Report to/Rapport au :

Corporate

Services and Economic Development Committee

Comité des services organisationnels

et du développement économique

and Council / et au Conseil

16 January 2007 / 16 janvier 2007

Submitted

by/Soumis par : Greg Geddes, Chief Corporate Services Officer/

Chef des Services généraux

Contact Person/Personne ressource : Gordon

MacNair, Manager, Real Estate Services

Real Property Asset Management/Gestionnaire, Services immobiliers,

Gestion des biens immobiliers

(613) 580-2424 x21217, Gordon.MacNair@ottawa.ca

|

Ref N°:

ACS2007-CRS-RPM-0001 |

|

SUBJECT: |

DISPOSAL AND SALE OF SURPLUS PROPERTY - |

|

OBJET : |

CESSION ET VENTE D’UNE PROPRIÉTÉ EXCÉDENTAIRE - 150, CHEMIN mONTRÉAL -

1436705 ONTARIO INC. |

REPORT RECOMMENDATIONS

That the Corporate Services and Economic Development Committee

recommend Council:

1. Declare

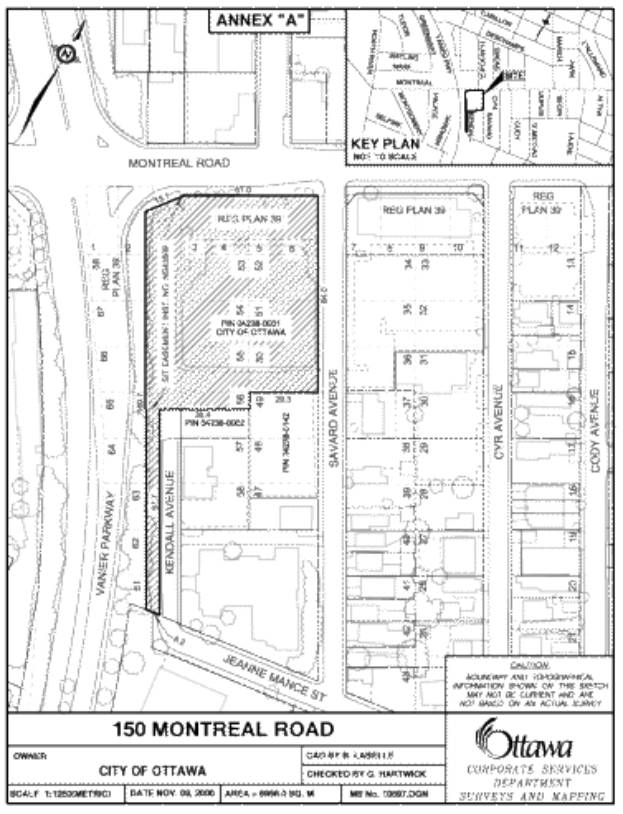

a parcel of land shown on Annex “A” attached, containing approximately 6956.0 m2, being part of

Registered Plan 39 and shown as Parts 1,2,4,5 and 6, Plan 5R-4023

Vanier/Gloucester, in the City of Ottawa, as surplus to the City ’s needs;

2. Approve

the sale of the land described in Recommendation 1 to 1436705 Ontario Inc., for

$850,000.00 plus GST, pursuant to an Agreement of Purchase and Sale that has

been received; and

3. Waive

those internal procedures for the disposal of surplus properties, as set out in

Schedule B of By-law 2002-38, that apply to the internal and external

circulation of surplus properties, potential for housing, and publicly

marketing the property for sale, in respect of the land sale set out in

Recommendation 2.

RECOMMANDATIONS DU

RAPPORT

Que le Comité des services organisationnels et du développement

économique recommande au Conseil :

1. de

déclarer un terrain d’une superficie approximative de 6956,0 mètres carrés,

indiqué à l’Annexe « A » ci-jointe, décrit comme une partie du Plan

enregistré 39 et désigné comme les parties 1, 2, 4, 5 et 6 du Plan 5R-4023

Vanier/Gloucester dans la Ville d’Ottawa, excédentaire aux besoins de la Ville;

2. d’approuver

la vente du terrain décrit dans la recommandation 1 à 1436705 Ontario Inc. pour

la somme de 850 000, 00 $, TPS en sus, conformément à la convention

d’achat-vente reçue;

3. de

surseoir aux procédures internes relatives à la cession de propriétés

excédentaires, telles qu’elles sont énoncées dans l’Annexe B du Règlement

2002-38, qui s’appliquent à la circulation interne et externe des propriétés

excédentaires présentant un potentiel pour la construction de logements ainsi

qu’à la commercialisation dudit terrain relativement à sa vente présentée dans

la recommandation 2.

BACKGROUND

The subject property is a 6956.0 m2 parcel of land, situated at the southeast corner of the intersection of Montreal Road and the Vanier Parkway, as shown on Annex “A” of this report.

In 1978, the former City of Vanier entered into a Downtown Revitalization Agreement with the Province and also Development and Lease Agreements, dated October 1978, with Mastercraft Construction Corporation Ltd. (“Mastercraft”) with respect to this property.

Under the Development Agreement, the City purchased and leased back the property to Mastercraft, according to the terms and conditions of the Lease Agreement (the “Lease”), for a term ending on 31 December 2030. Mastercraft then improved the property with a three-storey, 50,579 sq. ft. building, which originally housed a cinema complex.

The Lease provided favourable terms to Mastercraft as an incentive for undertaking the development of the property, as part of the Downtown Revitalization in the former City of Vanier. This included a provision for the City to pay the land portion of the realty taxes.

1436705 Ontario Inc. (the “company”), as a successor to Mastercraft, now owns the building, which is currently used for medical offices with ground floor retail, and is now the Lessee of the property.

DISCUSSION

The Lease provided an option for the Lessee to purchase the property (the “Option”) that may be exercised any time after 1 January 2001, by the Lessee, by giving written notice to the City on or before 1 June of the year in which the option is to be exercised (the “option year”).

The Lease then defines the purchase price as “the then current market value as may be agreed upon by the Lessor and the Lessee”. It also provides a defined timetable for completing the purchase and sale transaction, once the option has been exercised, with time being of the essence, as follows:

- The purchase price to be negotiated by 1 September of the option year and failing this, for the matter to be resolved through arbitration by 15 November of the option year; and

- The transaction to be closed on or before 31 December of the option year.

On 31 May 2005, the company provided notice in

writing to the City that it had exercised its option to purchase the

property. A meeting was then held on 21

June 2005, between officers of the company and City staff to discuss the

“then current market value of the land”.

At the meeting, the

company officers indicated that they had initiated two appraisals to establish

the land value, based on instructions stemming from a legal opinion from their

solicitor, regarding the meaning of "the then current market value of the

land", as set out in the Lease.

It was then agreed

that, if both parties did not give similar instructions to their respective

appraisers, this would likely result in a substantial difference in the

resulting opinions of current market value of the land.

In order to facilitate the negotiating process

for establishing the market value of the land, the company officers undertook

to provide a copy of their solicitor's legal opinion, to the City by 24 June

2005 and to have the appraisals completed and forwarded to the City, within the

following two week period, together with the company's resulting position as to

the “then current market value of the land”.

From July to November 2005, City staff made

a number of efforts to obtain the above information from the

company. On 29 November 2005, City

staff

notified the company that the City had obtained one appraisal and that it may

not be necessary for the City to obtain another appraisal, depending upon the

estimates of value set out in the reports from the company’s appraisers. Staff indicated that, without the company’s

position as to the value, it was not possible to determine whether there was

any disagreement between the parties as to the land value, and therefore, the

arbitration provisions set out in the Lease Agreement were not yet

applicable. Staff also pointed out the urgent need to establish the purchase

price in order to close the transaction by 31 December 2005.

Early in 2006, the company officers indicated verbally that they still wanted to purchase the property and subsequently, on 31 May 2006, the company wrote to City staff and indicated that:

- A recent legal opinion from the company’s solicitor indicated that, “time was no longer of the essence”, for completing the transaction, since neither party had enforced that provision of the Agreement, and would remain so unless one party, by notice, reinstated that “time is of the essence ”;

- Should the City not be in agreement with that position, then the letter would serve, on a “without prejudice basis”, as a notice that the company was again exercising its Option, as set out in the Lease; and

- The company would forward a report by its appraiser, and a legal opinion letter from its solicitor, by 15 June 2006, with respect to the issue of “then current market value”.

On 15 June 2006, City staff received a copy of the company’s appraisal report that also included a copy of the company solicitor’s legal opinion.

Since City staff had a number of concerns regarding the company’s positions, as set out in its 31 May 2006 letter and the information received from the company on 15 June 2006, these matters were referred by Legal Services on 21 July 2006, to outside counsel to obtain an independent legal opinion.

Real Estate Services also commissioned an independent “peer review” appraisal report, with respect to the company’s appraisal report dated 15 June 2006.

The “peer review” appraisal report was received on 9 August 2006 and the independent legal opinion was received on 28 August 2006.

On 28 August 2006, City staff also notified the company in writing that:

· The City did not agree with company’s legal opinions and appraisal information, provided to the City since 31 May 2006;

· The issues of dispute raised in the independent legal opinion could be forwarded for arbitration, if the company so wished; and

· Notwithstanding the City’s legal position regarding the disputed issues, City staff was still prepared to negotiate a sale of the property, on a “without prejudice basis”, to the City’s legal position regarding the provisions of the Lease.

Between September 2006 and October 2006, City staff and company officers negotiated, on a “without prejudice” basis, to the legal positions of the parties, a value approach that might be used for establishing the purchase price. The City then obtained a further independent appraisal, dated 18 October 2006, based on the negotiated approach.

On 23 October 2006, City staff notified the company in writing that staff could support a purchase price of $850,000.00, based on the estimate of value, set out in the October 2006 appraisal report and taking into account the information provided in the City’s November 2005 appraisal report, the company’s June 2006 appraisal report, and the City’s August 2006 “peer review” appraisal report.

On 6 November 2006, the parties signed an Agreement of Purchase and Sale

that is subject to City Council approval, as per Recommendation #2 of this

report, and on the basis that this Agreement was negotiated on a “without

prejudice” basis, to the legal positions of the parties, in the event that

Council does not give its approval.

Since the subject property is fully developed with improvements owned by

the company and the company has a leasehold interest in the property until 31

December 2030 and the lease contains an option to

purchase, the internal

procedures for the disposal of surplus properties, as set out in Schedule B of

By-law 2002-38, that apply to the internal and external circulation of surplus

properties, potential for housing, and publicly marketing the property for

sale, are not considered appropriate for the disposal of this property. As a result, this report recommends, as per

Recommendation #3, that these procedures be waived with respect to the sale of

this property to the company.

CONSULTATION

As the sale of this property is subject

to the provisions of the Lease, which includes an option to purchase, and the

company’s leasehold interest does not expire until 31 December 2030, internal

and external circulations with respect to this property have not been carried

out in this case. The local Ward

Councillor is aware of this report.

The staff actions and recommendations

related to the disposal and sale of this property, result from staff taking

full account of the independent legal opinion and independent Real Estate appraisals

provided to the City.

ENVIRONMENTAL IMPLICATIONS

As

the subject property is fully developed and has been leased by the City to the

company, and to its predecessors in title since 1978, and as the company is the

owner of the building located on the property, the Agreement of Purchase and

Sale stipulates that the property is being sold by the City on an “as is”

basis, since the City has not had care and control of this property since 1979.

HOUSING FIRST POLICY

The Official Plan policy directs that the City make

land available for affordable housing and give priority for the sale or lease

of surplus City-owned property for this purpose.

The Housing First Policy, approved by Council on 13

July 2005, establishes priority consideration to the Housing Branch, in the

identification of potentially surplus City-owned property, to be used in

achieving the City’s affordable housing program targets. The policy also requires that the Official

Plan target of 25% affordable housing, be met on any City-owned property sold

for residential development. Where

viable, residential properties are disposed of without a condition requiring an

affordable housing component, 25% of the proceeds from the sale are to be credited

to a housing fund, to be used for the development of affordable housing

elsewhere in the City.

The subject property is zoned C2/B-33 - Downtown

Commercial Zone, Medium Density and since the property is also fully developed

and under Lease until 31 December 2030, therefore, it does not meet the

affordable housing criteria, outlined in the Housing First Policy.

FINANCIAL

IMPLICATIONS

This transaction represents revenue of $850,000.00

to the Corporation and will be credited to the City’s Sale of Surplus Land

Account.

SUPPORTING DOCUMENTATION

Attached as Annex “A”, is a sketch showing the

surplus property.

DISPOSITION

Following Council’s approval, Real Property Asset

Management and Legal Services Branches will complete the transaction with the

company.

ANNEX A