|

3. 2009 DEVELOPMENT CHARGES BY-LAW REVIEW: POLICY

FRAMEWORK

EXAMEN DE 2009 DU RÈGLEMENT MUNICIPAL SUR LES

REDEVANCES D'AMÉNAGEMENT : CADRE STRATÉGIQUE

|

Committee recommendations as

amended

That Council approve the policy framework

underlying the update of the Development Charges Background Study as detailed

in this report.

1. That Development Charge By-law be used to recover the full

costs of eligible infrastructure;

2. That the costs continue to be allocated on a city-wide and

area specific basis per Document 1 of this report;

3. That the distribution of arterial and collector road

servicing costs be allocated based on Vehicle Kilometres Travelled (VKT);

4. That the annual indexing of the

various DC rates be adjusted to correspond to the date of the new Development

Charge By-law adoption in 2009;

5. That the transition period for

applying the new DC rates to building permits, that have been filed with the

City prior to passage of the new by-law, be extended to December 31, 2009;

6. That going forward with the new

Development Charges By-law, a cash-flow analysis be undertaken to determine the

residential and non-residential charges;

7. That the repayment of front-ended

projects be based on the schedule of timing identified in the cash-flow analysis;

8. That redevelopment credits expire

five years after the issuance of a demolition permit.

RecommandationS modifiÉeS du Comité

Que le Conseil approuve le cadre stratégique sous-tendant la mise à jour

de l’étude préliminaire sur les redevances d’aménagement, comme il est expliqué

en détail dans le présent rapport :

1. que

le Règlement municipal sur les redevances d'aménagement serve à recouvrer la

totalité des coûts des aménagements admissibles;

2. que

les coûts continuent d'être répartis en fonction de l'ensemble de la ville et

des secteurs particuliers, conformément au document 1 du présent rapport;

3. que

la répartition des coûts de soutien des artères et des routes collectrices

principales soit basée sur le nombre de véhicules-kilomètres;

4. que l'indexation annuelle des divers

tarifs de redevances d'aménagement soit ajustée de manière à concorder avec la

date d'adoption du nouveau Règlement municipal sur les redevances d'aménagement

en 2009;

5. que la période de transition pour

l'application des nouveaux tarifs de redevances d'aménagement aux permis de

construire demandés à la Ville avant l'adoption du nouveau règlement municipal

soit prolongée jusqu'au 31 décembre 2009;

6. que dorénavant, le Règlement sur les

redevances d'aménagement exige qu'une analyse des flux d'encaisse soit

effectuée afin de déterminer les redevances d'aménagement résidentiel et non

résidentiel;

7. que le remboursement des projets

financés par anticipation soit basé sur le calendrier établi dans l'analyse des

flux d'encaisse;

8. que

les crédits au réaménagement expirent cinq ans après la délivrance du permis de

démolir.

Documentation

1.

Deputy

City Manager's report, Infrastructure Services and Community Sustainability,

dated 17 February 2009 (ACS2009-ICS-CCS-0002).

2.

Extract

of Draft Minutes, 24 February 2009.

Report to/Rapport au :

Planning and Environment Committee

Comité de l’urbanisme et de l’environnement

and Council / et au Conseil

17 February 2009 / le 17 février

2009

Submitted

by/Soumis par : Nancy

Schepers, Deputy City Manager

Directrice municipale adjointe

Infrastructure Services and

Community Sustainability

Services d’infrastructure et Viabilité des

collectivités

Contact

Person/Personne-ressource : Rob Mackay, Acting Director/Directeur intérimaire,

Community Sustainability Services/Services de viabilité des collectivités

(613)

580-2424 x22632, Rob.Mackay@ottawa.ca

|

|

Ref N°: ACS2009-ICS-CSS-0002

|

SUBJECT:

|

2009 DEVELOPMENT CHARGES BY-LAW

REVIEW: POLICY FRAMEWORK

|

|

|

|

OBJET :

|

EXAMEN DE

2009 DU RÈGLEMENT MUNICIPAL SUR LES REDEVANCES D'AMÉNAGEMENT : CADRE

STRATÉGIQUE

|

REPORT

RECOMMENDATIONS

That the Planning and Environment Committee recommend

Council approve the policy framework underlying the update of the Development

Charges Background Study as detailed in this report.

1. That Development Charge By-law be used to recover the full

costs of eligible infrastructure;

2. That the costs continue to be allocated on a city-wide and

area specific basis per Document 1 of this report;

3. That the distribution of arterial and collector road

servicing costs be allocated based on Vehicle Kilometres Travelled (VKT);

4. That non-statutory exemptions, unless they promote smart

growth or affordable housing, be

discontinued two-years after the passage of the by-law;

5. That the annual indexing of the various dc rates be adjusted

to correspond to the date of the new Development Charge By-law adoption in

2009;

6. That the transition period for applying the new DC rates to

building permits, that have been filed with the City prior to passage of the

new by-law, be extended to December 31, 2009;

7. That going forward with the new Development Charges By-law,

a cash-flow analysis be undertaken to determine the residential and

non-residential charges;

8. That the repayment of front-ended projects be based on the

schedule of timing identified in the cash-flow analysis;

9. That redevelopment credits expire five years after the

issuance of a demolition permit.

RECOMMANDATIONS DU RAPPORT

Que le Comité de l’urbanisme et de l’environnement recommande

au Conseil d’approuver le cadre stratégique sous-tendant la mise à jour de

l’étude préliminaire sur les redevances d’aménagement, comme il est expliqué en

détail dans le présent rapport :

1. que le Règlement

municipal sur les redevances d'aménagement serve à recouvrer la totalité des

coûts des aménagements admissibles;

2. que les coûts continuent

d'être répartis en fonction de l'ensemble de la ville et des secteurs

particuliers, conformément au document 1 du présent rapport;

3. que la répartition des

coûts de soutien des artères et des routes collectrices principales soit basée

sur le nombre de véhicules-kilomètres;

4. que les exemptions non

législatives, sauf celles qui favorisent la croissance intelligente ou le

logement abordable, soient supprimées deux ans après l'adoption du règlement

municipal;

5. que l'indexation

annuelle des divers tarifs de redevances d'aménagement soit ajustée de manière

à concorder avec la date d'adoption du nouveau Règlement municipal sur les

redevances d'aménagement en 2009;

6. que la période de

transition pour l'application des nouveaux tarifs de redevances d'aménagement

aux permis de construire demandés à la Ville avant l'adoption du nouveau

règlement municipal soit prolongée jusqu'au 31 décembre 2009;

7. que dorénavant, le

Règlement sur les redevances d'aménagement exige qu'une analyse des flux

d'encaisse soit effectuée afin de déterminer les redevances d'aménagement

résidentiel et non résidentiel;

8. que le remboursement des

projets financés par anticipation soit basé sur le calendrier établi dans

l'analyse des flux d'encaisse;

9. que les crédits au

réaménagement expirent cinq ans après la délivrance du permis de démolir.

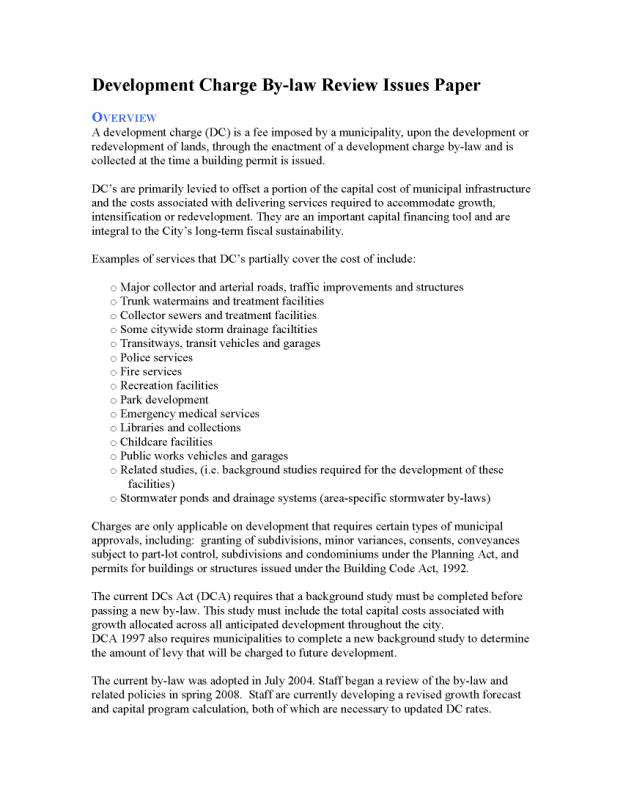

BACKGROUND

The Development Charges Act, 1997 (DCA)

received Royal Assent December 8, 1997.

According to the Act, when municipalities adopt a development charge

by-law, it must be supported by a background study that estimates the amount,

type and location of development; includes a calculation for each municipal

service included in the development charge (e.g. growth/non-growth split,

residential/non-residential split, capacity in existing systems), and an

examination, for each service, of the long-term capital and operating costs for

the capital infrastructure required and other information that is deemed

relevant. The DCA also states that

municipalities, wanting to impose development charges, must update and complete

a new background study to determine development charges within a five-year

period of the existing by law in-force date.

Therefore, the City of Ottawa must pass new development charge by-laws

by July 2009 when its various by-laws expire.

The upcoming adoption of the City’s revised Official Plan and related

Transportation and Infrastructure Master Plans will establish a new vision for

determining capital priorities based on current growth projections.

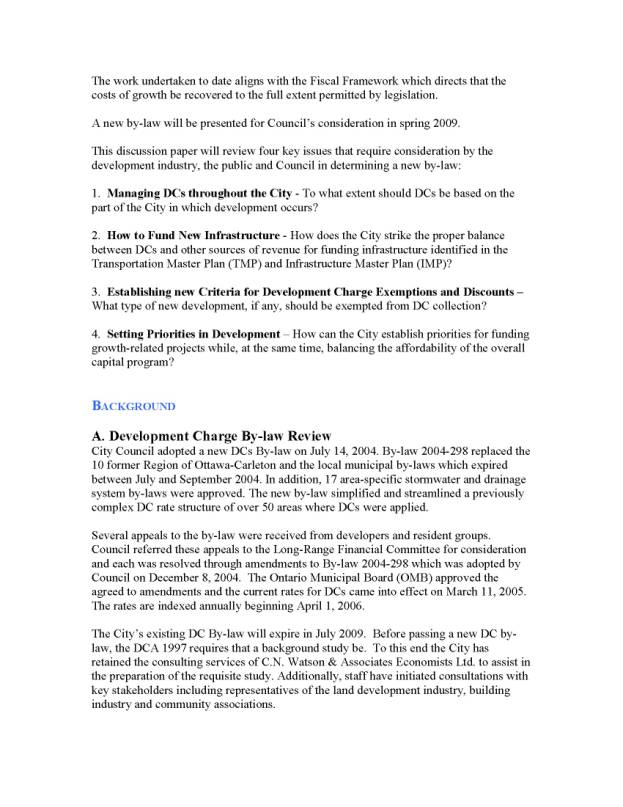

DISCUSSION

This report is designed to

initiate the policy discussion required in producing a revised development

charges background study and by-law.

Staff and the consultant have established various components of the

policy framework and calculation methodology proposed to be incorporated into

the revised study. The following

outlines several of the key principles and approaches required in calculating

the new set of charges that are tailored to the City’s specific requirements.

Calculation Framework

a) The Development Charge (DC) By-law will

be used to recover the full costs of anticipated development.

One of the Guiding Principles

passed as part of the Fiscal Framework-2007 is that growth should pay for

itself to the full extent allowed by legislation and not be subsidized by

property taxes and utility rates.

Staff, as part of the completion of the DC background study, will

undertake a review of the quantum of both the residential and non-residential

development charge rates based on the Council approved growth forecast

(population/employment projections).

The overall goal will be to collect development charges to fund the

forecasted total growth-related capital program for the provision of eligible

services. The City's list of categories

of services includes: Roads, Sanitary Sewers, Water, Stormwater, Fire, Police,

Public Transit, Parks, Recreation, Libraries, Child Care, Paramedic Services,

Public Works, and Studies. In addition,

a new service category has been included for the provision of Social Housing. Municipal services which continue to be

ineligible for DC funding include cultural facilities e.g. museums, theatres

and art galleries; tourism facilities e.g. convention centres; parkland

acquisition, including woodlots and environmentally sensitive areas; hospitals;

waste management services; and general administrative headquarters.

In 2006, the Province of Ontario

amended the DCA to allow the Region of York and City of Toronto to increase the

DC funding available to offset the costs of Toronto/York Subway Extension. The two innovative financing strategies

granted by the Province were: basing the planned level of service on future

requirements rather than on the average level of service in the ten years prior

to the study and exempting the Toronto/York Subway Extension from the

requirement for a 10 per cent mandatory municipal contribution. In the fall of 2008, the Province of Ontario

decided not to amend the DCA to also allow other municipalities the ability to

use these financial strategies to increase the amount of DC funding associated

with implementing similar transit service expansions.

b) The study will incorporate objectives

contained in the Official Plan update, Transportation, and Infrastructure

Master Plan reviews to be completed in early 2009.

The structure of the development

charge by-law(s) will continue to be used to contribute to the implementation

of policies such as the encouragement of compact development, use of existing

infrastructure, encouragement of mixed-use development, and concentration of

rural growth in villages. The master

plans will also contain updated estimates of project timing and detailed

construction costs. Although in the recently completed analysis by Hemson

Consulting it suggests there is a municipal deficit in servicing village

development, staff believe this represents good land use planning that prevents

ribbon development, etc.

c) The calculation methodology will

continue to align the servicing characteristic and geography of Ottawa

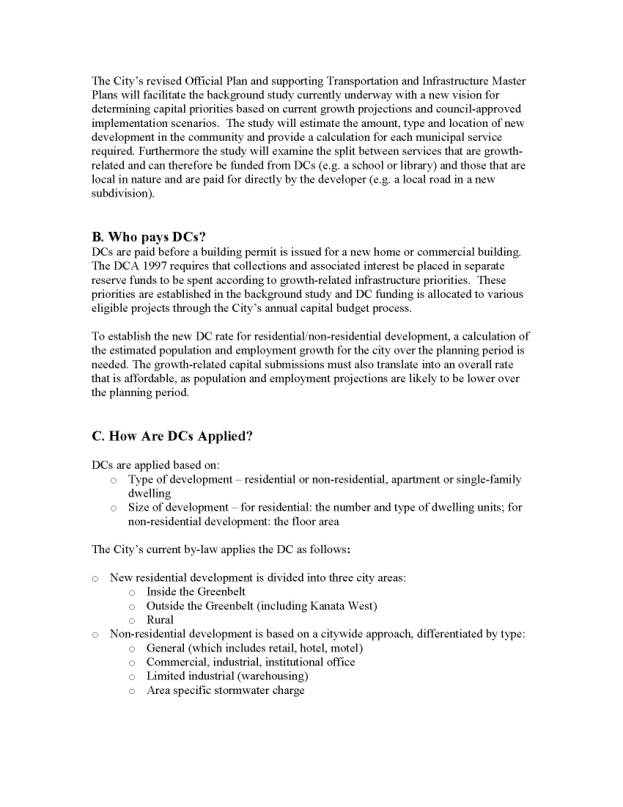

(Document 1), which are as follows:

i. Implement

city-wide cost allocation for those service areas that are appropriately funded

by all new development.

Some growth-related services provide benefit throughout the Ottawa

service area. These often provide

benefit to the entire Ottawa area from a single location (sewage treatment) or

the growth-related benefit is diffuse and cannot be assigned to a specific

geographic location. Other examples

are: water purification, major road network, and child care. The growth component of these facilities

should be cost-shared at a uniform rate in one part of the city as another.

ii. Implement

specific "large area rates" for services that can be assigned to

general geographic distribution areas.

Wherever possible and reasonable, charges should be amalgamated to a

higher geographic area to spread the cost over the area of development being

served; to reduce administrative error and cost; to increase stakeholder

community understanding; to avoid penalizing development unnecessarily for

particular geographic features; and to maintain some consistency between

charges for growth-related municipal services, property taxation and user fee

practices.

With fewer area-specific charges, the City is better able to

determine its servicing priorities; to use funding more flexibly within service

accounts; to better respond to factors impacting municipal decisions; and to be

more strategic in its service provision.

Monies collected for services in relation to development charges cannot

be used for another purpose. Therefore

care must be taken in the definition of areas.

If areas are defined too finely, it may remove users of the service from

the requirement to pay (those locating outside of the defined area). For example, with a recreation facility, if

the area of users were too narrowly defined, future users from other growth

areas would not be required to pay, even though they are users of the

facility. Narrowly defined areas can

lead to a reduction in flexibility for the municipality as monies collected can

only be spent for the specific services in the specific area. In addition, it would reduce the City's

ability to determine its servicing priorities.

In effect, individual developers would determine the priority of the

infrastructure that gets built. With

the definition of specific areas at an appropriately high level, these concerns

can be greatly mitigated.

Therefore, to implement the general direction of the revised

Official Plan and to reflect principles of equity, most services would be

assessed with a large area approach:

Inside the Greenbelt, Outside the Greenbelt, and Rural. For example, staff are proposing that the

arterials and collectors within the Roads service category be allocated based

on the additional Vehicle Kilometres Travelled (VKT) generated from each area. This distribution takes into account the

increase in trip internalization from the three large geographic areas. This results in the following allocation of

future Road costs: eight per cent to Inside the Greenbelt, 65 per cent to

Outside the Greenbelt, and 27 per cent to the Rural Area.

The current Official Plan and existing by-laws provide that

particular portions of the city are not within the service area for some

municipal services. As a result,

residents outside of the defined boundary have not shared in the cost of

providing sanitary, water and transit services. This practice will be reviewed as part of the by-law update.

iii. Implement

specific area rates for services that clearly benefit only a definable client

group.

Some growth-related servicing projects are required solely for the

benefit of a localized and definable service area, for example, the

construction of a storm water management infrastructure that provides a service

to specific lands not previously serviced.

Such costs can be segregated and allocated to specific benefiting

areas. This practice would be continued

where a clear case can be made that it is the most equitable practice. It also encourages landowners to address

servicing and infrastructure requirements by entering into front-ending

agreements with the City.

d) Undertake a review of the current list

of discretionary or non-statutory exemptions.

Development charges are based upon

the estimated capital needs attributable to growth-related municipal services. Where charges for categories of uses are

exempted or reduced, some other means of funding or offsetting the capital

costs must be found. Exemptions are

most effective when they represent the difference between a project proceeding

and not proceeding by funding the gap to make the project financially

feasible. Therefore, certain

non-statutory exemptions (Document 2) are proposed to be discontinued unless

they promote transit use, smart growth and environmental stewardship such as

the use of existing infrastructure (redevelopment of brownfield areas) and are

considered sufficiently desirable (non-profit housing) to warrant a tax-based

subsidy. There will be a two-year

phase-out period, starting on date of the passage of the by-law, in which

organizations will be able to continue to apply for an exemption under the

current by-law provisions. After the

two-year grace period, all of the exemptions listed in Document #2 to be

discontinued, are proposed to be eliminated.

e) Continue to use the Infrastructure

Construction Price Index.

In March 2003, Council adopted a

Statistics Canada Infrastructure Development Charges Price Index to replace the

use of the Statistics Canada Construction Price Index that is prescribed by the

Development Charges Act, 1997. The new

inflation factor was considered by the City and industry to better reflect the

localized benchmark costs for Ottawa.

The new index has increased 17 per cent (2002-2006) versus 24 per cent

to 25 per cent for the prescribed (Toronto) DC Index over the same

timeframe. Currently, indexing takes

place annually on April 1 but will be adjusted to correspond to the date of

by-law adoption. The development industry has requested this change to better

reflect their construction cycle.

f) Provide for post-adoption

implementation requirements to allow landowners with in-stream planning

applications to receive the benefit of the existing lower development charges

(if applicable).

During the last by-law review

several landowners challenged the City on the lack of transition provisions as

grounds for appealing the by-law. There

is no legislative requirement for such provisions; however, many municipalities

currently provide a transition program.

In the last by-law the transition time frame was extended to December

1. Staff are recommending an extension

to the end of the year. The cost of

phasing in the charges under the current by-law was approximately $8 million.

g) Review existing by-law definitions.

The proposed definition changes to

the by-law will help provide greater clarity regarding the application and

implementation of various provisions and rates, therefore, assisting staff in

the day-to-day administration of the documents.

h) Undertake a cash-flow analysis to

determine the quantum of the residential and non-residential charges.

The final step in determining the

new rates will be an annualized cash-flow analysis of the growth-related net

capital program for each service category.

This methodology will take into account the forecasted timing of

projects, receipt of payments, interest earnings, reserve fund balances (for

both hard and possibly soft services) and carrying costs. In many instances, expenditures are required

for roads, water, and sewer projects well in advance of the collection of

fees. The City will, therefore,

experience financial challenges because cash flows may not be at optimal

levels. This will require the

assistance of the development community to help facilitate the construction of

certain projects. Staff will work with

developers to establish a viable financing plan that will provide the necessary

funding to undertake infrastructure works in a timely sequence. Such funding arrangements could include the

prepayment of development charges, front-ending agreements, and credits

(services-in-lieu) for all or a portion of fees payable given in exchange for

performing the work. It is anticipated

that there will be minor timing changes made to the capital forecast as part of

the City’s annual capital budget process.

Repayment of front-ended projects will be based on the schedule of

timing identified in the background study.

i) Update redevelopment credits

(demolition credits).

Redevelopment credits are provided

in recognition that a pre-existing residential and non-residential building or

structure, that has been demolished, had an existing demand on services

allocated to the property. Staff are

recommending the imposition of a five-year time limit, which is common

municipal practice, between the issuance of a demolition permit and the

granting of a building permit for preserving the credit. Any demolitions that take place after the

passage of the new by-law will be subject to the five-year redevelopment credit

expiry period. Demolition allowances

would continue to be based on the rate in effect in the active by-law with the

overall development charge reduction not exceeding the amount otherwise

payable. A credit would not apply,

after a two-year transition period, if a building type were exempt under the

by-law i.e. former school sites.

Finally, credits would remain with the property and would not be

transferable to another parcel of land.

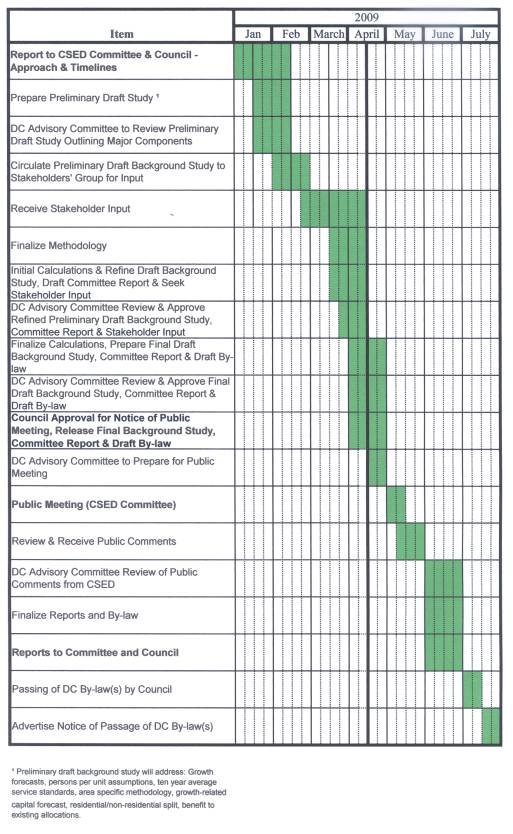

j) Timetable for the Development Charges Study.

The development of a new

background study will be lead by Community Sustainability Services Branch with

input and assistance from the various City departments. Consulting services have been retained for

specific areas of work. An Advisory

Committee has been established for the study, consisting of managers and

directors from many areas of the corporation. This committee is intended to

ensure that there is corporate-wide understanding and concurrence with the

development charges review process. A Stakeholders' Group has been formed to

provide input into the process and feedback at key stages of the review. A timetable for the development charges

review is provided for information in Document 3.

The critical points in the review

include: the timing of the adoption of

the new by-law, the formal public consultation process that will take place in

the spring of 2009 and the preparation of the information for the public

consultation process.

CONSULTATION

Before passing a development charge

by-law, Council is required to hold at least one public meeting to review the

Development Charges Background Report, Council report and proposed Development

Charges By-law. The timelines of the Development Charges Review Study work plan

foresees this meeting to be held at the Corporate Services and Economic

Development Committee at the end of May 2009. A minimum of 20 days notice of the meeting(s) is required and the

proposed by-law and background study are to be made available to the public at

least two weeks prior to the meeting. Public notice may be given by publication

in a newspaper with sufficiently general circulation.

Any person who

attends a meeting may make representations relating to the proposed

by-law. If a proposed by-law is changed

following a meeting, Council shall determine whether a further meeting is

necessary. Such a determination is

final and not subject to review by a court or the Ontario Municipal Board.

Prior to the

formal public consultation, a Development Charges Stakeholders’ Group has been

established. The Stakeholders’ Group is comprised of interested representatives

of the residential and non-residential development community, GOHBA and BOMA,

and citizen groups. The Stakeholders’ Group is intended to provide an informal

forum for input, liaison and feedback at key stages of the preparation of the

development charges by-law.

LEGAL/RISK MANAGEMENT IMPLICATIONS

The Development Charges Act provides for a five-year time period

for the duration of development charges by-laws. The current by-laws were enacted on 14 July 2004; therefore the

next by-laws must be enacted no later than 13 July 2009.

To the extent that persons are of the view that the City does not follow

the process set forth in the act and regulation with respect to the content of

the background study and the by-law, they are able to appeal the by-law to the

Ontario Municipal Board. The Board does

not have the power to increase a development charge but may only provide for a

decrease. Where the Board does so,

affected persons are entitled to a refund with interest.

FINANCIAL IMPLICATIONS

The fiscal framework is the City’s high-level

“roadmap” to sustainable finances. It

is a Council-endorsed “financial constitution”, which will guide all financial

decisions and will be the primary instrument to measure the City’s financial

condition. One of the ten key financial

elements listed under Growth is that the DC by-law will be used to recover the

costs of growth to the full extent permitted by legislation (thereby minimizing

the financial burden of the costs of growth on existing residents).

SUPPORTING DOCUMENTATION

Document 1 - Summary of Proposed Geographic Recovery

Areas

Document 2 - List of Discretionary Exemptions

Document 3 - Development Charges Update - Timetable

Document 4 - Development Charge Issue Paper

DISPOSITION

City staff to carry out the direction of Council with

regards to the preparation of the Development Charges Study.

SUMMARY OF PROPOSED GEOGRAPHIC RECOVERY AREAS DOCUMENT 1

|

Service

|

DC Recovery Area

|

|

City-wide

|

3 Area-specific

|

Small area-specific

|

|

Arterial roads

|

|

√

|

|

|

Collector roads

|

|

√

|

|

|

Water purification

|

√

|

|

|

|

Water distribution

|

|

√

|

|

|

Sanitary sewer treatment

|

√

|

|

|

|

Sanitary sewer collection

|

|

√

|

|

|

Storm drainage general

|

√

|

|

|

|

Storm drainage ponds

|

|

|

√

|

|

Police stations

|

|

√

|

|

|

Police vehicles

|

√

|

|

|

|

Fire stations and vehicles

|

|

√

|

|

|

Transit corridors and vehicles

|

√

|

|

|

|

Neighbourhood and community parks

|

|

√

|

|

|

Recreation centres

|

√

|

|

|

|

Other recreation facilities

|

|

√

|

|

|

Library branches

|

|

√

|

|

|

Library materials

|

√

|

|

|

|

Child care facilities

|

√

|

|

|

|

EMS posts and vehicles

|

√

|

|

|

|

Vehicles and works yards

|

√

|

|

|

|

Social housing

|

√

|

|

|

|

Corporate studies

|

√

|

|

|

LIST OF DISCRETIONARY EXEMPTIONS DOCUMENT 2

The City’s by-law exempts several

categories of development from DCs. The following is the list of

Council-approved exemptions, shown in Section 7 of the current by-law, which

are proposed to be discontinued after a two-year transition period post

adoption of the new by-law:

·

Every place of worship and the land

used in connection therewith;

·

Every churchyard, cemetery or burying

ground exempt under the Assessment Act

for taxation purposes;

·

Non-residential use buildings used for

bona fide agricultural purposes;

·

Farm retirement lots in accordance

with the official plan;

·

Non-residential

use development involving the creation or addition of accessory uses containing

less than ten square metres of gross floor area;

·

Subject to

clause (m), temporary buildings provided that such buildings are removed within

two years of the issuance of the building permit;

·

A garden

suite, provided that such garden suite is removed within ten years;

·

A building

for the sale of gardening and related products provided that such building is

not erected before 15 March and is removed before 15 October of each year;

·

A non-profit health care facility;

·

Farm help

lots, severed prior to 9 July 1997;

·

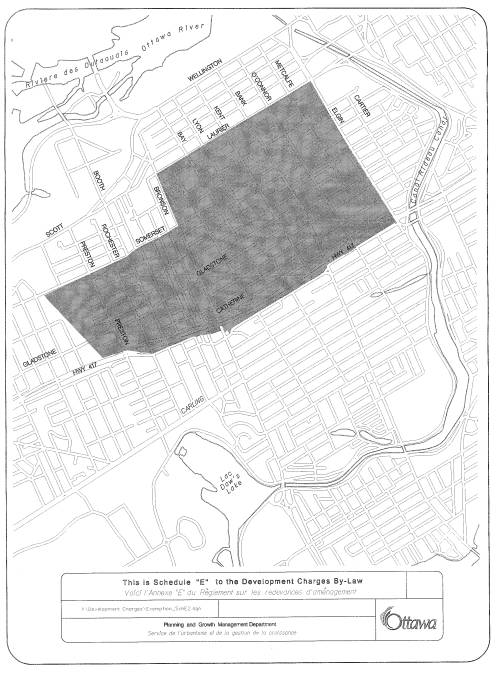

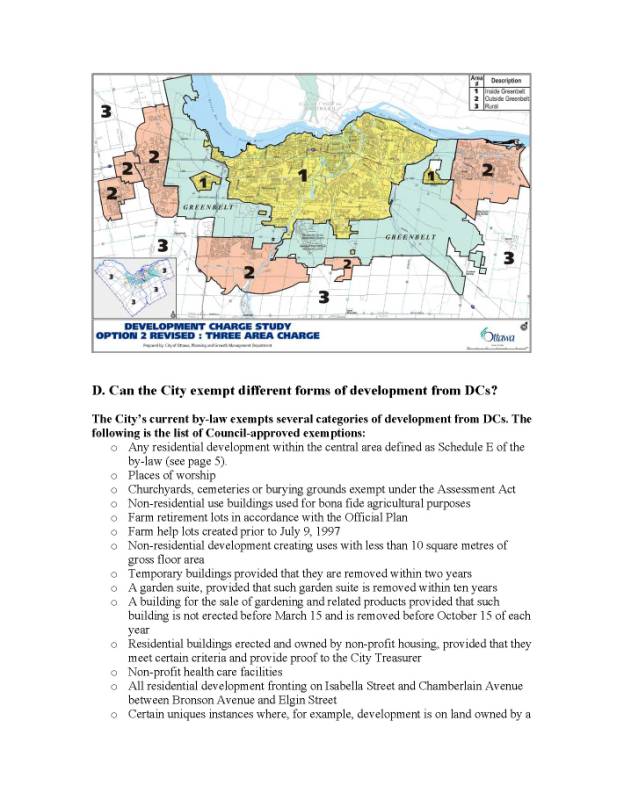

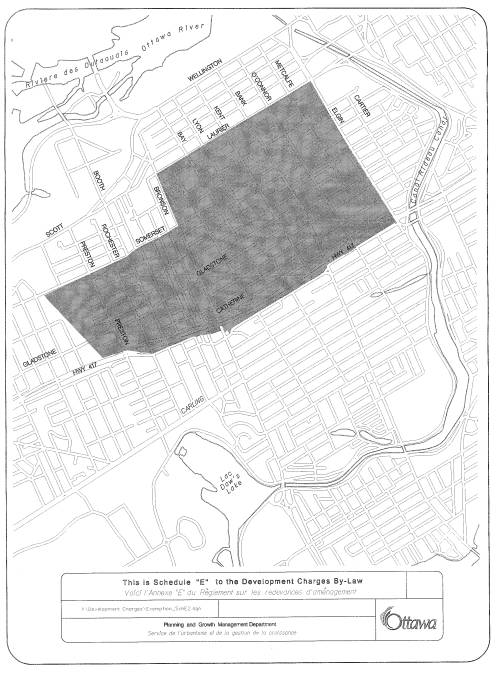

All

residential development within the areas described on Schedule “E” below;

- Where specifically authorized by a resolution of Council;

development on land owned by a non-profit corporation;

- Where specifically authorized by a resolution of Council,

development on land where a public facility is being provided; and

- All residential development fronting on Isabella Street and

Chamberlain Avenue between Bronson Avenue and Elgin Street.

These discretionary exemptions would

continue to be available, after the two-year transition period, based on the

City’s objectives associated with smart growth and affordable housing:

·

A residential use building erected and

owned by non-profit housing, provided that satisfactory evidence is provided to

the Treasurer that the residential use building is intended for persons of low

or modest incomes and that the dwelling units are being made available at

values that are initially and will continue to be below current market levels

in the City;

- Where specifically authorized by a resolution of Council,

development on contaminated land.

DEVELOPMENT

CHARGES UPDATE - TIMETABLE DOCUMENT 3

2009

DEVELOPMENT CHARGES BY-LAW REVIEW: POLICY FRAMEWORK

EXAMEN DE 2009 DU RÈGLEMENT MUNICIPAL SUR LES

REDEVANCES D'AMÉNAGEMENT : CADRE STRATÉGIQUE

ACS2009-ICS-CSS-0002 CITY WIDE/À L'ÉCHELLE DE

LA VILLE

Rob Mackay, Acting Director of Community

Sustainability Services, provided a PowerPoint presentation, which is held on

file with the City Clerk. He was

accompanied by Gary Baker, Program Manager of Development Charges and Ian

Cross, Manager of Economic Development.

Chair Hume noted that a development charge

exemption might not be the best way to achieve a public policy goal, noting

that it is probably the only tool the City has been using.

Nancy Schepers, Deputy City Manager,

Infrastructure Services & Community Sustainability responded that staff

would provide additional analysis on available tools to assist with key public

policy decisions. With respect to the

downtown exemption, Chair Hume thought there might be other tools that would

better achieve public policy goals and infrastructure needs in the central

area.

In response to questions from councillors, staff

provided the following clarifications:

·

Cam Watson is

only one of two consultants working in Ontario on development charges studies.

·

Recommendation

4 is included to ensure staff have clear direction moving forward in the

preparation of the background study.

During the last review, exemptions were added at the Council adoption

stage.

·

Non-statutory

exemptions over the last five years have resulted in approximately $21 million

in deferred growth related infrastructure.

There is road and sewer infrastructure in various wards that have not

been able to proceed partly because of this exemption list. Over the last five

years, the exemptions for places of worship have resulted in a loss of $1.6

million. Staff agreed to provide the

list of exemptions and the breakdown of the $21 million and how it relates to

the overall collected development charges.

·

Brownfields are

included as an exemption, as this type of development promotes intensification

by turning these sites around and causing taxes to be paid. At least two brownfield projects have been

approved and two are currently under review.

Site size is not a factor under the current program.

·

The matrix of

cost will return to committee. If a

change is required to the exemptions or to the phase out period, adjustments

can be made, as the modeling will be in place.

·

Estimate the

capital cost to provide the service level and reduce the cost by the capital

grant subsidies that are in hand and available, but the amount is reduced.

·

A list of

members of the Stakeholders Group will be made available by staff.

·

The consultant

carefully looks at the projects to assign growth and Benefit to Existing

(BTE). The project list will be

released, outlining the BTE component, which can be challenged.

·

With respect to

recommendation 3 and Vehicle Kilometers Traveled (VKT), it is unclear if the

calculation includes transit but it is assumed it involves vehicle trips. Staff will report back on how the Greenbelt

is factored in and charged. It is

anticipated that the rate will be lower inside the Greenbelt; however it is too

early to provide an indication of what the rates might look like.

·

Staff are

proposing that if a project is to be advanced through a front ending agreement,

repayment will occur in the year initially forecasted for the work to

occur. The wording of the agreements

will be changed accordingly. Staff will

provide additional information with respect to how front-ending agreements work

and are funded.

·

In regard to

the transition provision, staff wanted to provide at least six months to allow

for the dealing of complex sites. If a

permit is within the system before the adoption of the by-law, a permit must be

released before the end of 2009 and the fees must be paid. Developers have expressed concern with the

lack of transition policies under the current by-law.

·

A

two-transition period is also provided for non-statutory exemptions being

removed from the by-law, including the downtown exemption. The new Official Plan proposes

intensification for this and other areas.

Much development and intensification has occurred in Westboro and the By

Ward Market, two areas that were not exempted from development charges. Staff will provide information on the

exemption area as part of the direction on possible tools to achieve policy

goals.

·

The proposed

approach will provide a cash flow basis for sufficient investment in growth

related projects each year. A 2006

policy required that all the funds must be received in order to proceed with a

park. Certain crediting agreements have

occurred with developers who construct a park at the outset and get paid back

when the full funding is achieved. At

Councillor Monette and Chair Hume’s request, staff will return with information

on park development in terms of funding and timing.

·

In regard to

eligible services, social housing is permissible under the Development Charges Act and is included in this by-law, but only 90

per cent could be collected from development charges. Acquisition of land for parks is ineligible as this particular item

is already covered under the Planning Act.

The municipality can recover the cost through the tax base or

through fees and charges.

·

Cultural

facilities became ineligible in 1997 when the Conservative government made

changes to the Development Charges Act.

·

For the most

part, development charges were not used to construct the Orléans Art

Center. The building was through a

municipal capital facility agreement and was exempt from development charges. Council funded the five per cent park

component. The high density housing

proposed on the east side of the town center, next to a future transit station,

received a 50 per cent break on the road related component of the development

charges as an incentive.

·

The York

example was looked at in terms of forward averaging to establish a higher rate

for transit; however, the province indicated that they would not re-open the Development Charges Act in this regard.

·

The development

community has raised the possibility of reducing development charges by

providing such services as parks in advance.

Staff are reviewing this model, predicated in Kanata West, with Parks

and Recreation.

In response to further questions, Ian Cross,

Program Manager of Research and Forecasting, explained that staff believe they

have good grounds for thinking that the census undercounted, particularly in

the central parts of the City of Ottawa.

He assured the committee that the forecasts and analysis used by staff

are based on building permit issuances and other data. He felt that the census issue is not a

concern relative to the development charge review. Mr. Cross explained that a handout was prepared on the evolution

of population and dwelling unit change in the Centertown area at the request of

Mr. Casey. A footnote does acknowledge

that the 2006 census number undercounts the actual dwelling units and

population.

Councillor Wilkinson spoke against removing

the exemption for places of worship, asking for staff to provide some rationale

as to why particular exemptions are being removed. She commented on the valuable programs undertaken by churches,

such as youth programs.

Tim Marc, Senior Legal Counsel, explained

that there are two different approaches with respect to front ending. For roads, proponents would receive payment

in the year that it was budgeted, while stormwater ponds are paid back as

building permits are issued.

Councillor Doucet noted that the Comparative Municipal Fiscal Impact Analysis

undertaken by Hemson Consulting Ltd. showed residents inside the Greenbelt pay

approximately $1000 more than households outside. He hoped the review would address this imbalance. With respect to VKT, he opined that it

should be simple and solely focused on cost, including transit. He felt that the City must figure out a way

to structure these costs, to avoid a relentless wheel of subsidy.

Chair Hume, as President of the Association

of Municipalities of Ontario, stated that they have received clear direction

from the Premier that the government is not interested in entertaining changes

to the Developmental Charges Act at this time. A special circumstance, like the York amendment, could be

entertained if there is consensus from both government and industry.

Following questions from committee members on

the presentation, the committee heard from public delegations.

Rob Price, Greater Ottawa Homebuilders

Association (GOHBA),

commenced by referencing a letter that was circulated and held on file. He noted that GOHA is represented on the

stakeholders committee by B.N. Global and noted challenges moving forward,

including the timeframe. Staff have

begun meeting with B.N. Global on various service areas; however he suggested

most of the costing that has been discussed and presented by staff has been

done as though the report has already been approved. GOHA is also concerned with the exemption for social housing,

suggesting it is a social matter not a growth issue. Secondly, the policy is based on the Transportation and

Infrastructure Master Plans and the Official Plan, which are in the process of

review. Third, no background

information is available with respect to recommendation 3 to alter the

allocation of road costs. He added that

the same is true with regard to recommendation 4, as the report does not speak

to the implications that go along with phasing out non-statutory

exemptions. In summation, he stated

that the City has known that this by-law has to be renewed every five years and

the City is under the gun to have a new by-law in place by July 13, 2009. The association does not feel that there is

enough time for meaningful dialogue.

The current economic climate must also be kept in mind, as this process

should not be viewed as an opportunity to generate additional revenues. Housing and the construction industry in its

spin offs are probably the largest economic employer in the region. GOHA is willing to work with staff but time

and appropriate analysis are necessary moving forward.

In response to questions from Councillor

Leadman, Mr. Price confirmed GOHA is a member of the Stakeholders Group and

meetings have already taken place. He

suggested they have been more or less token consultations, as cost estimates

were provided by the City without discussion or stakeholder analysis or input.

Councillor Leadman asked staff to comment on

this statement, because the whole idea of consultation is to have input from

stakeholders.

Mr. Mackay stated that he would not

characterize the sessions as token meetings, noting staff and the consultant

have put forward the list of projects that are being proposed to be funded by

development charges. Mr. Baker has

participated in a number of meetings over the last six weeks and there has been

a lot of dialogue back and forth. Mr.

Mackay added that he has been reading emails and taking calls on this

matter. As for the timeline, he agreed

that it is tight and there is a lot to be done; however, the issues paper does

a good job of explaining the policy framework and the key drivers with respect

to establishing the background study.

Mr. Mackay added that it is a balancing act and the homebuilders may not

agree with the project lists, but this is why a consultant is guiding the

process.

Mr. Baker explained that the stakeholders

group began meeting in September 2008, followed by subsequent meetings in

October and November. The elements

before committee were discussed with the GOHA on February 3, 2009 and changes

were made to take into consideration issues raised by the industry. Additional meetings on roads and transit are

planned for this afternoon and a meeting with the GOHA consultant is in the

works. A draft background study will be

presented in late March, after stakeholder feedback on a preliminary

draft. The critical path for the

process is set out in Document 3.

Mr. Price commented further on the timeframe

and getting comprehensive analysis and feedback from the industry within four

weeks in one of its busiest times of the year.

Chair Hume noted that one of the things

discussed at the strategic planning session last week was establishing some

project sponsors that would allow staff and a small subset of the committee to

work together to bring forward reports.

He advised that Ms. Schepers suggested that this matter could be the

first and with the concurrence of the committee, Councillors Feltmate, Hume,

Harder and Leadman were identified to assist staff as project sponsors on this

file.

Doug Casey, Charlesfort Developments, indicated he is not a member of GOHA and

did not participate in the preparation of this policy framework. He commented on the economic context and the

City’s fiscal situation. He spoke

against reintroducing development charges to the downtown and removing the

exemption for churches. He spoke favourably with respect to exemptions for brownfield

sites and affordable housing.

Referencing a project at Kent and Lisgar, he advised that the new

residential tower would bring in $1 million annually in taxes as compared to

$34 thousand for the previous use. He

suggested the City would not have increased costs as services are already

provided in the area. With respect to

Centretown, he noted the population has decreased from 35, 600 in 1941 to 24,

000 in 2006, suggesting development charges should not be reintroduced until

the population numbers of 1941 are achieved. He noted Centretown has suffered over time with the construction

of the Queensway and the widening of Kent Street, making the neighbourhood

unfriendly for families. He added that

more people must live downtown to support businesses and services. Mr. Casey explained that he does not

currently own land found on Schedule E.

Chair Hume reiterated the need to look at

other incentives to encourage growth in the downtown area.

Councillor Leadman noted that most, if not

all, of the development occurring downtown is not family friendly and the

population has decreased. She noted

development in Westboro along Traditional Mainstreets have also not favoured families.

Mr. Casey rebutted that he thought that there

was changing demographics with young and old choosing to live downtown. With respect to the population data, he

noted development charges are intended to be tied to growth and the data shows

population in Centretown well below 1941 levels.

In response to questions from Councillor

Leadman, Mr. Baker advised that the development charge review does not look to

the tax component. The review does

involve benchmarking and best practices from other Ontario cities and the

consultant retained by the City has worked with many other municipalities.

Mr. Mackay indicated that the review coincides with the approval of

all master plans and the Official Plan.

Staff are taking into consideration Council’s priorities and policy

objectives. Specific to Centretown, Mr.

Mackay noted that $2.1 million were exempted in the area, while major

development occurred in non-exempted areas, such as the By Ward Market. The rates will be set as part of the second

phase and recommendations will be made, keeping in mind the current economic context

and rates set in other municipalities.

Mr. Marc advised that the July 14, 2009 deadline is legislated as

five years from the passage of the previous by-law. He cautioned that if the City does not have a new by-law in place

by that date, no development charges can be collected in the City of Ottawa and

there is no opportunity to extend that date.

Councillor Doucet voiced that the review should lead to the creation

of more multi-use, sustainable 24-7 living communities by developing a city

that pays for itself. He spoke in

support of keeping the exemption downtown, which has lead to some good

intensification.

Councillor Hunter countered that development charges are

disincentives for development, noting a parking spot in a new condo development

downtown costs $40,000. He noted that

downtown intensification does have a cost in terms of infrastructure capacity,

notably as it relates to combined sewers.

He also noted that many more people work downtown as compared to 1941.

Responding to comments from Councillor Wilkinson, Mr. Casey said it

is very expensive to build downtown, including encroachment permits and the

cost of land.

Councillor Wilkinson recalled that developers told her the land

value went up immediately when the exemption area was approved for the

downtown. She commented that the review

must take a citywide approach.

Jim Burghout, Claridge Homes, addressed

the removal of certain exemptions, touching on opportunity and obligation. He suggested the City has an opportunity to

continue to use exemptions as an incentive to encourage the residential

development in the target areas of the Official Plan, most notably in the

downtown area where they have been in place for some time. The former City of Ottawa put in place a

very aggressive incentive program for the downtown area in the mid 1990s that

included development charges and fee exemptions. Mr. Burghout advanced that the program played a huge role in

bringing Claridge and many others to the downtown. The projects started out small but as the economy got better, the

projects got bigger and more sophisticated.

Over the last five or six years, Claridge has built about 1, 000 units

outside the exempted area, paying $6-7 million in development charges as the

economy was good. Over that time, the

company aggressively attempted to purchase some of the land in the exempt area

with significant investment to do so by purchasing surface parking lots so that

they can be developed. Mr. Burghout

said the discussion about the population in Centretown is interesting because

back in 1976 when the Centretown Official Plan was passed, they made reference

to population. There’s a specific

reference in the Centretown Secondary Plan, which is part of the Official Plan,

which talks about a 50 per cent increase in population in Centretown if the policies

of that plan are followed; however, it has not happened. He stated that development charge exemptions

are by far the most effective and appealing incentives to a developer, as they

are a direct capital cost affecting the bottom line.

With respect to the obligation part, Mr.

Burghout reminded that Section 3.6.6 of the Official Plan speaks to the central

area and specifically includes the adjacent residential neighbourhoods of

Centretown and Sandy Hill. It states

that in keeping with the strategic direction set out in Section 2, the City

will encourage new infill dwelling in the central area and surrounding

residential neighbourhoods by providing financial incentives such as exemptions

from development charges, building permits fees or other development

levies. He suggested that at the very

least the present exemption area should remain so, but he thought that the

opportunity exists to expand that area.

He thought that the City should look into exemption or reduction for

areas where rapid transit stations are located. He commented that it is critical that the new by-law be

consistent with the directions of the new Official Plan and master plans, which

is currently not the case.

After closing the public hearing, Chair Hume

asked the committee to turn their attention back to the recommendations of the

committee.

In response to questions from Councillor

Leadman, Mr. Mackay advised that consultation will continue as part of the

process to assist in the development of the background study. Consultation is also on-going on the list of

projects.

Mr. Marc advised that staff needs some

direction in order to be able to proceed and draw up a background study to

present to Council. In the opinion of

Legal Services, the approval of these recommendations would not give rise to

the rules on revisiting an issue, should Council wish to take a different

position when the report comes forward for formal adoption in June or

July. In sum, there is an opportunity

for Council to make adjustments later on in the process.

Councillors Feltmate and Hunter respectively

presented and then withdrew the following motions dealing with Recommendation

4.

BE IT RESOLVED that places of worship and

land in connection therewith and non-profit health and social services that

have operational funding from the City continue to be exempt.

THAT consideration of discontinuing

non-statutory exemptions be considered within up to two years after the passage

of the by-law.

Mr. Marc clarified that exemptions are a

straight loss to the City and must be made up from the tax base.

Following further legal advice, the Committee

agreed to remove Recommendation 4 and directed staff to bring back, as part of

the next step, a definitive list of exemptions.

Chair Hume also received concurrence to

proceed with project sponsors on this matter with Councillors Feltmate, Harder,

Hume and Leadman acting in that capacity.

That the Planning and Environment Committee

recommend Council approve the policy framework underlying the update of the

Development Charges Background Study as detailed in this report.

1. That Development Charge By-law be used

to recover the full costs of eligible infrastructure;

2. That the costs continue to be allocated

on a city-wide and area specific basis per Document 1 of this report;

3. That the distribution of arterial and

collector road servicing costs be allocated based on Vehicle Kilometres

Travelled (VKT);

4. That non-statutory exemptions,

unless they promote smart growth or affordable housing, be discontinued two-years after the passage

of the by-law;

5. That the annual indexing of the various

DC rates be adjusted to correspond to the date of the new Development Charge

By-law adoption in 2009;

6. That the transition period for applying

the new DC rates to building permits, that have been filed with the City prior

to passage of the new by-law, be extended to December 31, 2009;

7. That going forward with the new

Development Charges By-law, a cash-flow analysis be undertaken to determine the

residential and non-residential charges;

8. That the repayment of front-ended

projects be based on the schedule of timing identified in the cash-flow

analysis;

9. That redevelopment credits expire five

years after the issuance of a demolition permit.

DIRECTIONS

TO STAFF:

1. Staff will review the non-statutory

exemptions and report back as part of the next report to committee in April

2009. (Recommendation 4 was not voted

on and referred to staff as part of the review). The review should also outline and categorize the approximate $21

million of deferred infrastructure investment delayed due to the

exemptions. Staff are to provide the

percentage this represents with respect to overall development charges.

2. Staff will review and report on

front-ending agreements, specifically with regard to timing and funding.

3. Staff will provide information with

regard to the funding and timing of park development.

4. Staff will provide information on

incentives, other than DC exemptions, to achieve policy objectives. The effectiveness and continued

appropriateness of the downtown exemption area should be analyzed in this

regard.

5. Staff will provide clarification with

regard to the Vehicle Kilometres Traveled calculation as it relates to the

Greenbelt.