Report

to/Rapport au :

Corporate Services and Economic Development Committee

Comité des services organisationnels

et du développement économique

and Council / et au Conseil

14 February 2007 / le 14 février 2007

Submitted by/Soumis

par : Nancy Schepers, Deputy City Manager/

Directrice municipale adjointe

Planning, Transit and the Environment/ Urbanisme,

Transport en commun et Environnement

Contact Person/Personne ressource : Dennis

Jacobs, Director, Planning, Environment and Infrastructure Policy

Planning, Environment and Infrastructure

Policy/Politiques d’urbanisme, d’environnement et d’infrastructure

(613) 580-2424 x25521, dennis.jacobs@ottawa.ca

|

SUBJECT: |

|

|

|

|

|

OBJET : |

REPORT RECOMMENDATION

That the Corporate Services and Economic Development Committee recommend Council resolve to exempt the River Parkway Preschool Centre from development charges as a non-profit corporation under Section 7(s) of the Development Charges By-law 2004-298.

RECOMMANDATION DU

RAPPORT

Que le Comité des

services organisationnels et du développement économique recommande au Conseil

de décider d’exempter River Parkway Preschool Centre des redevances

d’aménagement en tant que société sans but lucratif en vertu de l’article 7(s)

du Règlement sur les redevances d’aménagement 2004-298.

BACKGROUND

Under Section 7(s) of the Development Charges By-law 2004-298, adopted by Council in July 2004, development on land owned by a non-profit corporation may be exempted from development charges where specifically authorized by a resolution of Council.

River Parkway Preschool Centre is located at 30 Cleary Avenue in Kitchissippi Ward of Ottawa and has been operating out of the First Unitarian Church since 1968. This childcare centre is a non-denominational, not-for-profit organization. Due to the age of the building the child care space is currently substandard with many deficiencies. In 2000, the Unitarian congregation acquired land in Bay Ward, adjacent to their existing holdings that was identified as surplus to their needs. River Parkway Preschool Centre submitted a proposal to establish a stand-alone childcare centre to house their existing non-profit childcare program. The proposed development will consist of a one and one-half storey building, containing six play/class rooms, administration, food preparation, utility rooms, and a second storey mezzanine level storage area. A stand-alone childcare centre will be able to offer parenting programs and professional development for staff after hours of operation. The program will serve Toddler, Preschool, Kindergarten and School Age children, with the licensed capacity for 69 spaces. Preliminary work on this project began in 2003 with the majority of the funds being required in 2007. River Parkway Preschool has requested an exemption based on their not-for-profit status.

CONSULTATION

FINANCIAL IMPLICATIONS

The development charges applied to this project were at the institutional rate of $7.40 per square foot. The area of the building addition for the meeting room/class room addition is 12,887 square feet. Therefore, the total estimated development charge payable of $95,364 would be foregone by the City if this request is approved.

An exemption may not be made up through an increase in fees for other categories (DC Act 1997, c.27, s. 5 (6) 3). Any reduction in the DC collections arising from an exemption may result in a shortfall in funding to support growth-related projects. This shortfall will be addressed in the five-year review of the development charge by-law as required by legislation.

SUPPORTING DOCUMENTATION

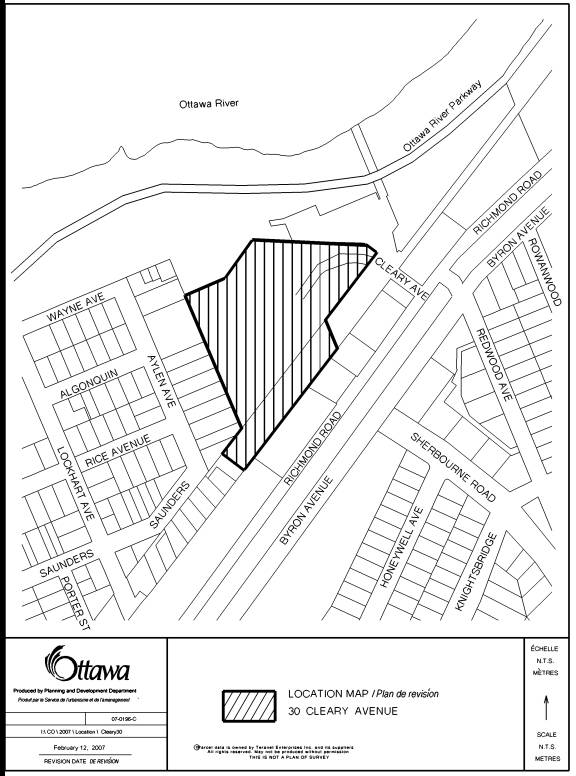

Document 1 General Location Map

DISPOSITION

The Building Services Branch will note that this project is not subject to development charges at such time as a building permit for the project is issued.

DOCUMENT 1

General Location Map