|

12. BROWNFIELDS GRANT APPLICATION-LE ST. DENIS

LIMITED-345 ST. DENIS STREET (FILE NO.F18-04-07-DENI) Demande de subvention pour

la remise en valeur des friches industrielles - entreprise le

saint-denis limitée - 345, rue saint-denis (fichier no f18‑04‑07‑deni) |

Committee RecommendationS

That Council:

1.

Approve the

Brownfields Rehabilitation Grant Application submitted by

Le St. Denis Limited, owner of the property at 345 St. Denis Street,

for a Brownfields Rehabilitation Grant not to exceed $1,760,048,

payable to Le St. Denis Limited over a maximum of ten (10) years, subject to

the establishment of, and in accordance with, the terms and conditions of the

Brownfields Rehabilitation Grant Agreement;

2.

Direct staff to

enter into a Brownfields Rehabilitation Grant Agreement with Le St. Denis

Limited establishing the terms and conditions governing the payment of the

Brownfields Rehabilitation Grant, for, and redevelopment of, 345 St. Denis

Street, satisfactory to the Deputy City Manager, Planning, Transit and the

Environment, the City Solicitor and, the City Treasurer; and

3.

Resolve to exempt

the proposed redevelopment at 345 St. Denis Street by Le St. Denis

Limited from paying future municipal development charges under Section 7(t) of

the Development Charges By-law 298-2004, and under the Guideline for the

Development Charge Reduction Program due to Site Contamination, approved by

Council March 28, 2007.

RecommandationS du comité

Que le Conseil :

1.

Donne

son aval à la demande de subvention pour la remise en valeur des friches

industrielles présentée par l’entreprise Le Saint-Denis Limitée (ci‑après

« l’entreprise »), propriétaire du 345, rue Saint-Denis, en vue d’une

subvention pour la remise en valeur des friches industrielles d’au plus

1 760 048 $, payable à l’entreprise pendant au plus dix

(10) ans, sous réserve de l’adoption des modalités de cette demande de

subvention et conformément à celles‑ci;

2. Confie au personnel la tâche de conclure avec

l’entreprise une entente de subvention pour la remise en valeur des friches

industrielles, dans laquelle seront stipulées les modalités du versement d’une

subvention pour la remise en valeur des friches industrielles, en vue de la

remise en valeur du 345, rue Saint-Denis, à la satisfaction de la directrice

municipale adjointe, Urbanisme, Transport en commun et Environnement, du chef

du Contentieux et de la trésorière municipale; et

3. Veille à dispenser

l’entreprise du versement de redevances d’aménagement ultérieures dans le

réaménagement proposé au 345, rue Saint-Denis, en vertu de l’article 7t)

du Règlement sur les redevances d’aménagement 2004‑298 et des lignes

directrices du Programme de dispense des redevances d’aménagement en cas de

contamination, avalisées par le Conseil le 28 mars 2007.

Documentation

1. DCM’s report (Planning, Transit and the

Environment) dated 29 February 2008 (ACS2008-PTE-ECO-0008).

Report to/Rapport au :

Corporate Services and Economic Development

Committee

Comité des services organisationnels et du développement économique

and Council / et au Conseil

29 February 2008 / le 29 févrièr 2008

Submitted by/Soumis par : Nancy Schepers, Deputy City Manager/

Directrice municipale adjointe,

Planning, Transit and the

Environment/

Urbanisme, Transport en commun et

Environnement

Contact Person/Personne ressource : Rob Mackay, A/Director

Economic

and Environmental Sustainability/

Direction

de la viabilité économique et de la durabilité de l’environnement

(613)

580-2424 x22632, Rob.Mackay@ottawa.ca

REPORT RECOMMENDATIONS

That the Corporate Services and Economic Development Committee

recommend Council:

1. Approve the Brownfields Rehabilitation

Grant Application submitted by Le St. Denis Limited, owner of the

property at 345 St. Denis Street, for a Brownfields Rehabilitation Grant not to

exceed $1,760,048, payable to Le St.

Denis Limited over a maximum of ten (10) years, subject to the establishment

of, and in accordance with, the terms and conditions of the Brownfields

Rehabilitation Grant Agreement;

2. Direct

staff to enter into a Brownfields Rehabilitation Grant Agreement with Le St.

Denis Limited establishing the terms and conditions governing the payment of the

Brownfields Rehabilitation Grant, for, and redevelopment of, 345 St. Denis

Street, satisfactory to the Deputy City Manager, Planning, Transit and the

Environment, the City Solicitor and, the City Treasurer; and

3. Resolve

to exempt the proposed redevelopment at 345 St. Denis Street by

Le St. Denis Limited from paying future municipal development charges

under Section 7(t) of the Development Charges By-law 298-2004, and under the

Guideline for the Development Charge Reduction Program due to Site Contamination,

approved by Council March 28, 2007.

RECOMMANDATIONS DU RAPPORT

Que le Comité des services organisationnels et du développement économique recommande au Conseil :

1. de donner son aval à la demande de subvention pour la remise en valeur des friches industrielles présentée par l’entreprise Le Saint-Denis Limitée (ci‑après « l’entreprise »), propriétaire du 345, rue Saint-Denis, en vue d’une subvention pour la remise en valeur des friches industrielles d’au plus 1 760 048 $, payable à l’entreprise pendant au plus dix (10) ans, sous réserve de l’adoption des modalités de cette demande de subvention et conformément à celles‑ci;

2. de confier au personnel la tâche de conclure avec l’entreprise une entente de subvention pour la remise en valeur des friches industrielles, dans laquelle seront stipulées les modalités du versement d’une subvention pour la remise en valeur des friches industrielles, en vue de la remise en valeur du 345, rue Saint-Denis, à la satisfaction de la directrice municipale adjointe, Urbanisme, Transport en commun et Environnement, du chef du Contentieux et de la trésorière municipale; et

3. de veiller à dispenser l’entreprise du versement de redevances d’aménagement ultérieures dans le réaménagement proposé au 345, rue Saint-Denis, en vertu de l’article 7t) du Règlement sur les redevances d’aménagement 2004‑298 et des lignes directrices du Programme de dispense des redevances d’aménagement en cas de contamination, avalisées par le Conseil le 28 mars 2007.

EXECUTIVE SUMMARY

Assumptions

and Analysis:

Le St. Denis Limited has filed an application for a Brownfields Rehabilitation Grant for the clean-up and adaptive building restoration of 345 St. Denis Street, a 7,500 square metre property that contains a vacant 3,325 square metre two-storey building. The property was formerly occupied by École Cadieux, a junior elementary school built in 1957.

The Phase II Environmental Site Assessment verified that the site (subsoil and groundwater) is contaminated with hydrocarbons from underground furnace oil storage tanks located immediately north of the building. This contamination is also suspected to be under the northeast portion of the building. Soil impacted with heavy metals in excess of Ministry of the Environment (MOE) standards was also discovered.

The existing building contains asbestos on pipe wrap, in floor tiles and in plaster on the masonry.

The quantity and severity of these contaminants is such that the property cannot be used for residential purposes without remediation and cleanup or encapsulation of the contaminated areas.

The site qualifies as an eligible "brownfield" under the City's Brownfields Community Improvement Plan (CIP).

The Rehabilitation Grant Program is a tax-increment based grant funded through the tax increase that results from redevelopment of the property.

Grants will equal 50 per cent of the City portion of the increase in property taxes that results from the redevelopment, payable annually for up to 10 years, or up to the time when the total grant payments equal the total eligible costs, whichever comes first. The City will only pay the annual grant after property taxes have been paid in full each year.

The environmental site assessment, remediation, risk management and LEED[1] program components costs of an approved Rehabilitation Grant may be applied against development charges payable, subject to Council approval. The maximum reduction of development charges is 50 per cent of these cost components.

This application for assistance is based on a remediation plan which is a combination of site cleanup; the encapsulation of the interior asbestos contaminants and; the adaptive restoration and upgrade of the existing structure both to meet current code requirements, and to improve its environmental footprint to meet LEED requirements for renovated buildings.

The City approved a zoning by-law amendment for this property on January 9, 2008. It involves the restoration and reconstruction of the former school building to contain 49 condominium residential apartments. It also includes 19 freehold townhouses.

The total costs eligible for a Brownfields Rehabilitation Grant are $3,786,249, of which $535,404 is the costs eligible for reduction in development charges due to site contamination.

The Brownfields CIP specifies that the total of all grants and development charge reduction shall not exceed 50 per cent of the cost of rehabilitating said lands and buildings, the cap on eligible costs is $1,893,125.

Based on the formulas contained within the approved CIP, the municipal development charges are reduced to 0 and the Rehabilitation Grant is $1,760,048.

Over $17.3 million in new residential assessment would be added to the property tax assessment roll at full development. Staff estimates that over $68,000 per year in increased municipal property taxes, net of the Brownfields Rehabilitation Grant, can be expected at project completion. This is an increase over the current municipal taxes of $10,787 per year.

The project will earn the City over $100,000 in present value dollars in building permit fees and other development fees.

Without remediation and clean up, this site would have been left idle for an indefinite period of time, generating limited tax revenue and being a target for vandalism and impacting neighbouring property values.

Financial

Implications:

If this Rehabilitation Grant application is approved, the City would provide the owner with a grant equivalent to 50 per cent of the increase in municipal taxes. In this case, the total maximum grant is $1,760,048. The grant payment would be calculated annually and would be paid per year until the total eligible costs are repaid, or a maximum of 10 years, whichever comes first. At that time the City will begin to collect and retain the full municipal portion of the tax increment.

The City will retain 15 per cent of the municipal tax increment per year to coincide with the grant period until the total eligible costs are repaid. These monies will be deposited into the Municipal Leadership Account. This account would function as a revolving fund (capital account) to be used to support the Brownfields Redevelopment Strategy. The remaining 35 per cent of the municipal tax increment will be applied to the general City budget. No taxes will likely be rebated in 2008. As approved components of this project come forward in 2009 the Revenue Division will review rebated tax calculations.

A municipal development charge discount is a significant economic incentive for promoting brownfield redevelopment and revitalization. The approval of this report may result in a reduction of an estimated $133,077 in development charge revenues (net of development charge credit, see Document 4) that will not be payable at the time building permits are issued.

Public

Consultation/Input:

N/A

RÉSUMÉ

Hypothèses et analyse :

L’entreprise a présenté une demande

de subvention pour la remise en valeur des friches industrielles en vue du

nettoyage et de la remise en état adaptée du 345, rue Saint-Denis, propriété de

7 500 m2 où se trouve un immeuble vacant de deux étages

d’une superficie de 3 325 m2. Construit en 1957, cet

immeuble abritait jadis l’école primaire Cadieux.

À l’évaluation environnementale de

sites de phase II, on a décelé que ce site (le sous-sol et les eaux

souterraines) était contaminé par des hydrocarbures provenant de réservoirs

souterrains de mazout de chauffage, situés tout juste au nord de l’immeuble.

Cette contamination, soupçonne‑t‑on, s’étendrait également à la

partie nord-est de l’immeuble. En outre, il appert que la teneur en métaux

lourds dans le sol dépasse les normes du ministère de l’Environnement (MDE).

De l’amiante se trouve sur l’isolant

à tuyau, dans le carrelage et dans le plâtre de maçonnerie de l’immeuble.

La teneur de ces contaminants est

telle que la propriété ne peut servir à des fins résidentielles sans qu’il n’y

ait remise en état de même que nettoyage ou encapsulation des zones

contaminées.

Le site répond aux critères de

« friche industrielle », aux termes du Plan d’amélioration

communautaire (PAC) pour le réaménagement des friches industrielles de la

Ville.

Le Programme de subvention pour la

remise en valeur de sites consiste en une subvention axée sur la hausse des

taxes foncières, laquelle résulte du réaménagement de la propriété.

Les subventions correspondront à

50 % de la portion municipale de la hausse des taxes foncières qui

résulteront du réaménagement. Ces subventions seront versées chaque année

pendant au plus dix ans ou jusqu’à ce que le total des versements de subvention

corresponde au total des coûts admissibles, la période la plus courte étant

retenue. La Ville ne versera la subvention annuelle qu’une fois les taxes

foncières acquittées intégralement chaque année.

Les éléments de coût que sont

l’évaluation environnementale du site, l’assainissement, la gestion des risques

et le programme LEED[2]

dans une subvention approuvée en vue de la remise en valeur du site peuvent

s’appliquer aux redevances d’aménagement à verser, sous réserve de

l’approbation du Conseil. La réduction maximale des redevances d’aménagement

correspond à 50 % de ces éléments de coût.

La présente demande d’aide se fonde

sur un plan d’assainissement dans lequel interviennent le nettoyage du site,

l’encapsulation des contaminants intérieurs d’amiante de même que la remise en

état adaptée et la mise à niveau de la structure actuelle. Il s’agit ainsi de

répondre aux exigences actuelles du Code du bâtiment et de réduire

l’empiètement sur l’environnement, aux termes des exigences du programme LEED

ayant trait aux immeubles rénovés.

Le 9 janvier 2008, la

Ville a adopté une modification au règlement du zonage du 345, rue Saint-Denis.

Conformément à cette modification, l’immeuble qui abritait autrefois l’école

sera remis en état ou reconstruit pour y aménager 49 logements résidentiels

en copropriété. Le site comportera également 19 maisons en rangée.

Le montant total des coûts

admissibles à la subvention pour la remise en valeur des friches industrielles

s’établit à 3 786 249 $. De ce montant, la somme de

535 404 $ est admissible aux fins de la réduction des redevances

d’aménagement pour cause de contamination du site.

Compte tenu qu’il est précisé dans

le PAC pour le réaménagement des friches industrielles que le total de

l’ensemble des subventions et dispenses de redevances d’aménagement ne doit pas

dépasser 50 % du coût de remise en valeur des terrains et immeubles en

question, le plafond des coûts admissibles s’établit à

1 893 125 $.

En fonction des formules que

comporte le PAC approuvé, la dispense des redevances d’aménagement est ramenée

à 0 et la subvention en vue de la remise en valeur du site s’établit à

1 760 048 $.

Aux termes de la nouvelle évaluation

résidentielle, plus de 17,3 millions de dollars s’ajouteront au relevé

d’évaluation des impôts fonciers, une fois le projet à maturité. Selon le

personnel, une fois le projet mené à terme, une hausse de plus de

68 000 $ par année aux impôts fonciers municipaux est à prévoir,

après déduction de la subvention pour la remise en valeur de sites. Il s’agit

d’une hausse par rapport aux impôts municipaux actuels de l’ordre de

10 787 $ par année.

En outre, ce projet rapportera à la

Ville plus de 100 000 $ en valeur actuelle sous forme de droits

d’aménagement, notamment les droits de permis de construire.

Faute de travaux d’assainissement ou

de nettoyage, le site serait demeuré indéfiniment dans son état actuel, ce qui

aurait nui aux recettes fiscales de la Ville, entraîné un risque de vandalisme

et abaissé la valeur des propriétés avoisinantes.

Répercussions

financières :

Si la présente demande de subvention

pour la remise en valeur du site est approuvée, la Ville fournira au

propriétaire une subvention correspondant à 50 % de la hausse des taxes

municipales. Dans ce cas‑ci, la subvention maximale s’établira au total à

1 760 048 $. Le versement de cette subvention serait calculé

annuellement puis versé chaque année jusqu’à ce que le total des coûts

admissibles soit repayé, ou au plus pendant dix ans, la période la plus courte

étant retenue. La Ville se mettrait alors à recueillir et à retenir la partie

municipale complète de la hausse de taxe.

La Ville retiendra 15 % de la

hausse de taxe municipale par année en concomitance avec la période visée par

la subvention, jusqu’au remboursement intégral des coûts admissibles. Les fonds

qui en résultent seront déposés dans un compte de leadership municipal. À

l’exemple d’un fonds renouvelable (compte de capital), celui‑ci servira à

appuyer la Stratégie de remise en valeur des friches industrielles. La

proportion restante – 35 % – de la hausse de taxe municipale ira

au budget général de la Ville. Aucune taxe ne fera l’objet d’un remboursement

en 2008. Puisque les éléments approuvés dans le présent projet seront mis de

l’avant en 2009, la Division des recettes passera en revue les calculs des impôts

ayant fait l’objet d’un remboursement.

La diminution des redevances

d’aménagement à l’administration municipale constitue un incitatif économique

considérable dans la promotion du réaménagement et de la revitalisation des

friches industrielles. L’approbation du présent rapport pourrait se traduire

par une réduction des recettes des redevances d’aménagement évaluée à

133 077 $ (nette des crédits des redevances d’aménagement, voir

Document 4) qui ne seront pas payables au moment de la délivrance des permis de

construire.

Consultation

publique / commentaires :

s.o.

BACKGROUND

On April 25, 2007 City Council adopted the Brownfields Redevelopment CIP. Brownfields are abandoned, vacant, or underutilized properties where past actions have resulted in actual or perceived environmental contamination and/or derelict or deteriorated buildings. The Brownfields Redevelopment CIP contains a comprehensive framework of incentive programs including the Rehabilitation Grant Program and the Building Permit Fee Grant Program.

Le St. Denis Limited has filed an application for a Brownfields Rehabilitation Grant for the clean-up and adaptive building restoration of 345 St. Denis Street, a 7,500 square metre property that contains a vacant 3,325 square metre two-storey building. The property was formerly occupied by École Cadieux, a junior elementary school built in 1957. The property was declared surplus by the French Catholic School Board. It was acquired by Le St Denis Limited in June 2007.

The Phase II Environmental Site Assessment prepared by PatersonGroup Inc. verified that the site (subsoil and groundwater) is contaminated with hydrocarbons from underground furnace oil storage tanks located immediately north of the building. This contamination is also suspected to be under the northeast portion of the building. Soil impacted with heavy metals in excess of Ministry of the Environment (MOE) standards was also discovered. Metals, such as lead, are found in a layer of miscellaneous fill, which are the result of historical land-filling activities. The impacted fill is located over a large portion of the site and extends to a depth ranging from between 0.5 and two metres below ground surface.

The existing building, according to a report prepared by Dessau Soprin, ingénierie et construction, contains asbestos on pipe wrap, in floor tiles and in plaster on the masonry.

The quantity and severity of these contaminants is such that the property cannot be used for residential purposes without remediation and cleanup or encapsulation of the contaminated areas.

The site qualifies as an eligible "brownfield" under the City's Brownfields CIP.

The purpose of this report is to bring the Rehabilitation Grant application for 345 St. Denis Street before Committee and Council for approval.

DISCUSSION

The Rehabilitation Grant Program is a tax-increment based grant funded through the tax increase that results from redevelopment of the property.

Grants will equal 50 per cent of the City portion of the increase in property taxes that results from the redevelopment, payable annually for up to 10 years, or up to the time when the total grant payments equal the total eligible costs, whichever comes first. The City will only pay the annual grant after property taxes have been paid in full each year.

The environmental site assessment, remediation, risk management and LEED[3] program components costs of an approved Rehabilitation Grant may be applied against development charges payable, subject to Council approval. The maximum reduction of development charges is 50 per cent of these cost components.

The Building Permit Fee Grant Program provides an additional incentive in the form of a grant equivalent to 30 per cent of building permit fees paid on a project that has been approved for a Rehabilitation Grant. This grant is paid as a component of the Rehabilitation Grant.

The St. Denis Grant Application

The required documents that are to be submitted to the City as part of a Rehabilitation Grant application are described in Document 2. Staff have reviewed the submissions and deemed the application to be complete.

This application for assistance is based on a remediation plan which is a combination of site cleanup; the encapsulation of the interior asbestos contaminants and; the adaptive restoration and upgrade of the existing structure both to meet current code requirements, and to improve its environmental footprint to meet LEED requirements for renovated buildings.

Proposed Remediation and Adaptive Reuse

All contaminated soil will be excavated from the site for off-site disposal at a Ministry of the Environment licensed landfill facility. All of the contaminated material on the site classifies as solid non-hazardous waste. PatersonGroup Inc. estimates that the amount of contaminated material to be removed from the site is 5,000 tonnes. Any contaminated groundwater will be either treated on site or will be pumped by an MOE licensed contractor and disposed off site.

The asbestos on the pipe wrap and tiles in the building will be removed while the inert plaster asbestos will be encapsulated with a new interior drywall and stud structure.

As part of the necessary upgrade, the existing masonry building must be brought up to seismic standards. This will require a substantial structural enhancement including steel reinforcing and bracing to allow the adaptive reuse of the building. Wherever possible existing structure and finishes will be reused in the building. Energy features will be incorporated and the building will be certified under the LEED program.

Proposed Redevelopment Scheme

The City approved a zoning by-law amendment for this property on January 9, 2008. It involves the restoration and reconstruction of the former school building to contain 49 condominium residential apartments. It also includes 19 freehold townhouses.

Rehabilitation Grant-Eligible

Costs

Under the Brownfields Rehabilitation Grant program guide the applicant is required to submit various technical documents to determine eligibility and costs eligible for the rehabilitation grant. Staff reviewed the submissions and have determined that the total costs eligible for a Brownfields Rehabilitation Grant are $3,786,249, of which $535,404 is the costs eligible for reduction in development charges due to site contamination.[4]

A breakdown of the eligible costs is shown in Document 3.

Calculating the Rehabilitation Grant and Development Charge Reduction

Because the Ottawa Brownfields CIP specifies that the total of all grants and development charge reduction shall not exceed 50 per cent of the cost of rehabilitating said lands and buildings, the cap on eligible costs is $1,893,125.

Based on the formulas contained within the approved CIP, the municipal development charges are reduced to 0 and the Rehabilitation Grant is $1,760,048. The detailed calculations are shown in Document 4.

For the purposes of estimating the possible future municipal tax increment and the estimated pay-out period it has been assumed that all of the development components would be completed by 2009. The actual development may see elements of each of the components completed and occupied after this period. The detailed assumptions and the calculations are shown in Document 5.

The program period is a maximum of 10 years from the first payment or until all eligible costs have been paid by the annual grant, whichever comes first. It is possible that the pay-out would not occur within 10 years of the first payment at which time the annual municipal payment would end even if the grant has not been paid in full.

Without remediation and clean up, this site would have been left idle for an indefinite period of time, generating limited tax revenue and being a target for vandalism and impacting neighbouring property values.

Benefits

to the Community

Economic Benefits

The overall economic impact of the proposed development is estimated at $16.2 million in direct construction value spread over 19 townhouses and 49 apartments. Both direct and indirect economic benefits to the local economy will be realized during the remediation and construction period through payroll, purchased material supplies and services and equipment rentals. The economic benefits would span over the estimated 10-month remediation and construction period. It is estimated that during the construction period approximately 130 person years of direct employment and 227 person years of indirect employment would be created by this project.

After occupancy, there would be an injection of new goods and service spending in the businesses in the immediate area along Montreal Road as well as Beechwood Avenue.

Over $17.3 million in new residential assessment would be added to the property tax assessment roll at full development. Staff estimates that over $68,000 per year in increased municipal property taxes, net of the Brownfields Rehabilitation Grant, can be expected at project completion. This is an increase over the current municipal taxes of $10,787 per year.

The project will earn the City over $100,000 in present value dollars in building permit fees and other development fees.

City Strategic Directions

One of the City’s strategic directions is to integrate new growth seamlessly with established communities.

In general, residential intensification assists the City’s overall smart-growth urban management objectives by placing less of an emphasis on the expansion of service boundary (into greenfields) and more of an emphasis on the utilization of existing municipal infrastructure investments. The proposed retrofit of the school building to contain 49 apartments, in combination with the 19 freehold townhouses, is an excellent example of urban infill that blends seamlessly with the surrounding community. The scale and massing of the project ensures that it strengthens and compliments the neighbourhood building fabric which is currently a mixture of single detached houses, converted dwellings containing multiple units and small walk-up apartments. The range of housing also matches well with the local demand for both family and empty nester housing. Renewal of older neighbourhoods is necessary to broaden the housing mix and ensure choice for all household types thereby reducing the need to move.

The location of the development puts it within easy walking distance of shopping and community facilities and recreation (Nault Park and Richelieu Park). The site is served by local transit along Granville Avenue and is within 340 metres of Montreal Road where express transit service is available. In addition, as part of this development provision is being made for VRTUCAR (a car sharing service) on the site with all new owners receiving their first year’s membership in VRTUCAR with the purchase of their unit along with a new bicycle as an inducement to reducing the project’s reliance on the private automobile.

In general, encouraging residential intensification of brownfield sites can also have many positive economic, social, and environmental benefits to the surrounding neighbourhood and local economy.

ENVIRONMENTAL ImPLICATIONS

From an environmental perspective, this project exemplifies the principles of sustainable development and addresses the policies of the Environmental Strategy. Its location within an established neighbourhood ensures immediate access to hard and soft services already in place and broadens the base for future support of these services. By striving to achieve a LEED standard, it is assured that the environmental footprint of the overall project will be minimized.

The approval of this rehabilitation grant will encourage the redevelopment of this brownfield property and ensure that this contaminated site is properly assessed and remediated prior to development. Brownfield redevelopment is identified as a key strategy for promoting reinvestment in existing urban areas and for reducing the need to expand into greenfield sites. The remediation and redevelopment of brownfield sites assists in meeting the Environmental Strategy’s goal of “clean air, water and earth”.

CONSULTATION

N/A

FINANCIAL IMPLICATIONS

As per the Brownfields Redevelopment CIP, if this Rehabilitation Grant application is approved, the City would provide the owner with a grant equivalent to 50 per cent of the increase in municipal taxes. In this case, the total maximum grant is $1,760,048. The grant payment would be calculated annually and would be paid per year until the total eligible costs are repaid, or a maximum of 10 years, whichever comes first. At that time the City will begin to collect and retain the full municipal portion of the tax increment.

The City will retain 15 per cent of the municipal tax increment per year to coincide with the grant period until the total eligible costs are repaid. These monies will be deposited into the Municipal Leadership Account. This account would function as a revolving fund (capital account) to be used to support the Brownfields Redevelopment Strategy. The remaining 35 per cent of the municipal tax increment will be applied to the general City budget. No taxes will likely be rebated in 2008. As approved components of this project come forward in 2009 the Revenue Division will review rebated tax calculations.

A municipal development charge discount is a significant economic incentive for promoting brownfield redevelopment and revitalization. The approval of this report may result in a reduction of an estimated $133,077 in development charge revenues (net of development charge credit, see Document 4) that will not be payable at the time building permits are issued.

The reduction may not be made up through an increase in fees for other categories (Development Charges Act, 1997, S.O. 1997, c. 27, s. 5(6) para. 3). Any reduction in the Development Charge collections arising from an exemption may result in a shortfall in funding to support growth-related projects. This shortfall will be addressed in the five-year review of the development charge by-law as required by legislation.

SUPPORTING DOCUMENTATION

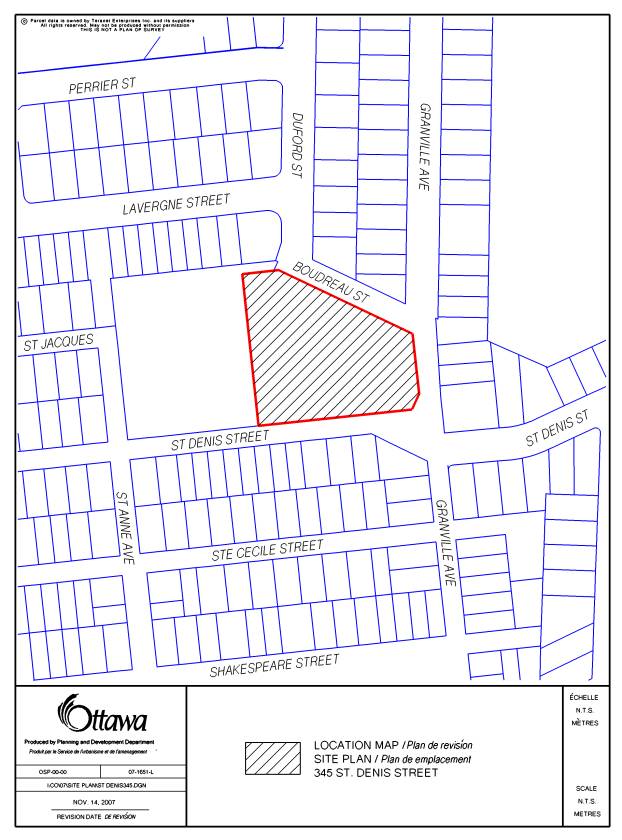

Document 1 General

Location Map

Document 2 Rehabilitation

Grant Application Requirements

Document 3 Rehabilitation

Grant-Eligible Costs

Document 4 Calculating the Rehabilitation Grant and Development Charge Reduction

Document 5 Estimated Future City Property Tax Increment and Annual Municipal Grant Payable

DISPOSITION

Legal Services Branch, to prepare the Brownfields Rehabilitation Grant Agreement.

Planning, Transit and the Environment Department, Building Code Services Branch will be notified that the properties are not required to pay municipal development charges at the time of building permit issuance.

Planning, Transit and the Environment Department and City Manager’s Office, Financial Services Branch to develop a general administrative approach to implement the Brownfields Redevelopment financial incentive program and more specifically for this application.

Planning, Transit and the Environment Department to monitor the performance of this grant application and prepare a status report on this application as part of an annual Brownfields Redevelopment monitoring report to Council.

Planning, Transit and the Environment Department to notify the solicitor (Daniel C. Fernandes, 418 Preston Street, Ottawa, ON K1S 4N2) of Council’s decision.

DOCUMENT 2

REHABILITATION

GRANT APPLICATION REQUIREMENTS

A Brownfields Rehabilitation Grant program guide was prepared as part of the administration of the Brownfields financial incentives program. This program guide provides the detailed requirements to an applicant in order to file a complete application with the City for consideration of financial assistance under this grant program. The applicant is required to submit various technical documents to determine eligibility and costs eligible for the rehabilitation grant. The following documents are required:

- All environmental studies (Phase I ESA, Phase II ESA, Remedial Action Plan and Risk Assessment);

- LEED (Leadership in Energy and Environmental Design) program estimated component costs: a) base plan review by certified LEED consultant; b) preparing new working drawings to the LEED standard; and c) submitting an administering the constructed element testing and certification used to determine the LEED designation;

- Detailed work plan and cost estimate prepared by a qualified person (as defined by the Environmental Protection Act and Ontario Regulation 153/04, as amended, for all eligible environmental remediation and risk assessment/risk management works;

- A cost estimate provided by a bona fide contractor for eligible rehabilitation/redevelopment and demolition costs;

- A set of detailed architectural/design and /or construction drawings; and

- An estimated post-project assessment value prepared by a private sector property tax consultant.

The applicant (registered owner) or agent acting on behalf of the registered owner is required to fully complete the application including all required signatures and complete the sworn declaration.

The costs eligible for a Brownfields Rehabilitation Grant for 345 St. Denis Street are estimated as follows:

|

|

Eligible

Costs

|

Actual/Estimated Cost |

|

1 |

Environmental studies |

$27,634[5] |

|

2 |

Environmental Remediation |

$396,970 |

|

3 |

Placing Clean fill and grading |

$14,600 |

|

4 |

Installing enviro/engineering controls as specified in work plan/risk assessment |

$0 |

|

5 |

Monitoring, maintaining, operating engineering works as specified in work plan/risk assessment |

$35,000 |

|

6 |

Environmental Insurance Premiums |

$0 |

|

7 |

The following Leadership in Energy and

Environmental Design (LEED) Program Components: a)

base

plan review by a certified LEED consultant; b)

preparing

new working drawings to the LEED standard c)

submitting

and administering the constructed element testing and certification used to

determine the LEED designation |

$61,200 |

|

|

Total Costs eligible for DC

reduction due to site contamination |

$535,404 |

|

8 |

Cost of Project Feasibility Study |

$10,000 |

|

9 |

30 per cent of the estimated Building Permit Fee to be paid |

$24,478 |

|

10 |

Building Demolition |

$125,500 |

|

11 |

Building Rehabilitation and Retrofit works |

$2,775,840 |

|

12 |

Upgrading on-site infrastructure including water services, sanitary sewers and stormwater management facilities |

$315,027 |

|

13 |

Constructing/upgrading off-site infrastructure where required to permit remediation, rehabilitation of the property |

$0 |

|

|

Total Costs Eligible for a

Rehabilitation Grant |

$3,786,249 |

From the above, the total costs eligible for a Brownfields Rehabilitation Grant are $3,786,249, of which $535,404 is the costs eligible for reduction in development charges due to site contamination.[6]

DOCUMENT

4

CALCULATING THE REHABILITATION

GRANT AND DEVELOPMENT CHARGE REDUCTION

The Ottawa Brownfields CIP specifies that, the total of all grants and development charge reduction shall not exceed 50 per cent of the cost of rehabilitating said lands and buildings.

|

1 |

Total eligible Costs- from Document 3 |

$3,786,249 |

|

2 |

Total capping at 50 per cent of line 1 |

$1,893,125 |

|

3 |

Estimated Development Charges (DC) |

$133,077[7] |

|

4 |

Total costs eligible for DC reduction from Document 3 –total of items

1to 7 |

$535,404 |

|

5 |

Capping at 50 per cent of line 4-development charge reduction* |

$267,770 |

|

6 |

Development charge is reduced by the amount in line 5 (line 3-line

5)** |

0 |

|

7 |

Eligible cost cap is reduced by DC reduction (line 2-line 3) |

$1,760,048 |

|

8 |

Total Rehabilitation Grant Payable |

$1,760,048 |

* The maximum reduction of development charges is 50 per cent of the cost components of line 4 if the site is located in the priority area. The site is located approximately 341 metres from Montreal Road, which is a “Transit Priority Corridor” and “Future Rapid Transit Corridor”. This location would qualify as being in the priority area under the Brownfields CIP and therefore is eligible for the 50 per cent maximum reduction.

**The environmental site assessment, remediation and risk management and LEED program certification cost components of an approved Rehabilitation Grant may be applied against development charges payable, subject to Council approval. Since the capped amount of eligible costs (from line 5) for the development charge reduction exceeds the estimated development charges (from line 3) to be paid the development charges would be reduced to 0.

The development charge is reduced to 0

(line 6 above).

The total Rehabilitation Grant

payable is $1,760,048

(line 8 above).

DOCUMENT

5

ESTIMATED FUTURE CITY

PROPERTYTAX

INCREMENT

AND ANNUAL

MUNICIPAL GRANT PAYABLE

Pre-Project Property Tax Rates and Property Taxes

Current Value Assessment (2007) on the property at 345 St. Dennis is $1,159,000, classed as Residential (RT). Current annualized property taxes are approximately $13,846.98[8] broken down as follows:

Table 1

|

Municipal Property Tax portion |

$10,787.13 |

|

Education Property Tax Portion |

$3,059.76 |

Total Pre-Project Property Taxes

|

$13,848.98 |

Property taxes are paid in full.

Based on the post-project assessment valuation prepared by Rheaume, Williams, Kalbfleish, chartered accounts[9], as submitted as part of the application, it has been estimated that once the entire project is complete, the property including all buildings will have a post-project assessment value of approximately $18,477,000 (2009$).

The breakdown is as follows:

|

19 townhomes (freehold) |

$5,961,000 |

|

Condo building 49 units |

$12,516,100 |

|

TOTAL

post construction assessment value |

$18,477,000 |

For the purposes of estimating the future municipal tax increment and the estimated pay-out period it has been assumed that all of the above components would be completed by 2009. The actual development may see elements of each of the components completed and occupied after this period but the table below would indicate the situation if the site were to be finished in 2009.

It is important to note that the tax increment is an estimate and provides guidance on the order of magnitude of the possible payment under the assumption of all buildings being completed, reassessed and taxes levied and paid in 2009. The tax rate (2007) and assessed values (2009) are held constant for illustration purposes. In practice the assessed value of the units would likely increase reflecting increasing property values to reflect the existing MPAC reassessment term. As well, there would likely be some increase in annual municipal taxes during the projection period.

The administration of the grant program would require that any grants to be paid be based on actual Municipal Property Assessment Corporation (MPAC) property assessment (including any resolution of appeals) of improved properties. The prevailing tax rate would be applied and only after taxes are paid in full for one year and only when the City is satisfied that all terms and conditions have been met as specified in the legal agreement between the City and the applicant would a tax rebate be issued. This rebate would be capped at 50 per cent of the municipal share of the increase in property taxes over the pre-project municipal property taxes paid.

The program period is a maximum of 10 years from the first payment or until all eligible costs have been paid by the annual grant, whichever comes first.

Annual Post-Project Property Tax Rates and Municipal Property Taxes

|

Dwelling Type |

Estimated assessment |

Municipal tax rate |

Estimated Municipal Tax |

|

19 townhomes * |

$5,961,000 |

0.9307% |

$55,479 |

|

49 apartments ** |

$12,516,100 |

0.9307% |

$116,486 |

|

TOTAL |

$18,477,000 |

|

$171,965 |

*Tax Class RT (Residential). **Tax Class NT (New Multi-Residential)

Note: New Multi-Residential (NT) and tax class RT have the same tax rates for 2007.

Estimated future Municipal Tax Increment = Estimated future municipal tax minus pre-project municipal share of taxes (2007). That is $171,965 (from Table 2) - $10,787 (from Table 1) = $161,178.

Once the future municipal tax increment has been determined based on the 50 per cent grant factor (as set by Council in the CIP) the annual grant could be $80,589. The possible payment schedule is shown in the following table.

In the administration of this grant each row would be calculated every year based on the new assessment, tax rate, taxes paid and actual municipal tax increment to establish the actual grant payment. It is possible that the pay-out would not occur within 10 years of the first payment at which time the annual municipal payment would end even if the grant has not been paid in full.

Table 4 Estimated Municipal Property Tax Changes

|

Year |

Existing Taxes |

New Taxes |

Municipal Tax Increment |

50% Grant |

15% to BMLRF* |

Revenue |

|

1 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

2 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

3 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

4 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

5 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

6 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

7 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

8 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

9 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

10 |

$10,787 |

$171,965 |

$161,178 |

$80,589 |

$12,008 |

$68,501 |

|

TOTAL |

$107,870 |

$1,719,650 |

$1,611,780 |

$805,890 |

$120,880 |

$685,010 |

*BMLRF-Brownfields Municipal Leadership Revolving

Fund

|

New municipal property tax portion (tax increment) for years one through 10 |

$1,611,780 |

|

Rehabilitation Grant value for years one through 10 |

$805,890 |

|

Contribution to BMLRF based on tax increment for years one through10 |

$120,880 |

|

Net new municipal portion of

property taxes for years one through 10 |

$685,010 |

|

|

|