Document 1

Document 1

|

Document 4

|

5. CAPITAL ADJUSTMENTS AND CLOSING PROJECTS - RATE SUPPORTED

AJUSTEMENT DU BUDGET DES IMMOBILISATIONS ET CESSATION DE PROJETS FINANCÉS PAR REDEVANCES

|

Committee recommendations

That Council:

1. Approve the budget adjustments as detailed in Document 1;

2. Authorize the closing of capital projects listed in Document 2, the funding of deficits as identified and the return of balance of funds to funding sources.

3. Approve a net decrease in debt authority of $3.422 million as a result of recommendations 1 and 2;

4. Permit those projects in Document 3 that qualify for closure, to remain open; and

5. Receive the budget adjustments in Document 4 undertaken in accordance with the Delegation of Authority By-law 2009-231, as amended, as they pertain to capital works.

RECOMMANDATIONS DU COMITÉ

Que le Conseil:

1. approuve les ajustements budgétaires décrits dans le document 1;

2. autorise la cessation des projets d’immobilisation énumérés dans le document 2, le financement des déficits indiqués et la remise des fonds restants aux sources de financement;

3. approuve une diminution du pouvoir d’endettement de 3,422 millions de dollars à la suite des Recommandations 1 et 2;

4. permette que, les projets mentionnés dans le Document 3 qui se qualifient pour une cessation, restent ouverts;

5. prenne connaissance des ajustements budgétaires décrits dans le Document 4, apportés aux termes du Règlement municipal 2009-231 sur la délégation de pouvoirs, modifié, et ayant trait aux travaux d’immobilisation.

DOCUMENTATION

1. City Treasurer’s report dated 17 May 2010 (ACS2010-CMR-FIN-0031).

Planning and Environment Committee

and Council / et au Conseil

Submitted by/Soumis par: Marian Simulik, City Treasurer/Trésorière municipale

Contact Person/Personne ressource:

Tom Fedec, Manager, Budget and Financial Planning,

Finance/ Gestionnaire, Planification budgétaire et financière, Finances

(613) 580-2424 x, 21316

Joanne Farnand, Manager, Financial Services/ Gestionnaire services financiers

Finance Department/Service des finances

(613) 580-2424 x22712, joanne.farnand@ottawa.ca

SUBJECT: |

CAPITAL aDJUSTMENTS AND CLOSING OF PROJECTS – RATE SUPPORTED |

|

|

|

OBJET : |

AJUSTEMENT DU BUDGET DES IMMOBILISATIONS ET CESSATION DE PROJETS FINANCÉS PAR REDEVANCES |

That Planning and Environment Committee recommend Council:

Que le Comité de l'urbanisme et de l'environnement recommande au Conseil :

Generally, budget adjustments to capital projects are required to:

· Adjust for increases or decreases in project costs;

· Consolidate similar accounts to facilitate issuing of contracts;

· Create separate accounts to facilitate project tracking;

· Account for the receipt of revenues not previously anticipated or for the over / underestimation of revenues; and

· Adjust project financing.

The Delegation of Authority By-law 2009-231, as amended, specifies those parameters in which budget adjustments may be made if authorized by the City Treasurer. Those capital budget adjustment requests that do not meet the delegated authority limits of the City Treasurer require the approval of City Council. Generally, Council authority is required for those capital budget adjustments involving:

· Transfers between programs or internal orders in excess of 10% or $100,000 whichever is the lesser;

· Transfers of debt authority between programs with previously approved debt authority, regardless of amount;

· Establishment of new projects outside the budget process;

· A reduction of or increase in funding authority; and

· Project closures.

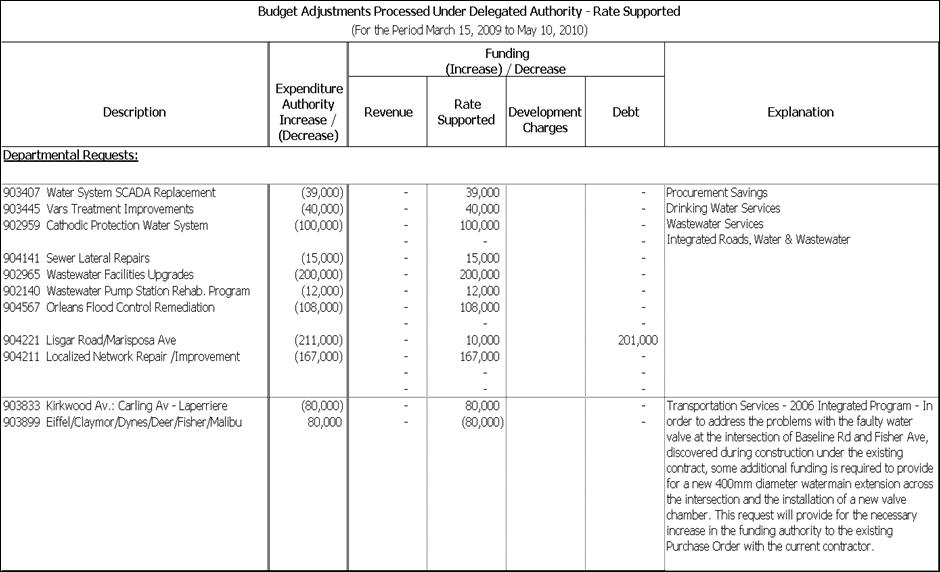

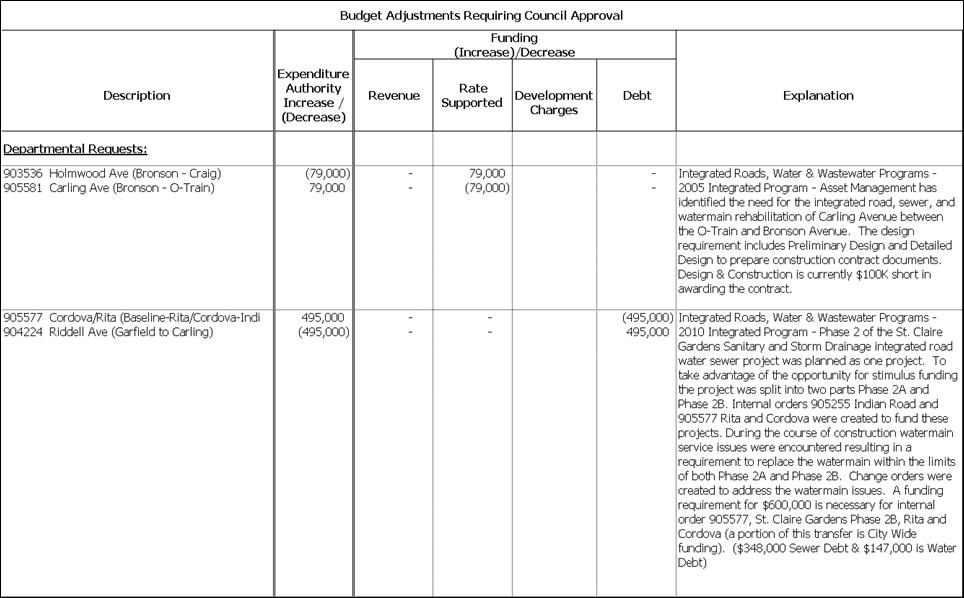

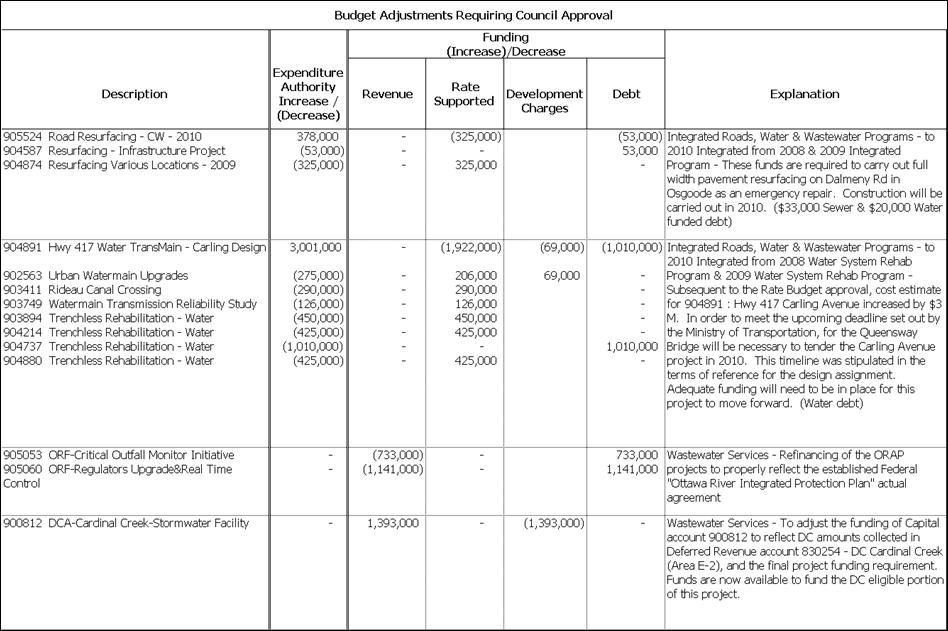

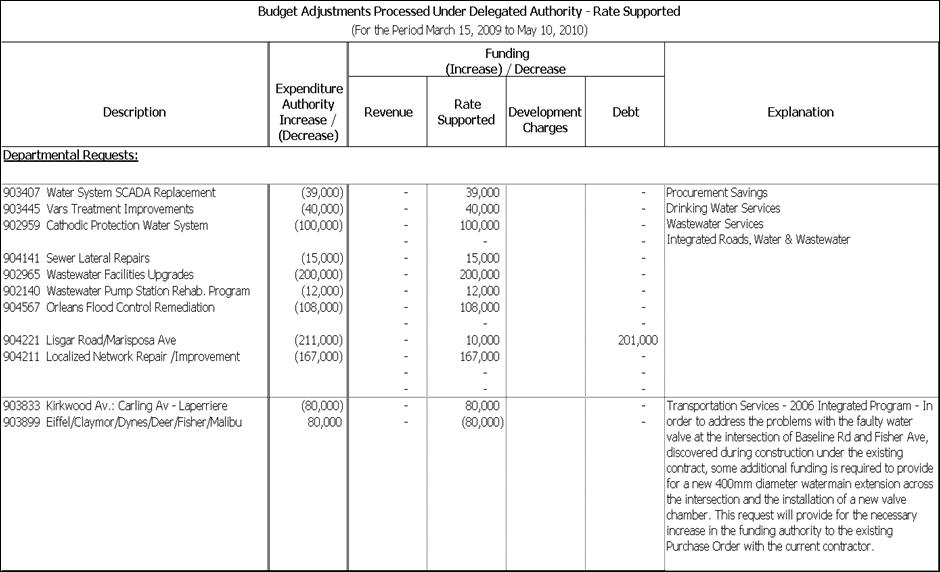

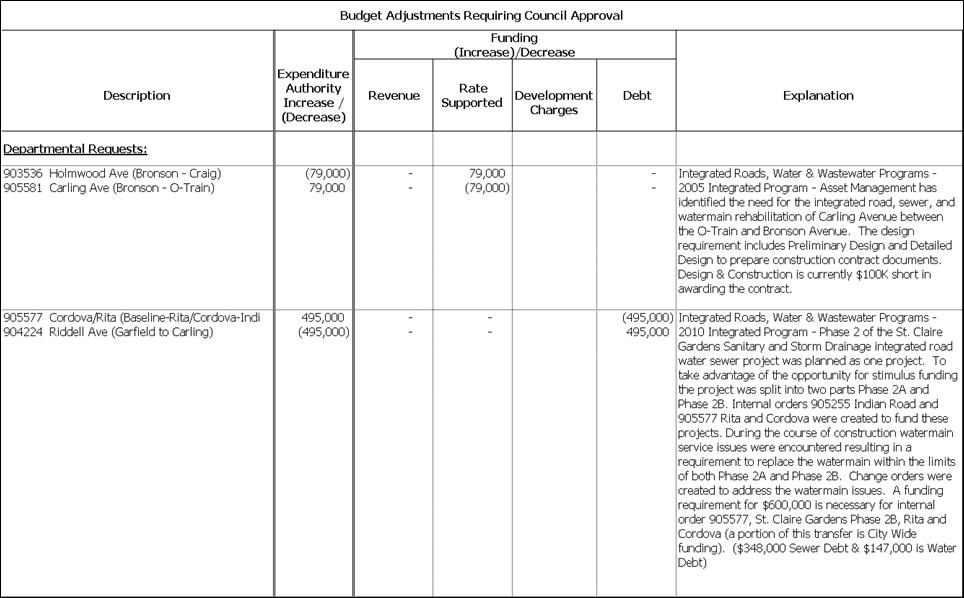

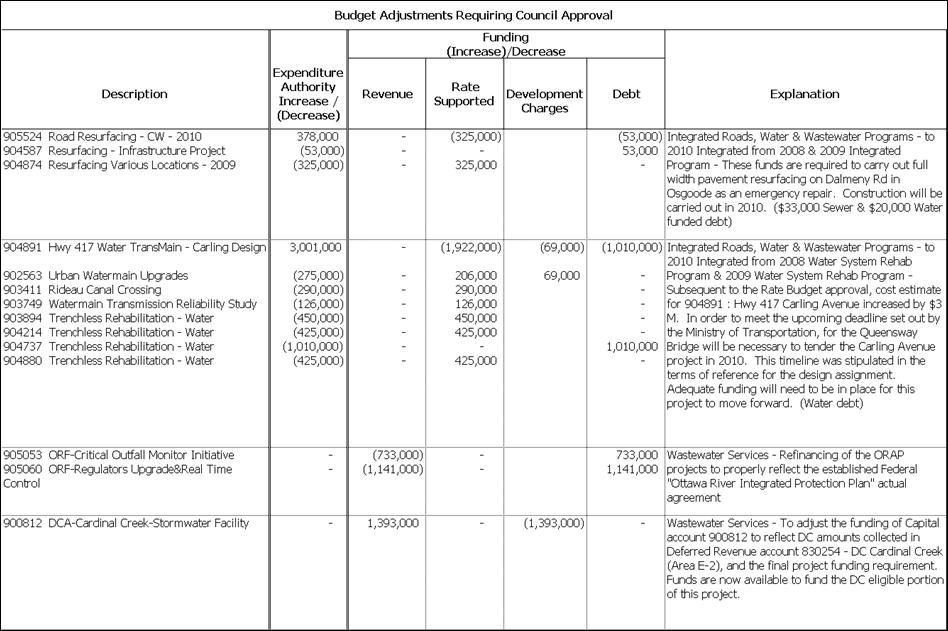

This report includes those capital budget adjustments that require specific Council approval (Document 1) as well as those that have been made as a result of delegated authority provisions (Document 5). The latter is provided for the information of Council, while adjustments in the former document are being recommended for approval.

Capital project closures are also included in this report with details provided in Document 2. In closing these projects, surplus funds are firstly applied to those projects being closed that are in deficits and the net surplus is returned to source.

As indicated above, the detail of those capital budget adjustments that require Council approval because they are not within the delegated authority limits of the City Treasurer for the transfer of funds is provided in Document 1. An explanation for why each budget adjustment is required, as provided by the submitting department, is also included.

Document 1 separates those budget adjustments requested by project managers from administrative adjustments. Unlike those requested by departments, administrative adjustments do not have an impact on scope or nature of work, nor do they involve transfers between projects. Generally, they revise the financing of a project and require Council approval because they either involve debt or exceed the authority limits provided to the City Treasurer as identified in the delegation of authority by-law.

All capital projects recommended for closure are listed in Document 2. Also provided is information related to the adjustments required that will return excess funds to source or fund project deficits.

For those integrated projects that will be closed, the information provided includes both tax and rate funding. This is because both tax and rate sources of funding are affected if there is a deficit or surplus when these projects are closed. Although this report seeks Council approval for the rate-supported portion of these projects only, the impact on the tax-supported portion is also shown for information purposes. The “Capital Adjustments and Closing of Projects – Tax Supported” report will show the same integrated projects, but will make recommendations related to the tax portion of the projects while the rate portion will be included for information.

Changes in debt authority require the specific approval of City Council. As a result of project closures, reductions, and project refinancing (contained in Document 1 and 2), there has been a net reduction of development charge debt authority of $3.422 million.

Criteria for Closure

As directed by the Executive Management Committee (EMC), capital projects will be considered for closure when it meets any one of the following three criteria:

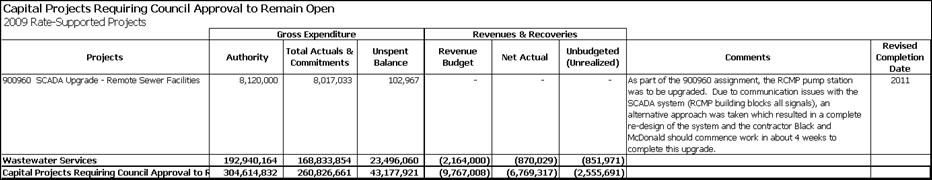

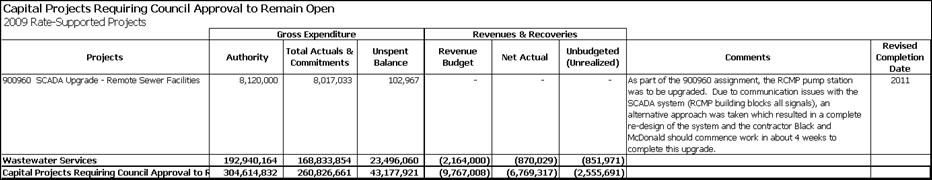

If a project meets any one of these criteria, but the project manager deems the project not complete, an explanation will be provided and a new year of completion recommended to City Council.

Document 3 lists those capital projects that qualify for closure based on the stated closure criteria, but are recommended to remain open. Project managers have provided reasons why each of these projects is to remain open. Upon Council approval of this recommendation, the year of completion for these projects will be revised accordingly.

Those capital budget adjustments processed under the authority delegated to the City Treasurer (By-law 2009-231) for the period, March 15, 2009 to May 10, 2010 are detailed in Document 4.

The authority to make adjustments under the By-law includes:

· transfers between stand-alone capital projects or capital programs that do not exceed ten percent (10%) or $100,000.00 for the life of the capital project receiving the transfer, whichever amount is less;

· transfers, without limit, between capital projects within an existing approved capital program;

· increasing the capital project authority if new or additional revenues are received that are conditional upon the delivery of specific works within the project; and

· funding adjustments to refinance any capital project to effect changes resulting from new funding sources.

Document 4 is provided for the information of Committee and Council as these adjustments have been processed.

The purpose of this report is administrative in nature and therefore no public consultation is required. All departments have been involved in its preparation.

There are no legal / risk management impediments to implementing the recommendations of this report.

The impact of the budget adjustments recommended in Document 1 and the closing of capital projects recommended in Document 2 are summarized in the chart below.

|

|

Budget Adjustments (Document 1) $000

(Return to Source)/ Funding Required |

Project Closures (Document 2) $000

(Return to Source)/ Funding Required |

Total $000

(Return to Source)/ Funding Required |

|

Revenue

|

555

|

-

|

|

|

Rate supported reserve funds · Water · Wastewater

Tax supported reserve funds

Subtotal |

(300) (700)

-

(1,000) |

(1,072) (2,675)

(33)

(3,780) |

|

|

Development charges |

3,933 |

(672) |

3,261 |

|

(3,374) |

(48) |

(3,422) |

|

|

Total |

114 |

(4,500) |

(4,386) |

Document 5 is an update to the City’s reserve fund position and incorporates the recommendations in this report.

Document 2 – Capital Projects Recommended for Closure

Document 3 – Capital Projects Requiring Council Approval to Remain Open

Document 4 – Budget Adjustments Processed Under Delegated Authority

Document 5 – Reserve Fund Status

Upon approval of this report, Finance will process the necessary adjustments.

Document 1

|