

$252,000 |

|

4 |

The following Leadership in Energy and Environmental Design (LEED) Program Components: a) base plan review by a certified LEED consultant b) preparing new working drawings to the LEED standard c) submitting and administering the constructed element testing and certification used to determine the LEED designation |

$74,081 |

|

5 |

Cost of Project Feasibility Study |

$10,000 |

|

6 |

30 per cent of the estimated Building Permit Fee to be paid |

$137,210 |

|

7 |

Building Demolition |

$1,820,498 |

|

8 |

Upgrading on-site infrastructure including water services, sanitary sewers and stormwater management facilities |

$1,503,479 |

|

9 |

Constructing/upgrading eligible off-site infrastructure including roads, water services, sanitary sewers, stormwater management facilities, electrical and gas utilities, where this is required to permit rehabilitation of the property |

$2,339,000 |

|

|

Total Costs

Eligible for a Rehabilitation Grant |

$6,884,368 |

From the above, the total costs eligible for a Brownfields Rehabilitation Grant are $6,884,368.[2]

CALCULATING THE REHABILITATION GRANT DOCUMENT 4

The Ottawa Brownfields CIP specifies that, the total of all grants and development charge reduction shall not exceed 50 per cent of the cost of rehabilitating said lands and buildings.*

|

1 |

Total eligible

Costs- from Document 3 |

$6,884,368 |

|

2 |

Total capping

at 50 per cent of line 1 |

$3,442,184 |

|

3 |

Total Rehabilitation Grant Payable |

$3,442,184 |

* The site is located at 1357 Baseline Road. The location is designated “Arterial Mainstreet” in the City of Ottawa Official Plan. This location would qualify as being in the priority area under the Brownfields CIP and therefore is eligible for a grant equivalent to 50 per cent of the municipal property tax increase that results from the redevelopment, payable annually for up to 10 years, or until the time when the total grant payments equal the total eligible costs whichever comes first.

The total

Rehabilitation Grant payable is $3,442,184 (line 3 above).

ESTIMATED FUTURE CITY PROPERTY TAX INCREMENT AND

ANNUAL MUNICIPAL GRANT PAYABLE

DOCUMENT 5

Pre-Project Property Tax Rates and Property Taxes

Current Value Assessment (2009) on the property at 1357 Baseline is $12,037,250, classed as Commercial (CT). Current property taxes are approximately $441,421[3] broken down as follows:

Table 1

|

Municipal Property Tax portion |

$242,688 |

|

Education Property Tax Portion |

$198,733 |

Total Pre-Project Property Taxes

|

$441,421 |

Based on a post-project assessment valuation prepared by Calloway Real Estate Investment Trust, and revised August 2009 by Clydsale Shopping Centres Limited (Property Taxation Department), as submitted as part of the revised application, it is estimated that once the entire project is complete, the property including all buildings could have a post-project assessment value in excess of $60,000,000.

There are many technical assumptions and variables that are used to project possible future commercial property tax assessments and future property tax estimates. These include consideration of building vacancy rates, expense rates, capitalization rates, income/fair market rents, amount of undeveloped/excess land, appropriate tax classes, tax rates and phase-in assessment values. [4] It is important to note that the final assessment value of the property would be established by the Municipal Property Assessment Corporation.

A project of this nature will see development occurring in phases dependent on market conditions. The applicant has indicated that the first phase of the project could commence next year. The whole project could take up to four years to complete. The first phase is to include a large format retail tenant and two retail use buildings comprising about 15, 189 square metres of gross floor area in total. The second phase would be comprised of a retail and office component of approximately 8,488 square metres. The final phase would be comprised of an additional 4,849 square metres of retail and office uses.

For the purposes of estimating a future municipal tax increment and

the estimated pay-out period it has been assumed for illustrative purposes that

the first phase would be completed within three years as per the stipulation

regarding payment of the grant.

It is important to note that the tax increment is only an estimate and provides guidance on the order of magnitude of the possible payment under the assumption of all buildings being completed, reassessed and taxes levied and paid in this period. The tax rates and all of the assessment valuation parameters are held constant for illustration purposes. In practice the assessed value would increase reflecting increasing tenant property and land values. As well, there would likely be some increase in the annual municipal levy during the projection period.

The administration of the grant program would require that any grants to be paid be based on actual Municipal Property Assessment Corporation (MPAC) property assessment (including any resolution of appeals) of improved properties. The prevailing tax rate would be applied and only after taxes are paid in full for one year and only when the City is satisfied that all terms and conditions have been met as specified in the legal agreement between the City and the applicant would a tax rebate be issued. This rebate would be capped at 50 per cent of the municipal share of the increase in property taxes over the pre-project municipal property taxes paid.

The program period is a maximum of 10 years from the first payment or until all eligible costs have been paid by the annual grant, whichever comes first.

Estimated Annual Post-Project Municipal Property Taxes- After Phase 1

|

Tax Class |

Estimated assessment |

Estimated pro-rated Municipal Tax |

|

Commercial and Shopping Centre |

$29,442,000 |

$558,525 |

Estimated future Municipal Tax Increment = Estimated future municipal tax minus pre-project municipal share of taxes (2009). That is $558,525 (from Table 2) - $242,688 (from Table 1) = $315,837.

Once the future municipal tax increment has been determined based on the 50 per cent grant factor (as set by Council in the CIP) the annual grant could be $157,919. The possible payment schedule is shown in the following table.

In the administration of this grant each row would be calculated every year based on the new assessment, tax rate, taxes paid and actual municipal tax increment to establish the actual grant payment. It is possible that the pay-out would not occur within 10 years of the first payment if the first phase of the project is all that is built at which time the annual municipal payment would end even if the grant has not been paid in full.

Table 3 Estimated Municipal Property Tax Changes if only Phase 1 built

|

Year |

Existing Taxes (2009) |

New Taxes |

Municipal Tax Increment |

50% Grant |

15% to BMLRF* |

Revenue |

|

1 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

2 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

3 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

4 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

5 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

6 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

7 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

8 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

9 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

10 |

$242,688 |

$558,525 |

$315,837 |

$157,919 |

$23,688 |

$134,231 |

|

TOTAL |

$2,426,880 |

$5,585,250 |

$3,158,370 |

$1,579,190 |

$236,880 |

$1,342,310 |

*BMLRF-Brownfields

Municipal Leadership Revolving Fund

|

New municipal property tax portion (tax increment) for years one through 10 |

|

|

Rehabilitation Grant value for years one through 10 |

|

|

Contribution to BMLRF based on tax increment for years one through10 |

$236,880 |

|

Net new

municipal portion of property taxes for years one through 10 |

$1,342,300 |

|

|

|