|

13. SINKING FUND FINANCIAL STATEMENTS 2008 AND

DISTRIBUTION OF SURPLUS états financiers des fonds

d’amortissement de 2008 et répartition des excédents |

COMMITTEE RECOMMENDATION

That Council approve an exemption from the payment of development charges by Lycée Claudel (1635 Riverside Drive) as a non-profit corporation under Section 7(s) of the Development Charges By-law 2004-298.

Recommandation du Comité

Que le Conseil approuve que le Lycée

Claudel (1635, promenade Riverside) soit exempt du paiement des redevances

d’aménagement à titre de société à but non lucratif, en vertu du paragraphe

7(s) du Règlement sur les redevances d’aménagement 2004-298.

DOCUMENTATION

1. Deputy

City Manager of Infrastructure Services and Community Sustainability report

dated 4 June 2009 (ACS2008-ICS-PGM-0114)

Report

to/Rapport au :

Corporate Services and Economic Development

Committee

Comité des services organisationnels et du développement économique

and Council / et au Conseil

04 June 2009 / le 04 juin 2009

Submitted

by/Soumis par : Nancy

Schepers, Deputy City Manager/Directrice municipale adjointe,

Infrastructure Services and Community Sustainability/Services

d’infrastructure et Viabilité des collectivités

Contact Person/Personne ressource : John L. Moser, General

Manager/Directeur général, Planning and Growth Management/Urbanisme et Gestion

de la croissance

(613)

580-2424 x28869, john.moser@ottawa.ca

SUBJECT:

|

REQUEST FOR DEVELOPMENT CHARGE

EXEMPTION - 1635 RIVERSIDE dRIVE |

|

|

|

OBJET :

|

DEMANDE

D’EXEMPTION DES REDEVANCES D’AMÉNAGEMENT – 1635, PROMENADE RIVERSIDE |

REPORT

RECOMMENDATION

That the Corporate Services and Economic Development Committee recommend Council approve an exemption from the payment of development charges by Lycée Claudel (1635 Riverside Drive) as a non-profit corporation under Section 7(s) of the Development Charges By-law 2004-298.

RECOMMANDATION DU RAPPORT

Que le Comité des services

organisationnels et du développement économique recommande au Conseil

d’approuver que le Lycée Claudel (1635, promenade Riverside) soit exempt du

paiement des redevances d’aménagement à titre de société à but non lucratif, en

vertu du paragraphe 7(s) du Règlement sur les redevances d’aménagement

2004-198.

BACKGROUND

Lycée Claudel is a secular French-language international school located at 1635 Riverside Drive. The school was incorporated as a non-profit organisation in 1962, governed by a dedicated board of volunteers. It has 962 students from pre-junior kindergarten to the end of secondary. In 2006, the school began planning a major construction project to refurbish old infrastructure (classrooms, library, administration offices) and add an auditorium. Construction started in 2008, with a scheduled completion date of December 2009. The current buildings and land were purchased from the National Capital Commission, and were built on the site of a former municipal landfill. The project thus includes significant soil remediation, as well as providing access to improved community infrastructure to local residents, (auditorium, meeting rooms, soccer field, etc.). The school is requesting an exemption from development charges based upon its not-for-profit status, as well as the benefits to the wider community from this project. Staff support the exemption request because it meets the criteria outlined in the current Development Charges By-law.

CONSULTATION

Staff have consulted with the Ward Councillor on this exemption request.

LEGAL/RISK MANAGEMENT IMPLICATIONS:

There are no legal/risk management impediments to implementing the recommendation in this report.

FINANCIAL IMPLICATIONS

The City portion of development charges deferred for the construction of an addition to the existing school was $109,694.57. This amount was based on a total square footage of 13,393.72 multiplied by the institutional development charge rate of $8.19. Therefore, the City's development charge portion would be foregone if this request were approved.

An exemption may not be offset through an increase in fees for other categories Development Charges Act, 1997, c.27 s.5(6)3). Any reduction in the development charges collections arising from an exemption may result in a shortfall in funding to support growth-related projects. This shortfall will be addressed in the five-year review of the Development Charges By-law as required by legislation.

SUPPORTING DOCUMENTATION

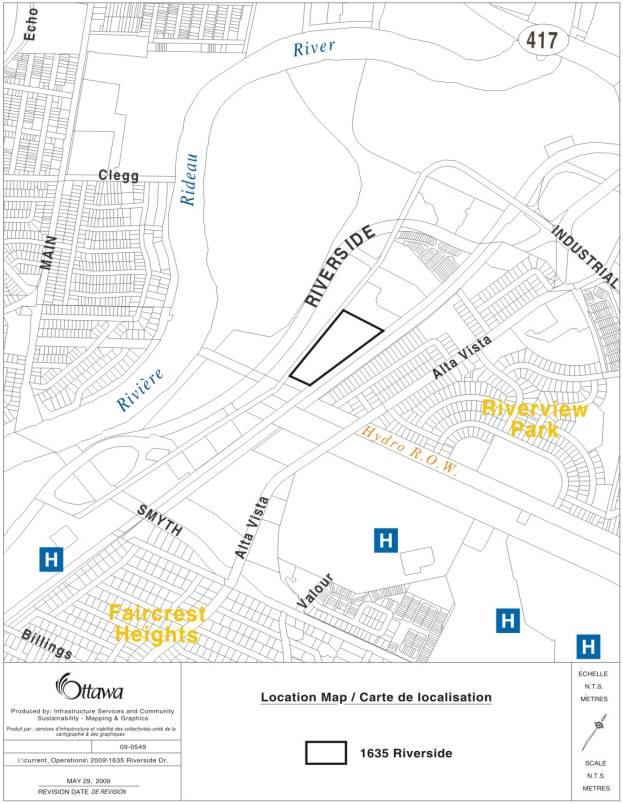

Document 1 - General Location Map - 1635 Riverside Drive

DISPOSITION

Should Council approve the exemption, deferral agreement No.OC904388 will be cancelled and any outstanding interest waived.

GENERAL LOCATION MAP – 1635 RIVERSIDE DRIVE DOCUMENT 1