Economic Development Update - January 2016

Monthly Highlights

- Economic Growth. Canada’s economy remained flat in October 2015, with gains in the mining, quarrying, and oil and gas extraction sector and the public sector offset by losses in all of the other components of national GDP.

- Inflation. Consumer prices in Ottawa rose 1.0 per cent in the 12 months to November 2015, marking a twelfth consecutive month in which local inflation sat below the Bank of Canada’s target of two per cent.

- Labour Market. The Canadian economy shed 35,700 jobs in November 2015, reversing gains in October (+44,400 jobs). Public administration experienced the largest decline (-32,500 jobs), as temporary election-related positions created in October were removed from the workforce. In line with this trend, Ottawa’s labour market shed 2,900 jobs in November, fully reversing the 2,600 jobs created the previous month.

- Real Estate – New Construction. Housing starts in Ottawa totalled 754 units in November 2015, marking the second best monthly performance to date this year. While new home construction continued to lag behind 2014 figures on a year-to-date basis (-12.2 per cent in November), stronger employment conditions are expected to help boost starts in 2016.

- Real Estate – Resale Market. Ottawa real estate agents sold 990 residential properties in November 2015 – down somewhat from the 1,161 homes sold in October. Despite the monthly decline, market analysts note that resale activity has increased year-over-year (+99 properties sold) as a result of milder fall weather and post-election activity.

- Construction. Building permits totalling $185.3 million were issued in Ottawa in October 2015, with the largest proportion of permits (29.5 per cent) issued for projects located within the Greenbelt.

New and Noteworthy

- Statistics Canada announced it will be hiring 35,000 workers across Canada to conduct the 2016 Census. Approximately 3,400 of these jobs will be located in the National Capital Region.

- Bank of Canada Governor Stephen Poloz gave the keynote address at the Mayor’s Breakfast event held at City Hall on January 7, 2016. Click here to view Mr. Poloz’ speech.

- Celebrations Ottawa Inc. recently announced a partnership with the CIBC that will see the two organizations co-host the 150th anniversary of Canada’s confederation in Ottawa in 2017.

Economy

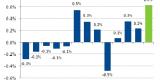

The Canadian Consumer Price Index (CPI) rose 1.4 per cent in the twelve months to November 2015, marking a twelfth consecutive month in which price inflation sat below the Bank of Canada’s target of two per cent. Consumer prices in Ottawa also held below the Bank’s target, rising 1.0 per cent over the same period.

Figure 1 – Rate of Inflation (%), 2014-2015

Looking at economic growth, Canadian Gross Domestic Product (GDP) remained flat (0.0%) in October 2015 after falling 0.5 per cent in September. Gains in the mining, quarrying, and oil and gas extraction sector (+0.7 per cent), and the public sector (+0.2 per cent) were offset by losses in all of the other main components of GDP (i.e., manufacturing, retail and wholesale trade, finance and insurance, construction, utilities, and transportation and warehousing).

Source: Statistics Canada Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for November 2015, and Gross Domestic Product results for Canada for October 2015.

Labour Market

The Canadian labour market shed 35,700 jobs in November 2015, largely offsetting gains in October (+44,400 jobs). The public administration sector experienced the largest decline in employment this month (-32,500 jobs) as temporary election-related positions (e.g., election administration positions, political party canvassers, poll workers, etc.) were no longer needed. Accordingly, the national unemployment rate edged-up slightly to 7.1 per cent (+0.1 per cent from October), on par with the rate in September when election hiring had yet to ramp-up.

“The details of the report [Labour Force Survey] were not as weak as the headlines suggested, with almost the entire job loss due to a steep drop in public administration – i.e., part-time, election-related jobs.” – BMO

At the provincial level, eight out of ten provinces posted job losses this month. Alberta saw the sharpest drop (-14,900 jobs), bringing its unemployment rate to 7.0 per cent (+0.4 per cent from October). In fact, this marked the first time since 1990 that Alberta’s unemployment rate sat above the rate in Ontario (6.9 per cent in November).

Following the trend at the national level, Ottawa’s labour market shed 2,900 jobs in November, fully reversing the 2,600 jobs added in October. Likewise, the unemployment rate rose slightly this month (+0.2 per cent to 6.3 per cent) following a small dip in October (-0.1 per cent).

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for November 2015 (custom data extraction, three-month moving average, seasonally adjusted).Other sources cited in this section include BMO Financial Group’s EconoFacts publication for December 4, 2015.

Real Estate

Housing starts in Ottawa totalled 754 units in November 2015 – the second best monthly performance on this indicator to date this year. Starts increased significantly on a month-over-month basis (+77.8 per cent or by a count of 330 units), with single-detached homes experiencing the single largest gain (+168 units).

In line with the trend in recent months, year-to-date housing starts continued to lag significantly behind the same period in 2014 (-12.2 per cent in November). While it is unlikely this trend will be reversed heading in to December, the Canada Mortgage and Housing Corporation notes that starts are set to improve in 2016 on the back of more robust employment conditions.

“In 2016, housing starts in the Ottawa [CMA] are expected to rebound by 4 per cent over 2015…Improvement in employment and wages will support housing starts over the forecast horizon.” – CMHC

Looking at the market for resale homes, Ottawa real estate agents sold 990 residential properties in November 2015 – down somewhat from the 1,161 homes sold in October. Despite the monthly decline, resale activity increased year-over-year with total sales up from 891 properties in November 2014. According to the Ottawa Real Estate Board (OREB), “mild temperatures in November, combined with increased activity post-election” help to explain the annual gains.

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for November 2015. Other sources cited in OREB’s news release on November 2015 sales figures (December 3, 2015) and CMHC’s Housing Market Outlook (Fall 2015).

Construction

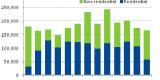

According to Statistics Canada, building permits totalling $185.3 million were issued in Ottawa in October 2015: $102.5 million in residential permits and $82.7 million in non-residential permits. Month-over-month, the value of permits issued declined 24.3 per cent, with non-residential permits experiencing the largest drop (-39.0 per cent). In line with the monthly trend, the value of building permits also dipped on a year-over-year basis (-15.7 per cent).

Figure 2 - Building Permits ($ thousands), 2014-2015

The largest proportion of permits issued in October occurred within the Greenbelt (29.5 per cent). Major projects this month include a $20.8 million permit issued for work at 160 Elgin Street (Place Bell) and an $18.7 million permit issued for 2 Rideau Street (Government Conference Centre).

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for October 2015 (seasonally adjusted) and City of Ottawa building permit data for October 2015. Please note that City figures may differ from Statistics Canada as data from the later allows for comparison to provincial and national figures.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Nov. 2014 | Oct. 2015 | Nov. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 2.0 | 0.6 | 1.0 | 0.4 | -1.0 | Down |

| Avg. Weekly Earnings ($) | 1,018 | 1,031 | 1,014 | -17 | -4 | Down |

Labour Market

| Indicator | Nov. 2014 | Oct. 2015 | Nov. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 575.2 | 567.8 | 565.5 | -2.3 | -9.7 | Down |

| Employed (‘000) | 540.4 | 532.8 | 529.9 | -2.9 | -10.5 | Down |

| Unemployed (‘000) | 34.8 | 34.9 | 35.6 | 0.7 | 0.8 | Up |

| Unemployment rate (%) | 6.1 | 6.1 | 6.3 | 0.2 | 0.2 | Up |

| Participation rate (%) | 70.3 | 68.6 | 68.3 | -0.3 | -2.0 | Down |

Real Estate

| Indicator | Nov. 2014 | Oct. 2015 | Nov. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 668 | 424 | 754 | 330 | 86 | Up |

| Average price - new homes ($) | 481,793 | 515,010 | 507,915 | -7,095 | 26,122 | Up |

| Average price - resale market ($) | 357,009 | 357,648 | 359,569 | 1,921 | 2,560 | Up |

Construction

| Indicator | Oct. 2014 | Sep. 2015 | Oct. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 110,706 | 109,281 | 102,549 | -6,732 | -8,157 | Down |

| Non-Residential permits ($000) | 109,081 | 135,590 | 82,707 | -52,883 | -26,374 | Down |

| Industrial ($000) | 9,821 | 19,539 | 4,230 | -15,309 | -5,591 | Down |

| Commercial ($000) | 42,001 | 93,437 | 62,714 | -30,723 | 20,713 | Up |

| Institutional/Gov’t ($000) | 57,259 | 22,614 | 15,763 | -6,851 | -41,496 | Down |

Economic Development Update - February 2016

Monthly Highlights

- Economic Growth. According to the Ontario Chamber of Commerce, the Liberal government’s promise to increase government spending is expected to fuel economic growth in Ottawa in 2016 and 2017.

- Inflation. Consumer prices in Ottawa rose 1.3 per cent in the 12 months to December 2015, marking a thirteenth consecutive month in which the local rate of price inflation sat below the Bank of Canada’s target of 2 per cent.

- Labour Market. On an annualized basis, Ottawa lost 2,700 jobs in 2015. Declines in the public administration and professional, scientific and technical services sectors (-7,500 jobs and -5,600 jobs) were offset by gains in construction (+12,200 jobs). Looking ahead, the Ontario Chamber of Commerce predicts employment will grow 0.9 per cent in 2016 and 1.9 per cent in 2017, as a result of federal government spending and growth in the high-tech and construction sectors.

- Real Estate. Ottawa housing starts experienced an annual decline of nearly 14 per cent in 2015 (790 units less than in 2014). Condominium starts experienced the sharpest drop year-over-year (-650 units), followed by row starts (-372 units). Resale market activity, on the other hand, increased 5.4 per cent annually in 2015. According to Canada Mortgage and Housing Corporation (CMHC), the resale market will continue to strengthen in 2016 before slowing slightly in 2017.

- Construction. While building permits continue to lag significantly behind the same period in 2014 (-22.0 per cent from year-to-date figures in November 2014), the outlook for the construction industry remains strong, with work continuing on several major projects in 2016, including Light Rail Transit.

New and Noteworthy

- The Bank of Canada held its overnight interest rate at 0.5 per cent in its most recent Monetary Policy Report released on January 20, 2016.

- The National Capital Commission (NCC) unveiled two proposals for the redevelopment of Lebreton Flats on January 26, 2016. Click here to view further details!

The Economy

The Consumer Price Index (CPI) measures changes in the price of consumer goods and services purchased by households. In Ottawa, consumer prices rose 1.3 per cent in the 12 months to December 2015, marking a thirteenth consecutive month in which the local rate of price inflation sat below the Bank of Canada’s target of 2 per cent. As is historically the case, the average price change reported in Ottawa for the period is slightly below the national and provincial level (1.6 per cent and 1.7 per cent, respectively).

In terms of economic growth, the Bank of Canada is calling for a modest increase in national gross domestic product in 2016 (+1.4 per cent). Not surprisingly, weaker oil prices are expected to subtract from growth in energy-based sectors. The Bank notes, however, that recent activity in the non-resource sectors “has been relatively solid and is expected to be the main source of growth going forward” as a result of the lower Canadian dollar.

At the local level, the Ontario Chamber of Commerce predicts that the Liberal government’s campaign pledge to increase public spending and incur a modest deficit will help spur economic activity in Ottawa in 2016 and 2017.

“Growth in public sector activity is expected to lift the broader economy through multiple channels, including greater demand for professional services and retail spending, more housing, and increased business and public-sector investment.” – Ontario Chamber of Commerce

Source: Statistics Canada Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for December 2015.Other sources cited in this section include the Bank of Canada’s Monetary Policy Report for January 2016 and the Ontario Chamber of Commerce’s 2016 economic update for the Ottawa CMA.

Labour Market

The Canadian economy added 22,800 jobs in December 2015 as a result of gains in part-time employment (+29,200 jobs). Despite the month-over-month increase, the unemployment rate remained constant at 7.1 per cent for a second consecutive month. Provincially, the Ontario labour market added the most jobs in December (+34,900 jobs) which led to a small dip in the provincial unemployment rate (-0.2 per cent to 6.7 per cent).

In line with the national and provincial trend, Ottawa added 1,000 jobs in the month of December. The modest addition of new jobs did not, however, affect the unemployment rate, which held steady at 6.3 per cent for a second consecutive month. On an annualized basis, the local labour market shed 2,700 jobs, all of which were full-time positions. By sector, public administration experienced the largest decline (-7,500 jobs), followed by professional, scientific and technical services (-5,600). On a more positive note, the construction sector showed strength this year, adding 12,200 jobs over 2014.

Looking ahead, local employment conditions are poised to improve in the next few years. According to the Ontario Chamber of Commerce’s latest forecast, increased government spending combined with growth in the construction and high-tech sectors will lead to job gains in 2016 and 2017.

“…the Ottawa CMA will experience growth in the coming years, projected at 0.9 per cent employment growth in 2016 and 1.9 per cent in 2017.” – Ontario Chamber of Commerce.

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for December 2015 (custom data extraction, three-month moving average, seasonally adjusted).Other sources cited in this section include the Ontario Chamber of Commerce’s 2016 economic update for the Ottawa CMA.

Real Estate

Housing starts in Ottawa totalled 422 units in December 2015, down from 577 units started at this time last year (a decrease of 26.9 per cent). Declines were noted in every dwelling type with the exception of single family homes (“singles”), which grew 61.7 per cent year-over-year in December.

On an annual basis, the number of housing starts in 2015 totalled 4,972 units, well behind the 5,762 units recorded in 2014 (a decline of 13.7 per cent). Condominium starts experienced the sharpest drop (-650 units), followed by row starts (-372 units). Bucking the trend, starts for single dwellings totalled 217 units more than in 2014.

On the resale market, Ottawa real estate agents sold 703 residential properties in December 2015 – the highest level of sales on record for the month of December. According to the Ottawa Real Estate Board, the total number of homes sold in 2015 was 14,691, which is an increase of 5.4 per cent from 2014. Looking ahead, resale market activity in 2016 is expected to build on the momentum from 2015 before slowing slightly in 2017.

“Resale market activity will continue to strengthen in 2016 before declining modestly in 2017” – CMHC

Looking at prices, the average selling price for a newly constructed single-detached residential property in Ottawa in December 2015 was $477,881. By comparison, the average price of a home on the resale market was $355,878.

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for December 2015. Other sources cited in OREB’s news release on November 2015 sales figures (January 6, 2016) and CMHC’s Housing Market Outlook (Fall 2015).

Construction

According to Statistics Canada, Ottawa issued building permits totalling $199.2 million in November 2015: $125.4 million in residential permits and $73.8 million in non-residential permits. Residential construction intentions increased 22.7 per cent from October, while non-residential construction declined 8.7 per cent.

The largest proportion of permits issued in November was for projects in the east end of Ottawa (37.9 per cent). The south end of the city comprised 26.7 per cent of total permits issued this month, followed by permits issued for Ottawa Centre (20.2 per cent) and for the west end (15.2 per cent).

In the 11 months to November 2015, local builders took out building permits valued at $2.0 billion, which is 22 per cent less than the value of permits issued over the same period in 2014. While it is unlikely this trend will be reversed in December, the outlook for Ottawa’s construction sector remains strong, with work continuing on several major projects in 2016, including Light Rail Transit.

The Conference Board of Canada expects the construction industry to grow by 3 per cent in 2016, well ahead of the 1.6 per cent growth it predicts for the economy as a whole.

“All in all, total construction output is forecast to climb by 2.9 per cent this year and 3 per cent next year [2016], a big improvement over the 0.8 per cent annual average decline over 2011-2014.” – Conference Board of Canada.

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for November 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allows for comparison to provincial and national figures. Other sources cited in this section include the Conference Board of Canada’s “Metropolitan Outlook” for Fall 2015.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Dec. 2014 | Nov. 2015 | Dec. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 1.5 | 1.0 | 1.3 | 0.3 | -0.2 | Down |

| Avg. Weekly Earnings ($) | 1,024 | 1,014 | 1,020 | 6 | -4 | Down |

Labour Market

| Indicator | Dec. 2014 | Nov. 2015 | Dec. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 574.8 | 565.5 | 566.4 | 0.9 | -8.4 | Down |

| Employed (‘000) | 540.7 | 529.9 | 530.9 | 1.0 | -9.8 | Down |

| Unemployed (‘000) | 34.1 | 35.6 | 35.5 | -0.1 | 1.4 | Up |

| Unemployment rate (%) | 5.9 | 6.3 | 6.3 | 0.0 | 0.4 | Up |

| Participation rate (%) | 70.2 | 68.3 | 68.3 | 0.0 | -1.9 | Down |

Real Estate

| Indicator | Dec. 2014 | Nov. 2015 | Dec. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 577 | 754 | 422 | -332 | -155 | Down |

| Average price - new homes ($) | 508,559 | 518,472 | 477,881 | -40,591 | -30,678 | Down |

| Average price - resale market ($) | 345,336 | 359,569 | 355,878 | -3,691 | 10,542 | Up |

Construction

| Indicator | Nov. 2014 | Oct. 2015 | Nov. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 96,330 | 102,216 | 125,448 | 23,232 | 29,118 | Up |

| Non-Residential permits ($000) | 102,080 | 80,750 | 73,757 | -6,993 | -28,323 | Down |

| Industrial ($000) | 449 | 4,260 | 6,180 | 1,920 | 5,731 | Up |

| Commercial ($000) | 30,421 | 60,727 | 52,031 | -8,696 | 21,610 | Up |

| Institutional/Gov’t ($000) | 71,210 | 15,763 | 15,546 | -217 | -55,664 | Down |

Economic Development Update - March 2016

Monthly Highlights

- Economic Growth. The Conference Board of Canada predicts that Ottawa-Gatineau’s economy will grow by 1.7 per cent in 2016, thanks to gains in the public administration, non-residential construction and high-tech services sectors.

- Inflation. The Canadian inflation rate sat at 2.0 per cent in January 2016 – marking the first time since November 2014 that the national rate sat at the Bank of Canada’s inflation control target. The Ottawa inflation rate was 1.6 per cent for the same period.

- Labour Market. The Ottawa labour market shed 1,100 jobs in January 2016, which led to a small increase in the unemployment rate (+0.1 per cent to 6.4 per cent). Looking ahead, local public administration employment is poised to grow 1.3 per cent in 2016 as the federal government – Ottawa’s single largest employer – prepares to announce a fiscal stimulus package as part of its 2016-17 budget.

- Real Estate. Ottawa housing starts totalled 345 units in January 2016 – a marked decline from December 2015 (-18.2 per cent). While most dwelling types experienced a drop in January, it is worth noting that condominium construction picked up significantly (+168 units) – bucking the trend of the past several months in this housing segment. On the resale market, Ottawa real estate agents sold 601 homes in January 2016, down from 703 homes sold in December 2015 (-14.5 per cent).

- Construction. Looking at the year in review, Ottawa issued $2.3 billion in building permits in 2015 – a decline of 16.6 per cent from the value of permits issued in 2014 ($2.7 billion), attributable to softer residential construction activity. The non-residential construction sector, on the other hand, continued to show strength in 2015, with total permits up 5.0 per cent from 2014.

New and Noteworthy

- The Bank of Canada continued to hold its overnight interest rate at the historical low of 0.5 per cent in its rate announcement of March 9, 2016.

- Mayor Jim Watson will lead an important trade mission to India from April 18 to 22, 2016. The purpose of the mission is to showcase Ottawa’s collective strengths in economic development.

The Economy

The Canadian economy grew by a modest 1.2 per cent in 2015, following growth of 2.5 per cent in 2014. Not surprisingly, the mining, quarrying, oil and gas extraction sector experienced the largest decline (-3.5 per cent). The finance and insurance sector (+4.5 per cent) experienced the largest gain. Looking ahead, the Bank of Canada predicts that economic growth in Canada will pick up by 1.4 per cent in 2016 before accelerating to 2.4 per cent in 2017.

Ottawa-Gatineau’s economy grew 1.0 per cent in 2015, on par with growth in 2014. Looking ahead, the Conference Board of Canada expects the federal government’s election promise to increase fiscal spending combined with strength in the construction and high-tech services sectors will help to drive growth of the local economy to 1.7 per cent in 2016.

“The [Ottawa-Gatineau] economy will continue to benefit from robust non-residential construction activity, thanks to several major ongoing projects, as well as positive momentum in the high-tech services sector.” – Conference Board of Canada

In terms of prices, Canada’s Consumer Price Index (CPI) increased 2.0 per cent in the 12 months to January 2016 – marking the first time since November 2014 that price inflation reached the Bank of Canada’s inflation control target. Consumer prices in Ontario also increased 2.0 per cent over the same period, while prices in Ottawa increased 1.6 per cent.

Source: Statistics Canada Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for January 2016 and Gross Domestic Product by Industry results for Canada for 2015.Other sources cited in this section include BMO Financial Group’s EconoFacts publication on real Canadian GDP (March 1, 2016) and the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Winter 2016).

Labour Market

The Canadian labour market shed 5,700 jobs in January 2016, with losses in eight of 10 provinces. Alberta and Manitoba saw the largest decline in employment (-10,000 jobs and -5,300 jobs, respectively), while Ontario added the most jobs month-over-month (+19,800 jobs). British Columbia was the only other province to post gains in employment over this period (+1,200 jobs).

Despite gains at the provincial level, the Ottawa labour market shed 1,100 jobs this January, reversing gains experienced in December (+900 jobs). As a result, the unemployment rate increased slightly to 6.4 per cent (+0.1 per cent from December 2015). As is historically the case, the unemployment rate in Ottawa remains below the rate at the national and provincial levels (7.2 per cent and 6.7 per cent, respectively).

Although the federal government has yet to table its 2016-17 budget, the Conference Board of Canada anticipates that increased fiscal spending – an important pillar of the Liberals’ election platform – will result in local job creation. In fact, the Conference Board predicts public administration employment will grow 1.3 per cent in 2016, marking the first increase in four years.

“The newly elected federal government has already signalled its willingness to run successive years of deficits, implying a slightly more positive outlook for public administration activity [in Ottawa-Gatineau].” – Conference Board of Canada

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for January 2016 (custom data extraction, three-month moving average, seasonally adjusted).Other sources cited in this section include the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Winter 2016).

Real Estate

Housing starts totalled 345 units in January 2016 – a marked decline from the 422 starts recorded in December 2015 (-18.2 per cent). By dwelling type, row housing experienced the sharpest drop in activity (-133 units from December), followed by single-detached homes (-122 units). It is worth noting that condominium construction picked-up significantly month-over-month (+168 units), bucking the trend of the past several months.

Muted economic growth, combined with significant job losses in the public administration sector over the past several years, has led to an increase in unsold inventory of newly built homes in Ottawa. The Conference Board of Canada predicts that housing starts in 2016 are likely to remain subdued as local builders look to sell-off this inventory before beginning construction on new units.

“Even though builders have scaled back construction, this has failed to prevent a build-up in inventory of newly completed homes…Therefore, we expect new home construction to remain weak in the near term.” – Conference Board of Canada

On the resale market, Ottawa real estate agents sold 601 homes in January 2016, down from 703 homes sold in December 2015 (-14.5 per cent). According to the Ottawa Real Estate Board (OREB), this month-over-month drop can be attributed to the onset of typical winter weather following warmer than usual conditions in the past few months of 2015.

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for January 2016. Other sources cited include the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Winter 2016) and OREB’s news release on January 2016 sales figures (February 3, 2016).

Construction

According to Statistics Canada, Ottawa issued $173.7 million in building permits in December 2015: $106.3 million in residential permits and $67.4 million in non-residential permits. The value of permits issued in December declined on a month-over-month basis (-13.5 per cent from November 2015), but increased significantly from December 2014 (+36.5 per cent).

Looking at the entire year, Ottawa issued a total of $2.3 billion in building permits in 2015 – a drop of 16.6 per cent from 2014 ($2.7 billion). This decline can be attributed to losses in residential construction intentions (-28.1 per cent from 2014), which aligns with the overall trend in housing starts observed over the same period (-13.7 per cent from 2014).

In contrast, the non-residential construction sector continued to show strength in 2015, with building permits issued for this type of construction up 5.0 per cent from 2014. As recently noted by the Conference Board of Canada, total construction output is set to climb 3.3 per cent in 2016 as work continues on several major non-residential construction projects.

“…non-residential construction activity has been strong as of late, and its outlook remains bright. An abundance of major projects in the area will drive activity at least until 2018.” – Conference Board of Canada

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for December 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allows for comparison to provincial and national figures. Other sources cited in this section include the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Winter 2016).

Tables: Monthly Key Indicators for Ottawa

Economy

| Indicator | Jan. 2015 | Dec. 2015 | Jan. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 1.2 | 1.3 | 1.6 | 0.3 | 0.4 | Up |

| Avg. Weekly Earnings ($) | 1,038 | 1,020 | 1,028 | 8 | -10 | Down |

Labour Market

| Indicator | Jan. 2015 | Dec. 2015 | Jan. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 571.2 | 565.8 | 565.5 | -0.3 | -5.7 | Down |

| Employed (‘000) | 533.6 | 530.4 | 529.3 | -1.1 | -4.3 | Down |

| Unemployed (‘000) | 37.5 | 35.5 | 36.3 | 0.8 | -1.2 | Down |

| Unemployment rate (%) | 6.6 | 6.3 | 6.4 | 0.1 | -0.2 | Down |

| Participation rate (%) | 69.7 | 68.2 | 68.1 | -0.1 | -1.6 | Down |

Real Estate

| Indicator | Jan. 2015 | Dec. 2015 | Jan. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 189 | 422 | 345 | -77 | 156 | Up |

| Average price - new homes ($) | 472,816 | 477,881 | 481,744 | 3,863 | 8,928 | Up |

| Average price - resale market ($) | 347,975 | 355,878 | 356,868 | 990 | 8,893 | Up |

Construction

| Indicator | Dec. 2014 | Nov. 2015 | Dec. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 79,962 | 123,737 | 106,350 | -17,387 | 26,388 | Up |

| Non-Residential permits ($000) | 47,325 | 77,106 | 67,389 | -9,717 | 20,064 | Up |

| Industrial ($000) | 502 | 5,965 | 686 | -5,279 | 184 | Up |

| Commercial ($000) | 41,183 | 54,000 | 48,802 | -5,198 | 7,619 | Up |

| Institutional/Gov’t ($000) | 5,640 | 17,141 | 17,901 | 760 | 12,261 | Up |

Economic Development Update - April 2016

Monthly Highlights

- Economic Growth. The Canadian economy grew 0.6 per cent in January 2016, exceeding many economists’ expectations of 0.3 per cent growth for the month. This growth can be attributed, in large measure, to gains in the utilities sector (+2.7 per cent), manufacturing (+1.9 per cent) and retail trade (+1.5 per cent).

- Inflation. Consumer prices in Ottawa increased 1.1 per cent in the 12 months to February 2016. On average, prices advanced at relatively the same pace as in February 2015, when the local rate of inflation stood at 1.0 per cent.

- Labour Market. Ottawa added 5,300 jobs in February 2016 – the single largest monthly increase since May 2014. While local unemployment also edged-up slightly (+0.2 per cent to 6.6 per cent) due to increased participation in the labour market, Ottawa’s unemployment rate remains one of the lowest among Canada’s largest census metropolitan areas.

- Real Estate. Housing starts totalled 198 units in Ottawa in February 2016 – up from 156 units at the same time last year (+42 units). On the resale market, Ottawa real estate agents sold 911 properties in February 2016 – an increase of 7.2 per cent over February 2015.

- Construction. Ottawa issued building permits totalling $166.2 million in January 2016 – a decline of 8.1 per cent from this time last year. Permits for institutional/governmental buildings made up the bulk of this month’s non-residential construction activity ($53.8 million), including a $19.1 million permit for work at Lamoureux Hall on the University of Ottawa campus.

New and Noteworthy

- Minister of Finance Bill Morneau tabled the newly elected liberal government’s first federal budget entitled “Growing the Middle Class” on March 22, 2016.

- The Kanata North BIA hosted Discover TECHNATA – a new approach to their highly successful career fair on April 7, 2016. The event showcased 49 companies and attracted 1,300 individuals looking for a job in Ottawa’s high-tech industry.

- The Bank of Canada held its overnight interest rate at 0.5 per cent in its most recent Monetary Policy Report released on April 13, 2016.

The Economy

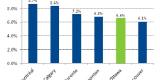

The Canadian economy grew 0.6 per cent in January 2016, marking a fourth consecutive month of positive economic growth. This month’s results exceeded economists’ expectations, with many anticipating 0.3 per cent growth month-over-month. By sector, utilities experienced the largest expansion (+2.7 per cent), followed by manufacturing (+1.9 per cent) and retail trade (+1.5 per cent).

Figure 1 - Monthly Change in Gross Domestic Product (GDP), Canada, 2015-2016

Consumer prices in Canada rose 1.4 per cent in the 12 months to February 2016. Canadians paid more on average for food than at this time last year (+3.9 per cent), while gasoline prices fells significantly over the same period (-13.1 per cent).

In Ottawa, prices rose 1.1 per cent in the 12 months to February 2016. On average, prices advanced at relatively the same pace as in February 2015, when the local rate of inflation stood at 1.0 per cent.

Source: Statistics Canada Gross Domestic Product by Industry results for Canada for January 2016 and Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for February 2016.

Labour Market

Canada’s economy shed 2,300 jobs in February 2016, which led to a slight uptick in the national unemployment rate (+0.1 per cent to 7.3 per cent). This month’s job losses resulted from a sharp decline in full-time employment (-51,800 full-time jobs vs. +49,500 part-time jobs). At the provincial level, Ontario saw the largest drop in employment (-11,200 jobs), while British Columbia saw the largest increase (+14,100 jobs).

Contrary to the trends at the national and provincial level, Ottawa added 5,300 jobs in February 2016 – the single largest monthly increase since May 2014. Despite the gain, the local unemployment rate edged-up to 6.6 per cent (+0.2 per cent from January) due to increased participation in the labour market. That said, Ottawa’s unemployment rate remains one of the lowest among Canada’s six largest census metropolitan areas (CMAs) – second only to Vancouver (6.1 per cent).

Source: Statistics Canada’s Labour Force Survey results for Canada and for the six largest CMAs including the Ontario portion of the Ottawa-Gatineau CMA for February 2016 (custom data extraction, three-month moving average, seasonally adjusted).

Real Estate

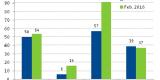

Housing starts totalled 198 units in Ottawa in February 2016 – up from 156 units at the same time last year (+42 units). Increases were observed in all dwelling types – except for apartments – with row housing seeing the largest increase (+34 units).

Figure 3 – Housing Starts by Dwelling Type, Ottawa, 2015-2016

On the resale market, Ottawa real estate agents sold 911 properties in February 2016 – an increase of 7.2 per cent over February 2015. According to the Ottawa Real Estate Board (OREB), “the leap year, which added an extra day to the month” could account for the uptick in activity seen this month.

Homes on the resale market continue to be relatively more affordable than newly built homes. The average selling price of a single-detached home on the resale market was $361,952 compared to $457,714 for a new construction.

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for February 2016. Other sources cited in OREB’s news release on February 2016 sales figures (March 3, 2016).

Construction

According to the most recent data from Statistics Canada, Ottawa issued building permits totalling $166.2 million in January 2016: $58.4 million in residential permits and $107.8 million in non-residential permits. Year-over-year, the value of permits declined 8.1 per cent.

Figure 4 – Value of Building Permits ($ millions), Ottawa, 2015-2016

On the non-residential side, institutional/governmental permits comprised the bulk of permits issued in February ($53.8 million) – as opposed to commercial ($31.5 million) or industrial permits ($22.5 million) – including a $19.1 million permit for work at Lamoureux Hall on the University of Ottawa campus.

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for November 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allow for comparison to provincial and national figures.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Feb. 2015 | Jan. 2016 | Feb. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 1.0 | 1.6 | 1.1 | -0.5 | 0.1 | Up |

| Avg. Weekly Earnings ($) | 1,041 | 1,028 | 1,048 | 20 | 7 | Up |

Labour Market

| Indicator | Feb. 2015 | Jan. 2016 | Feb. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 572.3 | 565.5 | 572.3 | 6.8 | 0.0 | - |

| Employed (‘000) | 532.9 | 529.3 | 534.6 | 5.3 | 1.7 | Up |

| Unemployed (‘000) | 39.5 | 36.3 | 37.7 | 1.4 | -1.8 | Down |

| Unemployment rate (%) | 6.9 | 6.4 | 6.6 | 0.2 | -0.3 | Down |

| Participation rate (%) | 69.8 | 68.1 | 68.9 | 0.8 | -0.9 | Down |

Real Estate

| Indicator | Feb. 2015 | Jan. 2016 | Feb. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 156 | 345 | 198 | -147 | 42 | Up |

| Average price - new homes ($) | 499,556 | 481,744 | 457,714 | -24,030 | -41,842 | Down |

| Average price - resale market ($) | 363,303 | 367,062 | 361,952 | -5,110 | -1,351 | Down |

Construction

| Indicator | Jan. 2015 | Dec. 2015 | Jan. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 31,859 | 106,350 | 58,370 | -47,980 | 26,511 | Up |

| Non-Residential permits ($000) | 148,957 | 67,389 | 107,839 | 40,450 | -41,118 | Down |

| Industrial ($000) | 594 | 686 | 22,481 | 21,795 | 21,887 | Up |

| Commercial ($000) | 56,872 | 48,802 | 31,494 | -17,308 | -25,378 | Down |

| Institutional/Gov’t ($000) | 91,491 | 17,901 | 53,864 | 35,963 | -37,627 | Down |

Economic Development Update - May 2016

Monthly Highlights

- Economic Growth. In its April Monetary Policy Report (MPR), the Bank of Canada revised its economic growth forecast for Canada to 1.7 per cent in 2016 – up from 1.4 per cent growth predicted in the January MPR – as a result of the federal government’s plan to increase fiscal spending.

- Inflation. Lower oil prices continue to impact the Canadian inflation rate, which remained below the Bank of Canada’s 2 per cent target in March 2016 (1.3 per cent). The local inflation rate sat at 1.0 per cent in the same period, while the rate at the provincial level sat at 1.5 per cent.

- Labour Market. Ottawa’s economy added 8,700 jobs since January 2016 (+5,300 in February and +3,400 in March), marking the highest two-month gain in employment observed since the same period in 2012.

- Real Estate. Ottawa homebuilders began construction on 793 units in the first quarter of 2016, which is up significantly from Q1 2015 (+346 units). This increase was especially pronounced in the apartment segment, where starts are trending well ahead of the same quarter last year.

- Construction. Ottawa issued building permits totalling $274.1 million in February 2016 – the strongest monthly recording since September 2014, when there was a surge in the value of permits as developers rushed to avoid an increase to development charges that took effect on October 1, 2014.

New and Noteworthy

- The National Capital Commission’s (NCC) Board has authorized the NCC to begin negotiations for the redevelopment of LeBreton Flats with RendezVous LeBreton, and to report back to the Board in November 2016.

- Ottawa Mayor Jim Watson led a delegation of 35 business and industry leaders to India from April 17 to 22, 2016. The successful trade mission resulted in a number of agreements and strategic partnerships.

- The City of Ottawa and Ottawa Tourism – in partnership with the Economic Club of Canada and the Ottawa Gatineau Hotel Association – will host the Ottawa Tourism Summit at the Shaw Centre on May 30, 2016. Please click here to register for the event.

The Economy

Consumer prices in Canada rose 1.3 per cent in the 12 months to March 2016, marking a second consecutive month in which price inflation held below the Bank of Canada’s target of 2 per cent. According to Statistics Canada, lower oil prices continue to exert downward pressure on the national inflation rate.

In Ottawa, consumer prices rose 1.0 per cent annually in March 2016, which is below the rate of inflation recorded for Ontario (1.5 per cent).

The concern with a low rate of inflation is that it can also be an indication of subdued economic growth. In fact, the Bank of Canada notes in its April Monetary Policy Report (MPR) that the “slack in the Canadian economy has continued to be a source of downward pressure on total inflation.”

On a more positive note, the Bank revised its economic growth forecast for Canada to 1.7 per cent in 2016 – up from 1.4 per cent growth predicted in the January MPR. Increased stimulus spending by the federal government is anticipated to offset downward pressures such as lower than anticipated exports (on the back of a stronger Canadian dollar) and subdued business investment (particularly in the energy sectors).

“This projection has been revised up slightly from January, reflecting stronger government expenditures associated with the recently announced fiscal measures …” – Bank of Canada

Source: Statistics Canada Gross Domestic Consumer Price Index results for Canada, Ontario and the Ontario portion of the Ottawa-Gatineau CMA for March 2016.Other sources cited in this section include the Bank of Canada’s Monetary Policy Report released on April 13, 2016.

Labour Market

The Canadian economy added 40,600 jobs in March 2016, pushing the unemployment rate down 0.2 per cent to 7.1 per cent. The bulk of jobs created this month were full-time (+35,300 jobs) – a significant portion of which occurred in Ontario (+26,300 jobs).

At the local level, Ottawa added 3,400 jobs in March 2016. Combined with record gains the previous month, the local labour market has added a total of 8,700 jobs since January 2016, which represents the most important two-month period for employment growth since February and March of 2012. Given that overall participation in the labour force also increased in March, the unemployment rate ticked up slightly to 6.8 per cent (+0.2 per cent from February).

Source: Statistics Canada’s Labour Force Survey results for Canada, Ontario and the Ontario portion of the Ottawa-Gatineau CMA for March 2016 (custom data extraction, three-month moving average, seasonally adjusted).

Real Estate

Canada Mortgage and Housing Corporation (CMHC) reported that housing starts in Ottawa totalled 250 units in March 2016 – up from 198 units in February. By dwelling type, row housing made up the largest proportion of starts this month (106 units).

On a quarterly basis, Ottawa homebuilders began construction on 793 units in the first quarter of 2016, which is up significantly from Q1 2015 (+346 units). This increase was especially pronounced in the apartment segment, where starts are trending well ahead of the same quarter last year (+209 units). Looking ahead, the CMHC predicts that apartment starts will rebound in 2016 – albeit slightly – following two years of subdued demand for this type of housing.

“In the high-rise segment of the market, condominium apartment starts will rise slightly in 2016 following two years of scaled back activity as builders cleared unsold inventories.” - CMHC

On the resale market, Ottawa real estate agents sold 1,166 properties in March 2016, an increase of 255 properties from the previous month. The Ottawa Real Estate Board (OREB) notes that “properties are starting to sell faster,” a positive indication heading into the busy spring season. Year-to-date, agents sold 2,678 resale properties – on par with the same period in 2015.

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for March 2016. Resale market data from OREB’s news release on February 2016 sales figures (March 3, 2016).Other sources cited in this section include CMHC’s “Housing Market Outlook” for Ottawa (Fall 2015).

Construction

According to Statistics Canada, Ottawa issued building permits totalling $274.1 million in February 2016 – $172.8 million in residential permits and $101.3 million in non-residential permits – marking the strongest monthly recording since September 2014, when there was a surge in the value of permits as developers’ rushed to avoid an increase to development charges that took effect on October 1, 2014.

Commercial permits, which include building types such as office and retail, comprised the vast majority of non-residential permits issued in February – rising to $95.3 million from $31.8 million the previous month. This includes a $23.4 million “office” permit for work undertaken at 3500 Carling Avenue – the former Nortel campus – which is being fit up for occupancy by the Department of National Defence.

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for February 2016 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allow for comparison to provincial and national figures.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Mar. 2015 | Feb. 2016 | Mar. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 1.2 | 1.1 | 1.0 | 0.1 | -0.2 | Down |

| Avg. Weekly Earnings ($) | 1,043 | 1,048 | 1,057 | 9 | 14 | Up |

Labour Market

| Indicator | Mar. 2015 | Feb. 2016 | Mar. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 571.9 | 572.3 | 577.5 | 5.2 | 5.6 | Up |

| Employed (‘000) | 532.6 | 534.6 | 538.0 | 3.4 | 5.4 | Up |

| Unemployed (‘000) | 39.3 | 37.7 | 39.5 | 1.8 | 0.2 | Up |

| Unemployment rate (%) | 6.9 | 6.6 | 6.8 | 0.2 | -0.1 | Down |

| Participation rate (%) | 69.6 | 68.9 | 69.4 | 0.5 | -0.2 | Down |

Real Estate

| Indicator | Mar. 2015 | Feb. 2016 | Mar. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 102 | 198 | 250 | 52 | 148 | Up |

| Average price - new homes ($) | 489,464 | 457,714 | 488,785 | 31,071 | -679 | Down |

| Average price - resale market ($) | 361,817 | 355,163 | 369,129 | 13,966 | 7,312 | Up |

Construction

| Indicator | Feb. 2015 | Jan. 2016 | Feb. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 91,691 | 57,865 | 172,852 | 114,987 | 81,161 | Up |

| Non-Residential permits ($000) | 72,902 | 107,819 | 101,270 | -6,549 | 28,368 | Up |

| Industrial ($000) | 4,240 | 22,915 | 2,908 | -20,007 | -1,332 | Down |

| Commercial ($000) | 59,909 | 31,797 | 95,337 | 63,540 | 35,428 | Up |

| Institutional/Gov’t ($000) | 8,753 | 53,107 | 3,025 | -50,082 | -5,728 | Down |

Economic Development Update - June 2016

Monthly Highlights

- Economic Growth. Ottawa’s economy is expected to grow 2.1 per cent in 2017. The local tourism and hospitality sector, in particular, will benefit from enhanced economic activity as the city hosts a series of major events in celebration of Canada’s 150th anniversary of confederation.

- Inflation. Consumer prices in Canada rose 1.7 per cent in the 12 months to April 2016. Despite persistently holding below the Bank of Canada’s target of 2 per cent, Canada’s inflation rate remains one of the highest among major industrialized economies.

- Labour Market. Ottawa has added 9,600 jobs since the beginning of 2016 – the strongest start to the year since 2012. Looking ahead, the Conference Board of Canada predicts that public administration employment will pick-up this year, after shedding 15,000 jobs between 2013 and 2015.

- Real Estate. To date in 2016, Ottawa builders began construction on 1,095 new housing units compared to 913 units over the same timeframe in 2015. This trend is expected to be maintained throughout 2016, as the market for new homes improves in line with economic conditions.

- Construction. The construction sector in Ottawa will continue to benefit from strong non-residential activity in the years ahead due to ongoing multi-year infrastructure projects and an increase in federal government funding for renovations to major national capital institutions such as the National Arts Centre. After expanding by 7.2 per cent in 2015, this sector is expected to grow a further 4.6 per cent in 2016.

New and Noteworthy

- The Bank of Canada announced it is holding the overnight interest rate at 0.5 per cent on May 25, 2016.

- The Economic Development and Innovation Department, in partnership with the tourism sector, hosted the Ottawa Tourism Summit on May 30, 2016. More than 250 representatives from the tourism industry were in attendance when Mayor Jim Watson and Michael Crockatt, President and CEO of Ottawa Tourism, provided their visions for the future of Ottawa’s tourism industry.

- On June 3, the Province of Ontario announced an investment of $1 billion towards the City’s Stage 2 LRT initiative. In addition, the Province has indicated its intention to cover 50 per cent of the costs associated with extending the system to the airport and from Place d’Orléans to Trim Road.

The Economy

Canada’s economy grew 0.6 per cent in the first quarter of 2016, following 0.1 per cent growth the previous quarter. Exports were the largest contributor to overall growth, posting gains of 1.7 per cent quarter-over-quarter. On the other hand, business investments experienced the most pronounced decline over the same period (-2.5 per cent) due in large measure to the continued weakness in the oil and gas sector.

In its spring outlook, the Conference Board of Canada revised its prediction for economic growth in Ottawa-Gatineau to 1.6 per cent for 2016 – down slightly from 1.7 per cent predicted this winter. That said, the forecast for 2017 remains strong (+2.1 per cent growth), particularly in the tourism sector, which is set to benefit from Ottawa’s programming for Canada’s sesquicentennial anniversary celebrations.

“Next year looks even better, as the tourism industry is expected to enjoy a banner year as several major events take place in the nation’s capital to celebration Canada’s 150th birthday.” – Conference Board of Canada

Looking at prices, Canada’s Consumer Price Index (CPI) rose 1.7 per cent in the 12 months to April 2016. While the national inflation rate continues to hold below the Bank of Canada’s target of 2.0 per cent, persistently low inflation is not unique to Canada. In fact, BMO Financial Group points out that “Canada continues to report the highest inflation rate among major industrialized economies.”

Source: Statistics Canada Gross Domestic Product results for Canada for Q1 2016 and Consumer Price Index results for Canada for April 2016. Other sources cited in this section include the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Spring 2016) and BMO Financial Group’s EconoFacts publication released on May 20, 2016.

Labour Market

The Canadian labour market shed 2,100 jobs in April 2016, following a gain of 40,600 jobs the previous month. Given the modest job loss, the national unemployment rate held steady at 7.1 per cent. At the provincial level, Ontario shed 3,300 jobs which resulted in an uptick in the unemployment rate to 7.0 per cent (+0.2 per cent from March).

At the local level, Ottawa’s economy added 900 jobs in April 2016, marking a third consecutive month of employment growth. In fact, Ottawa added 9,600 jobs since the beginning of 2016 – the strongest start to the year since 2012. The size of the labour force also increased this month, however, which resulted in a slight rise in the unemployment rate (+0.3 per cent to 7.1 per cent).

Looking ahead, the Conference Board of Canada expects that the Government of Canada’s efforts to stimulate economic growth by increasing fiscal spending will lead to increased hiring in the federal public service. After shedding nearly 15,000 jobs between 2013 and 2015, public administration employment in Ottawa-Gatineau is forecast to grow 0.6 per cent in 2016 and 1.1 per cent in 2017.

“Instead of focusing on balancing its books, [the federal government] is providing a modest boost to the Canadian economy… Thus, the federal government is expected to start hiring again, which of course is good news for the local outlook.” – Conference Board of Canada

Source: Statistics Canada’s Labour Force Survey results for Canada, Ontario and the Ontario portion of the Ottawa-Gatineau CMA for April 2016 (custom data extraction, three-month moving average, seasonally adjusted). Other sources cited in this section include the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Spring 2016).

Real Estate

Housing starts in Ottawa totalled 302 units in April 2016, up from 250 units the previous month. This month’s increase in new home construction was driven almost entirely by single-detached starts (+61 units from March), while apartment starts slowed over the same period (-24 units).

To date in 2016, Ottawa builders began construction on 1,095 new housing units compared to 913 units over the same timeframe in 2015. This trend is expected to be maintained throughout the remainder of the year, with the Conference Board of Canada noting that total housing starts in Ottawa are expected to rebound after three consecutive years of decline.

“Public sector job cuts and a sluggish economy have hurt demand for new homes. Housing starts declined for three straight years… Fortunately, we expect residential investment activity to start picking up this year, in line with a gradually improving economy.” – Conference Board of Canada

On the resale front, local real estate agents sold 1,714 residential properties in April 2016 – up from 1,567 properties last year (+9.4 per cent) – marking the best performance for the month of April since 2010. Resale market activity to date in 2016 is pacing ahead of last year (+3.4 per cent) heading into the busy spring/summer season.

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for April 2016. Resale market data from OREB’s news release on April 2016 sales figures (May 5, 2016).Other sources cited in this section include the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Spring 2016).

Construction

According to Statistics Canada, Ottawa issued building permits totalling $239.7 million in March 2016: $134.2 million in residential permits and $105.5 million in non-residential permits. The value of building permits issued in the first quarter of this year totalled $679.5 million – up significantly from the same quarter in 2015 (+32.4 per cent).

The Conference Board of Canada anticipates that non-residential construction will continue to be a key driver for economic growth in Ottawa this year and beyond. Several multi-year projects, including the rehabilitation of the parliamentary precinct ($3 billion) and phase 1 and 2 of light rail transit ($2.1 billion and $3 billion, respectively), are expected to build on last year’s strong performance, when the sector grew by a record breaking 7.2 per cent.

“Non-residential construction will remain a key driver of growth.” – Conference Board of Canada

In addition to ongoing projects, the most recent federal government budget has allocated significant funding towards improvements to several national capital institutions. For example, the National Arts Centre, which has already begun construction on a $110.5 million exterior renovation, has been awarded a further $114.9 million to upgrade interior performance and production spaces. Combined with an anticipated uptick in residential construction, this sector is forecasted to expand 4.6 per cent in 2016.

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for March 2016 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allow for comparison to provincial and national figures. Other sources cited in this section include the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Spring 2016).

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Apr. 2015 | Mar. 2016 | Apr. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 0.6 | 1.0 | 1.7 | 0.7 | 1.1 | Up |

| Avg. Weekly Earnings ($) | 1,036 | 1,057 | 1,077 | 20 | 41 | Up |

Labour Market

| Indicator | Apr. 2015 | Mar. 2016 | Apr. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 571.7 | 577.5 | 580.1 | 2.6 | 8.4 | Up |

| Employed (‘000) | 534.9 | 538.0 | 538.9 | 0.9 | 4.0 | Up |

| Unemployed (‘000) | 36.8 | 39.5 | 41.2 | 1.7 | 4.4 | Up |

| Unemployment rate (%) | 6.4 | 6.8 | 7.1 | 0.3 | 0.7 | Up |

| Participation rate (%) | 69.5 | 69.4 | 69.6 | 0.2 | 0.1 | Up |

Real Estate

| Indicator | Apr. 2015 | Mar. 2016 | Apr. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 466 | 250 | 302 | 52 | -164 | Down |

| Average price - new homes ($) | 546,171 | 488,785 | 512,956 | 24,171 | -33,215 | Down |

| Average price - resale market ($) | 380,387 | 369,129 | 381,641 | 12,512 | 1,254 | Up |

Construction

| Indicator | Mar. 2015 | Feb. 2016 | Mar. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($000) | 128,286 | 172,852 | 134,186 | -38,666 | 5,900 | Up |

| Non-Residential permits ($000) | 39,557 | 101,270 | 105,504 | 4,234 | 65,947 | Up |

| Industrial ($000) | 369 | 2,908 | 31,839 | 28,931 | 31,470 | Up |

| Commercial ($000) | 22,251 | 95,337 | 36,886 | -58,451 | 14,635 | Up |

| Institutional/Gov’t ($000) | 16,937 | 3,025 | 36,779 | 33,754 | 19,842 | Up |

Economic Development Update - July 2016

Monthly Highlights

- Economic Growth. The Canadian economy grew 0.1 per cent in April 2016 – a positive start to the second quarter. That said, economists caution that the Fort McMurray wildfires may dampen the economic outlook for May.

- Inflation. Canada’s inflation rate sat at 1.5 per cent in May 2016. The Bank of Canada expects inflation to remain below its target of 2.0 per cent for some time as a result of continued slack in the national economy.

- Labour Market. Ottawa added 3,500 jobs in May 2016, which led to a decline in the unemployment rate (-0.3 per cent to 6.8 per cent). Year-over-year, the local labour market added 9,600 jobs, in large measure due to gains in the health and education sector (+14,500 jobs).

- Real Estate. Ottawa housing starts totalled 549 units in May 2016 – a significant increase from the same time last year (+219 units). Notably, apartment starts experienced the largest gain year-over-year (+74 units). On the resale front, Ottawa real estate agents sold 1,921 properties over the same period, which is above the five-year average for May (1,864 properties).

- Construction. Ottawa issued building permits totalling $230.8 million in April 2016. On a year-to-date basis, the value of permits issued in the four months to April is trending well ahead of the same period last year (+37.1 per cent). With a recent funding announcement from the Province of Ontario, Stage 2 of Light Rail Transit will help to support recent momentum in the construction sector beyond 2018.

New and Noteworthy

- The Federal Economic Development Agency of Southern Ontario (FedDev Ontario) announced an $8 million contribution to the Innovation Centre at Bayview Yards for new programming and technology. The Innovation Centre is slated to open in later this year.

- During a recent City Council meeting, Mayor Jim Watson announced the eight projects that have been chosen so far to be piloted by the City of Ottawa as part of the Municipal Innovation Pilot Program. This program is designed for local, national, and international entrepreneurs to pilot new technologies, products, or services with the City of Ottawa.

The Economy

According to Statistics Canada, the Canadian economy grew 0.1 per cent in April 2016 – partially recovering from losses in February and March (-0.1 per cent and -0.2 per cent, respectively). While this increase starts the second quarter on a positive note, BMO Capital Markets cautions that May results will likely reflect a notable decline in economic growth due to the Fort McMurray wildfires.

Looking at prices, Canada’s Consumer Price Index (CPI) grew 1.5 per cent in the 12 months to May 2016. According to the Bank of Canada, the national inflation rate is expected to remain below its 2.0 per cent target for the foreseeable future. The Bank notes that “slack in the Canadian economy has continued to be a source of downward pressure on total inflation.”

Source: Statistics Canada Gross Domestic Product results for Canada for April 2016 and Consumer Price Index results for Canada and for the Ontario portion of the Ottawa-Gatineau CMA for May 2016. Other sources cited in this section include the Bank of Canada’s most recent Monetary Policy Report (April 2016).

Labour Market

The Ottawa economy added 3,500 jobs in May 2016, marking a fourth consecutive monthly increase. Since January 2016, local employment grew by 13,100 jobs – the strongest start to the year since the same period in 2012. This month’s increase led to a decline in the unemployment rate to 6.8 per cent (-0.3 per cent since April).

Year-over-year, the local labour market added 9,600 jobs in May 2016. By sector, health and education experienced the largest increase (+14,500 jobs), followed by the professional, scientific and technical services sector (+5,900 jobs). The construction sector, on the other hand, experienced the largest decline (-6,900 jobs), followed closely by the accommodation and food services sector (-6,200 jobs).

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for May 2016 (custom data extraction, three-month moving average, seasonally adjusted).

Real Estate

Ottawa housing starts totalled 549 units in May 2016 – a significant addition from the same time last year (+219 units). This increase was observed across all dwelling types, with apartment starts seeing the largest gain year-over-year (+74 units), followed closely by single and row starts (+70 units each).

On the resale front, Ottawa real estate agents sold 1,921 properties this May – marking a fourth consecutive monthly increase. Sales sat on par with May 2015 results, and well above the five-year average for the month (1,864 properties). The Ottawa Real Estate Board notes that “the resale market continued its steady pace upwards, continuing an above average trend for the month of May.”

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for May 2016. Resale market data from OREB’s news release on May 2016 sales figures (June 6, 2016).

Construction

According to the most recent data from Statistics Canada, Ottawa issued building permits totalling $230.8 million in April 2016: $147.4 million in residential permits and $83.4 million in non-residential permits. On a year-to-date basis, the value of permits issued in the four months to April 2016 is trending well above the same time last year (+37.1 per cent).

As was reported in previous months, non-residential construction in the nation’s capital is expected to continue fuelling economic growth in the years ahead. With construction of the Confederation Line – the largest infrastructure investment project in Ottawa to date ($2.1 billion) – already well underway, the Province of Ontario has committed $1.16 billion towards the Stage 2 Light Rail Transit initiative, which will help to support momentum in the construction sector beyond 2018.

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for April 2016 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allow for comparison to provincial and national figures.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | May 2015 | Apr. 2016 | May 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 0.8 | 1.7 | 1.4 | -0.3 | 0.6 | Up |

| Avg. Weekly Earnings ($) | 1,041 | 1,077 | 1,090 | 14 | 49 | Up |

Labour Market

| Indicator | May 2015 | Apr. 2016 | May 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 567.8 | 580.1 | 582.2 | 2.1 | 14.4 | Up |

| Employed (‘000) | 532.8 | 538.9 | 542.4 | 3.5 | 9.6 | Up |

| Unemployed (‘000) | 34.9 | 41.2 | 39.8 | -1.4 | 4.9 | Up |

| Unemployment rate (%) | 6.1 | 7.1 | 6.8 | -0.3 | 0.7 | Up |

| Participation rate (%) | 69.0 | 69.6 | 69.8 | 0.2 | 0.8 | Up |

Real Estate

| Indicator | May 2015 | Apr. 2016 | May 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 330 | 302 | 549 | 247 | 219 | Up |

| Average price - new homes ($) | 494,396 | 512,956 | 495,982 | -16,974 | 1,586 | Up |

| Average price - resale market ($) | 385,698 | 381,641 | 383,487 | 1,846 | -2,211 | Down |

Construction

| Indicator | Apr. 2015 | Mar. 2016 | Apr. 2016 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 103,040 | 133,743 | 147,353 | 13,610 | 44,313 | Up |

| Non-Residential permits ($000) | 45,730 | 103,574 | 83,397 | -20,177 | 37,667 | Up |

| Industrial ($000) | 2,066 | 31,331 | 19,203 | -12,128 | 17,137 | Up |

| Commercial ($000) | 39,572 | 36,916 | 59,411 | 22,495 | 19,839 | Up |

| Institutional/Gov’t ($000) | 4,092 | 35,327 | 4,783 | -30,544 | 691 | Up |

Economic Development Update - August 2016

Monthly Highlights

- Economic Growth. Although the Canadian economy declined by 0.6 per cent in May, the Bank of Canada expects real gross domestic product (GDP) to rebound in the third quarter of 2016, as oil production capacity is restored and rebuilding efforts commence in the wake of the Fort McMurray wildfires.

- Inflation. Canada’s inflation rate rose by 1.5 per cent in the 12 months to June 2016, remaining in line with the Bank of Canada’s expectation of sub-2 per cent inflation through the end of 2016. Consequently, at its July meeting, the Bank continued its accommodative monetary policy and maintained the key interest rate at 0.5 per cent.

- Labour Market. Ottawa’s labour market added 1,100 jobs this June, marking the fifth consecutive month of gains. Local employment has grown by 14,200 jobs year-to-date, which represents the strongest first half of a year since 2010.

- Real Estate. The 1,985 properties sold in Ottawa during June 2016 not only realized a 3.3 per cent monthly increase and a 17.4 per cent year-over-year gain, but also produced the highest sales total for any month in the history of the Ottawa resale market.

- Construction. In May 2016, Ottawa issued $209.8 million in building permits (+20.8 per cent year-over-year). In the five months to May, there were a total of $1.116 billion in building permits issued in Ottawa, which outpaced the first five months of 2015 by 33.5 per cent.

New and Noteworthy

- The Rideau Centre completed the final phase of a 3-year, $360 million redevelopment, and officially opened its doors to the public on August 11, 2016. The extensive remodel added 230,000 square feet of space to accommodate 21 new stores – the largest being a Simons department store spanning 100,000 square feet.

- On July 31, 2016, Ottawa was announced as the host of the 2017 Canadian Football League (CFL) Grey Cup. Ottawa last hosted the CFL’s championship game in 2004 and the 2017 edition of the Grey Cup along with all of its related events are expected to generate over $100 million for the Ottawa economy.

- Ottawa will be hosting One Young World 2016, the pre-eminent global Summit for young leaders. From September 28 to October 1, young leaders aged 18-30 from 196 countries will be in the nation’s capital to debate and devise solutions to the world’s most pressing issues.

The Economy

The Canadian economy contracted in May 2016, as real gross domestic product (GDP) fell 0.6 per cent from April. As reported in previous months, economists are attributing the decline, in large measure, to the wildfires in Fort McMurray. While the full economic impact of the wildfires remains uncertain, the Bank of Canada (BoC) estimates that second quarter GDP was reduced by 1.1 percentage points. Despite this sluggish growth, GDP in May still rose 1.0 per cent year-over-year and, according to the BoC, GDP is expected to rebound in the third quarter as oil production capacity is restored and rebuilding efforts begin.

At its meeting in July 2016, the BoC decided to hold the key interest rate at 0.5 per cent, thus maintaining accommodative monetary and financial conditions. Put another way, ongoing easy access to credit coupled with the depressed value of the Canadian dollar will help support economic growth, which is currently being driven by federal infrastructure spending and US domestic demand.

“Solid foreign demand and the past depreciation of the Canadian dollar will continue to support non-commodity exports… [which] are expected to exceed the pre-recession peak starting next year.”

– Bank of Canada

Looking at inflation, the national Consumer Price Index (CPI) increased by 1.5 per cent in the 12 months to June 2016. This rate remains in line with the BoC’s expectation that inflation will remain below 2 per cent through 2016. Locally, the Ottawa CPI rose 1.1 per cent in the 12 months to June 2016. The city’s inflation rate has sat below the BoC’s 2.0 per cent target since November 2014.

Source: Statistics Canada Gross Domestic Product results for Canada for May 2016 and Consumer Price Index results for Canada and for the Ontario portion of the Ottawa-Gatineau CMA for June 2016. Other sources cited in this section include the Bank of Canada’s most recent Monetary Policy Report (July 2016).

Labour Market

The Canadian labour market remained flat in June 2016 after shedding 700 jobs; however, the national unemployment rate ticked down to 6.8 per cent from 6.9 per cent in May, thanks to a 1.5 per cent drop in the unemployed population. While there is little difference month-over-month, it is worth noting that the economy added 107,600 jobs year-over-year (+0.6 per cent since June 2015).

At the local level, Ottawa’s economy added 1,100 jobs in June, extending the streak of consecutive monthly increases to five. Since January 2016, local employment has grown by 14,200 jobs, producing the strongest first half of a year since 2010. This month’s increase led to a 0.1 percentage point decline in the unemployment rate to 6.7 per cent.

Examining the last 12 months, the Ottawa labour market added 11,800 jobs. Broken down by sector, educational services saw the largest infusion of jobs (+11,400 jobs), followed by the health care and social assistance sector (+10,300 jobs). In contrast, construction experienced the largest year-over-year decline (-10,100 jobs), followed closely by the accommodation and food services sector (-8,200 jobs).

Source: Statistics Canada’s Labour Force Survey results for Canada and the Ontario portion of the Ottawa-Gatineau CMA for June 2016 (custom data extraction, three-month moving average, seasonally adjusted).

Real Estate

Ottawa housing starts totalled 525 units in June 2016, down slightly from 549 units the previous month. While single (+18 units), semi (+4 units), and row (+29 units) dwellings all recorded monthly gains, June totals were weighed down by apartment starts, which dropped by 75 units from May. This retreat is echoed in the longer term trend, as apartment starts in June fell 392 units from June 2015. Notably, this is the first month in 2016 that apartment starts have declined on a year-over-year basis, and according to the CMHC, “apartment starts are expected to decline in 2016, continuing a three year reduction of activity as builders clear unsold inventory.”

The resale market, on the other hand, continues to show signs of strength. According to the Ottawa Real Estate Board (OREB), 1,985 properties were sold in June 2016, registering a 3.3 per cent increase from the previous month and a 17.4 per cent year-over-year surge. In fact, the elevated sales in June produced a record-breaking month for the Ottawa resale market, with the closest comparable monthly sales figures dating back to May 2009 (1,967 units sold).

“Sales [in the resale market] this past month contributed not only to the highest June on record, it also turned out to be the highest sales in any month ever in the history of the Ottawa Market.”

– Ottawa Real Estate Board

The average sale price for resale properties was $376,959 in June – decreasing 1.7 per cent from May and down 1.6 per cent from the previous year. In comparison, the average sale price for new properties was $513,008 – rising 3.4 per cent from May and up 1.7 per cent from last June.

Source: New housing data from CMHC, “Housing Market Outlook – Spring 2016”, “Starts and Completions Survey”, and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for June 2016. Resale market data from OREB’s news release on June 2016 sales figures (July 6, 2016).

Construction

According to recent figures from Statistics Canada, in May 2016, Ottawa issued $209.8 million in building permits, producing a 20.8 per cent year-over-year increase. This month continued the year’s upward trend, as year-to-date there were $1.116 billion in building permits issued in the five months to May 2016, outpacing the same time last year by 33.5 per cent.