Economic Development Update - May 2015

Monthly Highlights

- Economic growth. Given the collapse of global oil prices, the Bank of Canada predicts that Canada’s economy will have stalled in the first quarter of 2015. On an annual basis, the Bank expects GDP growth for 2015 to come in at 1.9 per cent, down from its earlier prediction of 2.5 per cent in October 2014.

- Employment. In the 12 months to March 2015, employment in Ottawa’s construction sector showed signs of strength (+11,300 jobs) with several major non-residential construction projects underway, including Ottawa Light Rail Transit. While local public sector employment stands to improve following the elimination of the federal deficit, the Conference Board of Canada warns that further cuts could be on the table as the Government of Canada looks to offset the loss of revenue linked to lower oil prices.

- Unemployment. Ottawa’s unemployment rate sat at 7.1 per cent in March 2015, above the rate at the national and provincial level (6.8 per cent and 6.9 per cent, respectively).

- Real estate. New home construction in Ottawa trended significantly lower in the first quarter of 2015 compared to the same time last year (-42 per cent) as a result of colder than normal temperatures and weaker employment conditions. The resale market, on the other hand, is seeing modest signs of growth, with total sales up nearly two per cent year-over-year in the first quarter.

- Construction. While local construction in Ottawa is off to a slower start year-to-date in 2015 (down 37.5 per cent from the same time in 2014), the outlook for this sector continues to be positive with several major ongoing and upcoming projects expected to bolster growth this year and beyond.

New and Noteworthy

- Minister Joe Oliver tabled the Government of Canada’s Economic Action Plan for 2015-16 on April 21, 2015.

- The City of Ottawa and the National Capital Commission have agreed on a plan to extend light rail transit west along Sir John A. Macdonald Parkway.

- The Kanata North BIA hosted its second annual career fair on April 16, 2015. The event attracted nearly 1,100 talented individuals looking for a job in Ottawa’s high-tech industry.

The Economy

Against the backdrop of collapsing global oil prices, which have toppled nearly 60 per cent since June 2014, many economists have revised their predictions for economic growth in Canada in 2015. While first quarter figures have not yet been released, the Bank of Canada predicts that growth will have stalled on the back of a struggling oil and gas industry (which accounted for 8.5 per cent of national GDP in 2014).The Bank also reviewed its annual prediction for economic growth, calling for 1.9 per cent growth in 2015, down from 2.5 per cent predicted for the year at the time of the October 2014 release of the Monetary Policy Report.

“The Bank’s estimate of real GDP in the first quarter of 2015 has been revised down since the January Report, to essentially no growth, primarily reflecting the pulling forward of the impact of the oil price shock.” - Bank of Canada

On a more positive note, the lower Canadian dollar will likely help to soften the impact of the oil crisis by stimulating demand for Canadian goods and services. Specifically, the economic momentum seen in the United States is expected to benefit the manufacturing and non-energy exporting provinces, namely Ontario and Quebec.

Canada’s Consumer Price Index (CPI) increased 1.2 per cent in the 12 months to March 2015, well below the Bank of Canada’s price inflation target of 2 per cent. Following the national trend, Ottawa’s rate of inflation also sat at 1.2 per cent in March, down from a high of 2.4 per cent in October 2014. Given the strain on inflation resulting from oil prices, the Bank of Canada lowered its overnight interest rate to 0.75 per cent in January 2015.

Source: Statistics Canada’s Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for March 2014, and GDP at basic prices by industry results for Canada. Other sources cited in this section include the Bank of Canada’s “Monetary Policy Report” for April 2015.

Labour Market

Canada’s economy added 28,700 jobs in March 2015, following a slight dip in February (-1,000 jobs). This month’s job gain can be entirely attributed to part-time employment (+56,800 jobs), while typically higher-paying full-time employment retreated (-28,200). In contrast, the national labour market added 138,100 jobs over March 2014, the bulk of which were full-time (+110,500 jobs).

Looking at the local job market, Ottawa lost 1,000 jobs month-over-month pushing the jobless rate to 7.1 per cent – above the national and provincial rates (6.8 per cent and 6.9 per cent, respectively). That said, there were 4,300 more jobs in March 2015 than at the same time last year, as a result of significant gains in the construction sector (+11,300 jobs year-over-year) with several non-residential projects, including Ottawa Light Rail Transit, currently underway in the Capital.

Of particular interest for Ottawa, the Government of Canada recently announced that it will eliminate the deficit by fiscal year 2015-2016. As a result, pressures on employment in the federal public service – the largest employer in the region – are expected to ease. Nonetheless, the Conference Board of Canada cautions more cuts could be on the horizon as the federal government contends with the forecasted loss of revenue linked to declining oil prices.

“Lower oil prices and a weaker economy have made it more difficult for the federal government to balance its books as planned…with the largest impact from reduced oil prices expected to hit in 2015-2016, the federal government is expected to fall back into the red…” - Conference Board of Canada

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for March 2015 (custom data extraction, three-month moving average, seasonally adjusted). The data for individual economic sectors are not adjusted for seasonality. Other sources cited in this section the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Winter 2015).

Real Estate

Ottawa homebuilders started work on 102 dwelling units (i.e., starts) in March 2015, a sharp drop from the same month last year, when starts totalled 427 units. While all segments of the new home market retreated, condominium construction experienced the largest decline year-over-year, with total starts dropping to 19 units, down from 235 units in March 2014. Looking at the first quarter as a whole, overall starts are trending significantly lower than last year (-42.2 per cent) in light of colder than normal winter weather and softer employment conditions.

“Colder than normal temperatures in the first two months of the year reduced the number of construction work days and kept starts activity for all dwelling types at bay. In addition, weak CMA employment since last year dented housing activity as builders kept an eye on fundamental market signals before initiating large construction projects.” - CMHC

On the resale market, Ottawa real estate agents sold 1,208 residential properties in March 2015, up two per cent from last year. Year-to-date, local sales are ahead of Q1 2014 (+1.9 per cent) and are expected to maintain this momentum heading into the spring “hot” season.

On the commercial front, Colliers International is reporting a year-over-year increase in the overall office vacancy rate in Ottawa, which sat at 11.2 per cent for the first quarter of 2015, up from 9.7 per cent last year.

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for March 2015. Resale market data adapted from CREA’s monthly sales results for March 2015.Other sources cited in this section include CMHC’s “Housing Now” report for Ottawa (April 2015).

Construction

According to the most recent figures released by Statistics Canada, the City of Ottawa issued building permits totalling $150.8 million in February 2015: $81.4 million in residential permits and $69.4 million in non-residential permits. While construction intentions edged up from last month (+18.7 per cent), year-over-year permits experienced a sharp decline

(-38.3 per cent), due in large measure to lower demand in the residential segment (-50.3 per cent).

Looking at figures released by the City’s Building Code Services Branch, 325 permits were issued in February 2015, down from 350 permits in January and 348 permits at the same time last year. The largest proportion of permits issued were for projects undertaken within the Greenbelt (60.5 per cent), followed by Barrhaven/South Nepean in distant second (24.1 per cent).

While construction intentions are off to a slower start year-to-date in 2015 (down 37.5 per cent from the same time in 2014), the outlook for this sector in Ottawa continues to be positive. Aside from ongoing projects such as Ottawa Light Rail Transit and the renovation of the Rideau Centre, major projects slated for the coming years include the renovation and expansion of the University of Ottawa Heart Institute ($200 million), the renovation of the Government Conference Centre ($190 million), the renovation of the National Arts Centre ($110 million) and the redevelopment of Arts Court ($100 million).

“The non-residential construction sector’s outlook [in Ottawa-Gatineau] is much brighter.” - Conference Board of Canada

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for February 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. Other sources cited in this section include the City of Ottawa Building Code Services Branch’s “Construction, demolition, pool enclosure permits” monthly open data report for February 2015, and the Conference Board of Canada’s Metropolitan Outlook for Ottawa-Gatineau (Winter 2015).

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Mar. 2014 | Feb. 2015 | Mar. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 1.3 | 1.0 | 1.2 | 0.2 | -0.1 | Down |

| Avg. Weekly Earnings ($) | 1,063 | 1,041 | 1,043 | 2 | -20 | Down |

Labour Force

| Indicator | Mar. 2014 | Feb. 2015 | Mar. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 566.2 | 573.5 | 573.1 | -0.4 | 6.9 | Up |

| Employed (‘000) | 528.3 | 533.6 | 532.6 | -1.0 | 4.3 | Up |

| Unemployed (‘000) | 37.8 | 39.9 | 40.5 | 0.6 | 2.7 | Up |

| Unemployment rate (%) | 6.7 | 7.0 | 7.1 | 0.1 | 0.4 | Up |

| Participation rate (%) | 69.9 | 69.9 | 69.8 | -0.1 | -0.1 | Down |

Real Estate

| Indicator | Mar. 2014 | Feb. 2015 | Mar. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 427 | 156 | 102 | -54 | -325 | Down |

| Average price - new homes ($) | 527,983 | 499,556 | 489,464 | -10,092 | -38,519 | Down |

| Average price - resale market ($) | 359,084 | 358,206 | 361,572 | 3,366 | 2,488 | Up |

Construction

| Indicator | Feb. 2014 | Jan. 2015 | Feb. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 163,959 | 31,766 | 81,428 | 49,662 | -82,531 | Down |

| Non-Residential permits ($000) | 80,279 | 95,306 | 69,375 | -25,931 | -10,904 | Down |

| Industrial ($000) | 1,929 | 470 | 3,482 | 3,012 | 1,553 | Up |

| Commercial ($000) | 53,095 | 55,281 | 59,785 | 4,504 | 6,690 | Up |

| Institutional/Gov’t ($000) | 25,255 | 39,555 | 6,108 | -33,447 | -19,147 | Down |

Economic Development Update - June 2015

Monthly Highlights

- Economic growth. Canadian GDP contracted 0.1 per cent in the first quarter of 2015 as a result of declining capital investments (-2.5 per cent). Given the pressure of lower energy costs on overall price inflation in Canada, the Bank of Canada continues to maintain its key interest rate at a historically low 0.75 per cent.

- Labour market. Bucking the trend at the national and provincial levels (-19,700 jobs and -14,300 jobs, respectively), Ottawa’s labour market created 3,100 jobs in April 2015, bringing the unemployment rate down to 6.6 per cent from a nearly five-year peak of 7.1 per cent last month. In a recent report, the Bank of Montreal notes that Ottawa’s knowledge-based sector is showing signs of strength, which bodes well for the local labour market.

- Real estate. Housing starts in Ottawa totalled 466 units in April 2015, up from 102 units last month. That said, year-to-date housing starts in 2015 are lagging behind the same time last year (913 units in 2015 compared to 1,027 units in 2014). On the flip side, the resale market continues to show signs of strength, with 200 more units sold year-to-date this year, compared to 2014.

- Construction. While the city has seen an unprecedented level of non-residential construction in recent years, construction output declined by 12 per cent since 2010 as a result of a soft residential construction sector. On a more positive note, non-residential activity is expected to counterbalance the dip on the residential front this year, with construction output slated to rise 1.8 per cent over 2014.

New and Noteworthy

- Ottawa’s Shopify raised over $150 million in its initial public offering (IPO) which closed on May 27, 2015.

- Ottawa developer Morley Hoppner and Barry J. Hobin & Associates Architects were announced as the selected proponent for the $11.9-million design and build contract for the Innovation Centre at Bayview Yards.

- In partnership with Invest Ottawa and Ottawa Tourism, the City of Ottawa successfully launched the Capital Business Connect program on June 9, 2015.

The Economy

The national Consumer Price Index rose a meagre 0.8 per cent in the 12 months to April 2015 – the lowest increase since October 2013 – on the back of lower energy costs. In Ottawa, price inflation sat at 0.6 per cent for the same period, slumping from 1.2 per cent in March 2015, and well below the Bank of Canada’s inflation target range of 1 per cent to 3 per cent.

The concern with a low rate of inflation is that it can also be a sign of a slowing economy. In fact, the Bank of Canada has cited the low rate of inflation at the national level as one of the reasons it continues to hold its key interest rate at a historically low 0.75 per cent.

“Total CPI inflation is near the bottom of the Bank's 1 to 3 per cent inflation control range, largely due to the transitory effects of sharply lower energy prices.” – Bank of Canada

Looking at economic growth, Canadian GDP declined 0.1 per cent in the first quarter of 2015 – following gains of 0.6 per cent in the last quarter of 2014 – as the economy struggles to absorb the shock of lower oil prices. By GDP component, capital investment led the drop this quarter, contracting by 2.5 per cent, followed by exports and government expenditures (-0.3 per cent and -0.2 per cent, respectively). On the flip side, lower imports (-0.4 per cent), increased investment in inventories and higher consumer demand (+0.2 per cent and +0.1 per cent, respectively) helped to offset some of the negative headwinds this quarter.

Source: Statistics Canada Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for April 2015, and quarterly Gross Domestic Product results for Canada. Other sources cited in this section include the Bank of Canada’s “Monetary Policy Update” on May 27, 2015.

Labour Market

The Canadian economy shed 19,700 jobs in April 2015, partially reversing the 28,700 jobs created last month. Despite the negative headline, the national labour market showed some signs of strength with the addition of 46,900 full-time jobs, which are traditionally more stable and higher paying. Also, the unemployment rate remained steady at 6.8 per cent for a third consecutive month.

By province, Ontario shed 14,300 jobs this April, the second largest provincial decline month-over-month after British Columbia (-28,700 jobs). Despite the recent strains on its economy, Alberta saw the most significant gain in employment over the same period (+12,500 jobs), followed closely by Quebec (+11,700 jobs).

Bucking the trend at the national and provincial levels, Ottawa added 3,100 jobs in April 2015, bringing the unemployment rate down to 6.6 per cent from a nearly five-year peak of 7.1 per cent last month. Furthermore, the Bank of Montreal notes that Ottawa’s knowledge-based sector is showing signs of strength, which bodes well for the highly-skilled local labour force.

“…we’re starting to see a comeback in niche, specialized fields – particularly in knowledge-based industries. Ottawa remains a hub for such companies, and we’re starting to see a revival in that space from the depths of 2000. This is good news for the National Capital Region, with such firms looking to court a high-skilled labour force.” – BMO Financial Group

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for April 2015 (custom data extraction, three-month moving average, seasonally adjusted).Other sources cited in this section include BMO Financial Group’s “BMO Blue Book” for May 2015.

Real Estate

According to the Canada Mortgage and Housing Corporation’s (CMHC) most recent figures, housing starts in Ottawa totalled 466 units in April 2015, up from 102 units in March. This month’s increase was reflected across all dwelling types with the exception of rental starts. Condominium construction saw the largest uptick with 190 units under construction in April, compared to 19 units the previous month.

Notwithstanding the strong monthly performance in April, year-to-date new-housing activity (913 units) is trending below the same time last year (when starts totalled 1,027 units). This year’s dip can be attributed to a slower start in all dwelling types, with the exception of condominiums. Looking ahead, the Conference Board of Canada predicts that total housing starts in the Ottawa-Gatineau CMA will drop by 3 per cent in 2015 to a ten year low of 7,400 units.

On the resale market, members of the Ottawa Real Estate Board (OREB) sold 1,570 units in April 2015, up from 1,208 units the previous month, and above the five-year average for April sales (1,531 units). Year-to-date, the market for resale homes in Ottawa has outperformed the market for new homes, with total sales sitting at 4,258 units in 2015, compared with 4,058 units this time last year. This trend is expected to keep up heading into the spring months.

“Despite the late departure of the cold weather this April, buyers were out in full swing, propelling the Ottawa resale market into a busy spring selling season.” – OREB

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for April 2015. Resale market data from OREB monthly sales figures results for Ottawa. Other sources cited in this section include the OREB May 5, 2015 news release.

Construction

According to the most recent data released by Statistics Canada, the City of Ottawa issued nearly $144.3 million in building permits in March 2015 – $114.7 million in residential permits and $29.6 million in non-residential permits – down from the previous month ($151.2 million) and from March 2014 ($225.4 million). Year-to-date, total building permits are trending significantly below the same time last year (-34.4 per cent).

While the city has seen an unprecedented level of non-residential construction in recent years with major investments such as Ottawa Light Rail Transit and the Rideau Centre expansion, the Conference Board of Canada notes that construction output declined 12 per cent since 2010, mainly as a result of sagging activity on the residential front.

“Despite construction cranes and orange road pylons seemingly everywhere in Ottawa during the past few years, construction output has fallen a cumulative 12 per cent since 2010, including a 4.4 per cent decline in 2014. Sagging housing starts have been to blame for much of the recent weakness.” – Conference Board of Canada

Nevertheless, the Conference Board predicts that the upswing in non-residential construction will counterbalance the downturn in residential activity, with total output set to rise 1.8 per cent this year.

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for March 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allows for comparison to provincial and national figures. Other sources cited in this section include the Conference Board of Canada’s “Metropolitan Outlook” for Spring 2015.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Apr. 2014 | Mar. 2015 | Apr. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 2.0 | 1.2 | 0.6 | -0.6 | -1.4 | Down |

| Avg. Weekly Earnings ($) | 1,068 | 1,043 | 1,036 | -7 | -32 | Down |

Labour Force

| Indicator | Apr. 2014 | Mar. 2015 | Apr. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 567.8 | 573.1 | 573.8 | 0.7 | 6.0 | Up |

| Employed (‘000) | 527.9 | 532.6 | 535.7 | 3.1 | 7.8 | Up |

| Unemployed (‘000) | 39.9 | 40.5 | 38.1 | -2.4 | -1.8 | Down |

| Unemployment rate (%) | 7.0 | 7.1 | 6.6 | -0.5 | -0.4 | Down |

| Participation rate (%) | 70.0 | 69.8 | 69.8 | 0.0 | -0.2 | Down |

Real Estate

| Indicator | Apr. 2014 | Mar. 2015 | Apr. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 253 | 102 | 466 | 364 | 213 | Up |

| Average price - new homes ($) | 508,813 | 489,464 | 546,171 | 56,707 | 37,358 | Up |

| Average price - resale market ($) | 359,276 | 360,326 | 365,897 | 5,571 | 6,621 | Up |

Construction

| Indicator | Mar. 2014 | Feb. 2015 | Mar. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 171,667 | 82,090 | 114,665 | 32,575 | -57,002 | Down |

| Non-Residential permits ($000) | 53,696 | 69,127 | 29,589 | -39,538 | -24,107 | Down |

| Industrial ($000) | 644 | 3,483 | 303 | -3,180 | -341 | Down |

| Commercial ($000) | 48,668 | 59,536 | 20,964 | -38,572 | -27,704 | Down |

| Institutional/Gov’t ($000) | 4,384 | 6,108 | 8,322 | 2,214 | 3,938 | Up |

Economic Development Update - July 2015

Monthly Highlights

- Economy. According to Statistics Canada, national GDP contracted 0.1 per cent in April 2015, marking a fourth consecutive monthly decline. Given that economic growth in Canada was subdued in the first quarter of the year (-0.6 per cent annualized), there is growing concern among economists that Canada may be heading toward a recession (i.e., two consecutive quarters of negative economic growth).

- Labour Market. Ottawa’s job market contracted in May 2015, shedding approximately 2,000 jobs month-over-month. Despite this drop, the local unemployment rate dipped to 6.3 per cent, as a result of fewer workers participating in the labour market (-2,500).

- Real Estate. Housing starts in Ottawa totalled 330 units in May 2015, down from 466 units in April. Year-do-date, the local new home market is trending well below the same time last year (-35.7 per cent). On a more positive note, resale activity continues to show strength, with 6,184 properties sold to date this year, compared to 5,847 properties sold over the same period in 2014.

- Construction. The City of Ottawa issued $158.4 million in building permits in April 2015 – $110.2 million in residential permits and $48.2 million in non-residential permits – up from the previous month ($145.5 million), but down from 12 months ago ($186.8 million). Year-to-date institutional building permits in Ottawa in 2015 are trending significantly ahead of the same period last year, while all other building segments have seen a decline over the same period.

New and Noteworthy

- Invest Ottawa unveiled its new strategic plan on June 23, 2015 with a vision of becoming the most innovative city in Canada.

- Ottawa City Council approved its 2015-2018 Term of Council Priorities, as well as the Stage 2 Light Rail Transit (LRT) Environmental Assessment and Functional Design Report, at its meeting on July 8, 2015.

The Economy

The lower cost of oil continues to depress price inflation in Canada, with the national Consumer Price Index inching ahead a modest 0.9 per cent in the 12 months to May 2015. The trend in Ottawa is in line with the rest of the country, with the rate of inflation sitting at 0.8 per cent over the same period, down from 2.4 per cent last year.

The low rate of inflation is not the only concern when it comes to Canada’s economy. According to the most recent Statistics Canada data available, national GDP contracted 0.1 per cent in April 2015, marking a fourth consecutive monthly decline. This drop can be mainly attributed to oil and gas extraction, which fell 3.4 per cent since March.

Given that economic growth in Canada was subdued in the first quarter of the year (-0.6 per cent annualized), there is growing concern among economists – particularly in light of April’s results – that Canada may be heading toward a recession (commonly defined as two consecutive quarters of negative economic growth), unless May and June come through with strong gains.

“The oil shock continues to reverberate through the Canadian economy, in all its various forms. GDP came stumbling out of the gate in 2015 with four consecutive monthly declines, suggesting it will need some solid gains in the next few months just to keep it out of the red for the entire first half of the year.” BMO Financial Group

Source: Statistics Canada Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for May 2015, and Gross Domestic Product results for Canada for April 2015. Other sources cited in this section include BMO Financial Group’s econoFACTS publication released on June 30, 2015

Labour Market

After struggling in April, Canada’s labour market firmed up in May 2015 with the creation of 58,900 jobs, more than half of which were full-time (+30,900 jobs). Year-over-year, Canada added 192,300 jobs, entirely as a result of gains in the full-time segment (+233,000 jobs).

The Province of Ontario saw the largest increase in employment levels in May with the addition of 43,900 jobs, the bulk of which were full-time (+31,100 jobs). In terms of unemployment, Ontario’s jobless rate dipped to 6.5 per cent (down from 6.8 per cent in April), the lowest point since before the 2008-09 economic downturn, and below the national rate (6.8 per cent) for the first time in nearly nine years.

In contrast to the national and provincial level, Ottawa’s job market contracted in May, shedding approximately 2,000 jobs month-over-month. Despite the job loss, Ottawa’s unemployment rate dipped to 6.3 per cent, down from 6.6 per cent in April, as the number of workers actively looking for work (i.e., participating in the workforce) also declined (-2,500).

Of particular interest, the City of Ottawa’s recent Annual Development Report for 2014 notes that public administration employment edged up last year (+400 jobs), following the loss of 16,600 jobs in 2013. This coincides with the Conference Board of Canada’s prediction that most of the job losses in the federal public service have already taken place.

“Most of the cuts seem to have taken place, so little more downsizing is expected.” Conference Board of Canada

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for May 2015 (custom data extraction, three-month moving average, seasonally adjusted). Other sources cited in this section include the City of Ottawa Annual Development Report for 2014, and the Conference Board of Canada’s Metropolitan Outlook (Spring 2015).

Real Estate

Housing starts in Ottawa totalled 330 units in May 2015, down from 466 units in April. This trend is even more pronounced on a year-over-year basis, with starts dropping from 906 units in May 2014. Year-to-date, housing starts in Ottawa totalled 1,243 units, down from 1,933 units at the same time last year, which represents a nearly 36-per-cent slowdown.

While the April decline can be observed across all dwelling types, condominium construction – with a mere 24 starts in May – has seen the most pronounced drop (down from 190 units last month and 411 units last year), on the back of softer employment conditions and higher than normal existing inventory.

“Starts activity trended lower in May driven by a significant drop in apartments as builders are scaling back on condominium apartment starts. Tepid demand conditions for new condominium apartments due to weak employment in the CMA coupled with a high level of existing supply are causing this scale-back.” CMHC

On the resale side, Ottawa real estate agents sold 1,926 properties in May 2015, up from 1,570 units in April and 1,789 units last year. According to the Ottawa Real Estate Board, “the Ottawa housing market continued its strong performance in May, making it the best May for unit sales on record since 2009.” With 6,184 units sold to date in 2015, local resale activity is tracking 5.8 per cent above the same time last year (5,847 units sold).

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for May 2015. Other sources cited in this section include the OREB news release on May 2015 sales figures (June 3, 2015).

Construction

According to Statistics Canada, the City of Ottawa issued nearly $158.4 million in building permits in April 2015 – $110.2 million in residential permits and $48.2 million in non-residential permits – up from the previous month ($145.5 million), but down from 12 months ago ($186.8 million).

Looking across the city, central Ottawa saw the most significant proportion of construction activity in April (approximately 30 per cent), in large measure due to a permit issued for construction of a 28-storey apartment building at 101 Champagne Avenue, a project estimated at $33.8 million.

Year-to-date, building permits continue to trend below the same time last year (-13.0 per cent). By segment, industrial construction saw the sharpest adjustment in the first four months of 2015

(-52.6 per cent compared to the same period in 2014), followed by residential and commercial construction (-37.0 per cent and -20.3 per cent, respectively).

On the flip side, institutional and governmental construction to date in 2015 is significantly outpacing 2014 (+73.0 per cent), mainly as a result of a $20-million renovation of the Bank of Canada building in the downtown core. This trend is reflected across Canada, albeit at a lesser pace, with institutional intentions up 10.3 per cent year-to-date in 2015.

“In the institutional component, the value of permits rose [...] in April, following an 83.7% gain the previous month. The national advance was attributable to higher construction intentions for medical facilities and government buildings.” Statistics Canada

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for April 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allows for comparison to provincial and national figures.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | May 2014 | Apr. 2015 | May 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 2.4 | 0.6 | 0.8 | 0.2 | -1.6 | Down |

| Avg. Weekly Earnings ($) | 1,069 | 1,036 | 1,041 | 5 | -28 | Down |

Labour Force

| Indicator | May 2014 | Apr. 2015 | May 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 572.0 | 573.8 | 569.3 | -4.5 | -2.7 | Down |

| Employed (‘000) | 533.0 | 535.7 | 533.7 | -2.0 | 0.7 | Up |

| Unemployed (‘000) | 39.0 | 38.1 | 35.6 | -2.5 | -3.4 | Down |

| Unemployment rate (%) | 6.8 | 6.6 | 6.3 | -0.3 | -0.5 | Down |

| Participation rate (%) | 70.4 | 69.8 | 69.2 | -0.6 | -1.2 | Down |

Real Estate

| Indicator | May 2014 | Apr. 2015 | May 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 906 | 466 | 330 | -136 | -576 | Down |

| Average price - new homes ($) | 475,495 | 546,171 | 488,625 | -57,546 | 13,130 | Up |

| Average price - resale market ($) | 368,235 | 366,413 | 368,499 | 2,086 | 264 | Up |

Construction

| Indicator | Apr. 2014 | Mar. 2015 | Apr. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 134,999 | 115,617 | 110,172 | -5,445 | -24,827 | Down |

| Non-Residential permits ($000) | 51,770 | 29,849 | 48,192 | 18,343 | -3,578 | Down |

| Industrial ($000) | 2,199 | 303 | 1,876 | 1,573 | -323 | Down |

| Commercial ($000) | 44,467 | 21,224 | 38,633 | 17,409 | -5,834 | Down |

| Institutional/Gov’t ($000) | 5,104 | 8,322 | 7,683 | -639 | 2,579 | Up |

Economic Development Update - August 2015

Monthly Highlights

- Economy. The Canadian economy contracted for a fifth consecutive month in May 2015, with real gross domestic product (GDP) falling 0.2 per cent from the previous month. The Bank of Canada downgraded its prediction for GDP growth this year to 1.1 per cent – down from its prediction of 1.9 per cent as of April 2015 – but expects the non-resource sector to gain momentum in the third quarter of 2015.

- Inflation. The national Consumer Price Index (CPI) edged up 1.0 per cent in the 12 months to June 2015. Persistently low inflation in the first half of the year prompted the Bank of Canada to revise its overnight interest rate down to 0.5 per cent from 0.75 per cent.

- Labour Market. At the local level, Ottawa’s labour market shed 1,200 jobs this June – a second consecutive monthly decline. Over the last 12 months, the construction industry showed signs of strength with the addition of 15,400 jobs, while the public administration sector lost 12,500 jobs. The overall size of Ottawa’s labour market shrank in June, driving the unemployment rate down to 6.1 per cent, well below the national and provincial rate (6.8 per cent and 6.5 per cent, respectively).

- Real estate. Despite adding 772 starts in June, Ottawa’s new home market year-to-date is trending well below the same period last year (-20.0 per cent). The resale market, on the other hand, continues to pace ahead of 2014 on a year-to-date basis (+5.0 per cent). On the commercial front, the office vacancy rate edged up further in the second quarter of 2015 to 12.4 per cent as the effects of federal government downsizing continue to make their way through the local market.

- Construction. The second phase of the Ottawa Light Rail Transit project is expected to generate 24,000 person-years of employment and provide a $3.8 billion boost to the local economy.

New and Noteworthy

- The City of Ottawa’s Economic Development and Innovation department launched the Innovation Pilot Program on July 9, 2015. This new program is designed for local, national and international start-ups, and aims to pilot new technologies, products or services within City of Ottawa departments.

The Economy

The Canadian economy contracted for a fifth consecutive month in May 2015, with real gross domestic product (GDP) falling 0.2 per cent from the previous month. Unsurprisingly, the drop in the price of oil continues to ripple through the economy, with oil and gas extraction output falling 1.0 per cent, following a contraction of 3.4 per cent in April.

In its most recent Monetary Policy Update, the Bank of Canada downgraded its prediction for GDP growth this year to 1.1 per cent, down from its prediction of 1.9 per cent as of April 2015. While the Bank notes that the oil price shock is mostly responsible for dampened economic growth in the first half of the year, it expects non-resource based sectors to pick-up in the third quarter of 2015, and to sustain growth in 2016, on the back of increased demand from the United States.

“The Bank anticipates that the non-resource track for growth will begin to dominate in the third quarter…Importantly, exports are projected to return to solid growth, supported by continued improvements in U.S. demand…” – Bank of Canada

Looking at inflation, the national Consumer Price Index (CPI) edged up 1.0 per cent in the 12 months to June 2015, marking a sixth consecutive month where inflation sat at – or below – the lower boundary of the Bank of Canada’s inflation control range (i.e., 1 per cent to 3 per cent). As a result of persistently low inflation and negative GDP growth so far in 2015, the Bank revised its key overnight interest rate to 0.5 per cent from 0.75 per cent.

Source: Statistics Canada Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for June 2015, and Gross Domestic Product results for Canada for May 2015. Other sources cited in this section include the Bank of Canada’s “Monetary Policy Report” for July 2015.

Labour Market

The Canadian labour market shed 6,400 jobs in June 2015 after posting significant gains in May (+58,900 jobs). Despite the headline, this month’s Labour Force Survey results hint at some strength in the job market, with full-time employment up by nearly 150,000 jobs in the first six months of 2015.

At the local level, Ottawa’s labour market shed 1,200 jobs this June – a second consecutive monthly decline. That said, the overall size of the local labour force also shrank this month (i.e., approximately 2,000 workers chose to exit the labour market), which brought the unemployment rate down to 6.1 per cent from 6.3 per cent in May – well below the national and provincial rate (6.8 per cent and 6.5 per cent, respectively).

Looking at employment in Ottawa over the last 12 months, the construction sector saw the most important increase with the addition of 15,400 jobs year-over-year, which is line with the Conference Board of Canada’s prediction that the sector would help fuel economic growth at the local level this year and beyond. On the other, public administration shed 12,500 jobs over the same period. Given that the Parliamentary Budget Office is forecasting that the Government of Canada will face a budgetary deficit in fiscal year 2015-16, there will be continued interest in monitoring this segment of the economy in the following months.

“[The] PBO estimates that an updated Budget 2015 outlook would show deficits of $1.5 billion in 2015-16 and $0.1 billion in 2016-17…” – Parliamentary Budget Office

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for June 2015 (custom data extraction, three-month moving average, seasonally adjusted). The data for individual economic sectors are not adjusted for seasonality. Other sources cited in this section include the Parliamentary Budget Office’s update of the Budget 2015 fiscal outlook released on July 22, 2015.

Real Estate

Housing starts in Ottawa totalled 772 units in June 2015, up from 466 units the previous month. This monthly gain is the result of an increase in the condominium segment which surged ahead to 306 starts in June, up from 24 starts in May. Despite month-over-month gains, total construction starts in the first six months of the year are trending 20 per cent below the same period in 2014.

The resale market, on the other hand, continues to show signs of strength. According to the Ottawa Real Estate Board (OREB), year-to-date property sales continue to pace above the same time last year (+5.0 per cent), despite sales dipping in June from May levels (1,694 units and 1,926 units, respectively).

On the commercial front, the office vacancy rate in Ottawa edged up further in the second quarter of 2015 to 12.4 per cent from 11.2 per cent in the first quarter and 10.6 per cent at the same time last year. According to Colliers International, pressure on the vacancy rate is still being attributed to the federal government’s downsizing measures. That said, demand from the private sector, particularly from high-tech firms, is growing and is expected to offset public sector softening over the next two years.

“Apart from the public sector, the number of private sector tenants appears to be growing throughout Ottawa, especially in the high-tech sector. Many private sector companies are planning for positive growth over the next 12-24 months, which is likely to have a positive impact on the overall market.” – Colliers International

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for June 2015. Other sources cited in this section include the OREB news release on June 2015 sales figures (July 6, 2015) and Colliers International’s Ottawa Office Market Overview for Q2 2015.

Construction

According to Statistics Canada’s most recent figures, the City of Ottawa issued $172.3 million in building permits in May 2015: $119.1 million in residential permits and $53.2 million in non-residential permits. While the value of permits is up month-over-month (+8.9 per cent), the level of construction activity so far this year continues to trend considerably below the same period in 2014 (-27.9 per cent).

By area, the largest proportion of permits in May was concentrated within the Greenbelt (37.3 per cent), followed by Ottawa West and Ottawa South (29.0 per cent and 28.1 per cent, respectively). Construction in Ottawa East remained subdued at 5.6 per cent of total permits.

As mentioned in previous months, the construction sector in Ottawa is in full swing and is expected to fuel economic growth in the coming years. This trend will likely continue in the longer term, with the second phase of the Ottawa Light Rail Transit (OLRT) project, which will roll-out between 2018 and 2023, predicted to boost local economic growth by $3.8 billion.

“From an economic standpoint, the [Stage 2] project is expected to generate 24,000 person-years of employment, increase tax revenue to approximately $170 million, and provide an economic output of $3.8 billion to the local economy.” – City of Ottawa

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for May 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allows for comparison to provincial and national figures. Other sources cited in this section include the City of Ottawa’s news release on Stage 2 LRT (July 9, 2015).

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Jun. 2014 | May 2015 | Jun. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 2.7 | 0.8 | 0.9 | 0.1 | -1.8 | Down |

| Avg. Weekly Earnings ($) | 1,071 | 1,041 | 1,040 | -1 | -31 | Down |

Labour Force

| Indicator | Jun. 2014 | May 2015 | Jun. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 570.4 | 569.3 | 567.3 | -2.0 | -3.1 | Down |

| Employed (‘000) | 531.0 | 533.7 | 532.5 | -1.2 | 1.5 | Up |

| Unemployed (‘000) | 39.3 | 35.6 | 34.8 | -0.8 | -4.5 | Down |

| Unemployment rate (%) | 6.9 | 6.3 | 6.1 | -0.2 | -0.8 | Down |

| Participation rate (%) | 70.1 | 69.2 | 68.9 | -1.3 | -1.2 | Down |

Real Estate

| Indicator | Jun. 2014 | May 2015 | Jun. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 585 | 466 | 772 | 306 | 187 | Up |

| Average price - new homes ($) | 507,570 | 494,396 | 504,611 | 10,215 | -2,959 | Down |

| Average price - resale market ($) | 363,559 | 386,069 | 382,766 | -3,303 | 19,207 | Up |

Construction

| Indicator | May 2014 | Apr. 2015 | May 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 112,253 | 109,733 | 119,050 | 9,317 | 6,797 | Up |

| Non-Residential permits ($000) | 41,162 | 48,424 | 53,208 | 4,784 | 12,046 | Up |

| Industrial ($000) | 1,181 | 1,883 | 466 | -1,417 | -715 | Down |

| Commercial ($000) | 32,316 | 38,858 | 44,560 | 5,702 | 12,244 | Up |

| Institutional/Gov’t ($000) | 7,665 | 7,683 | 8,182 | 499 | 517 | Up |

Economic Development Update - September 2015

Monthly Highlights

- Economy. Canadian real Gross Domestic Product (GDP) contracted 0.1 per cent in the second quarter of the year, following a 0.2 per cent dip in Q1 2015. While Canada is now facing a “technical” recession (i.e., two consecutive quarters of negative GDP growth), several positive factors seem to indicate that the national economy is poised for growth in Q3.

- Inflation. The Ottawa Consumer Price Index (CPI) increased 1.4 per cent in the 12 months to July 2015, slightly above the inflation rate at the national level (+1.3 per cent), but below the rate for Ontario (+1.5 per cent).

- Labour Market. The Ottawa economy shed 2,400 jobs in July 2015, marking a third consecutive monthly decline. Since January 2015, the local labour market lost 4,300 jobs. Given that the overall size of the labour market also shrank over this period (-7,600 workers), the unemployment rate slipped from 6.6 per cent in January to 6.1 per cent in July.

- Real Estate. Year-to-date in July 2015, the market for new homes in Ottawa continues to trend below the same time last year (-15.9 per cent), while the resale market continues to edge ahead over the same period (+4.1 per cent). Looking at affordability, resale homes remain more competitively priced on average that newly built homes across the city.

- Construction. The City of Ottawa issued over $200.7 million in building permits in June 2015 with nearly 30 per cent of permits issued for projects within the Greenbelt. The local construction sector continues to show signs of strength, adding over 15,800 jobs in the 12 months to July 2015.

New and Noteworthy

- Full construction for the Ottawa Art Gallery Expansion and the Arts Court redevelopment began on August 5, 2015. This project represents an investment of over $100 million and is a key part of the City of Ottawa's Renewed Action Plan for Arts, Heritage and Culture.

- Each year, the City of Ottawa Immigrant Entrepreneur Awards acknowledges the business success of select individuals who were born outside of Canada and who now make Ottawa their home for their considerable contribution to the Ottawa economy. The deadline for nominations for the 2015 Awards is September 21, 2015.

The Economy

According to the most recent data released by Statistics Canada, Canadian real Gross Domestic Product (GDP) contracted 0.1 per cent in the second quarter of the year, following a 0.2 per cent dip in Q1 2015. While Canada is now facing a “technical” recession (i.e., two consecutive quarters of negative GDP growth), several positive factors seem to indicate that the national economy is poised for growth in Q3.

On the one hand, GDP growth in June 2015 came out strong at 0.5 per cent, mostly reversing losses experienced since the beginning of the year. Additionally, monthly growth in June was seen across all broad industry segments, including the oil and gas industry (+3.1 per cent) which has been particularly hard hit to date by the crisis in the oil patch. Finally, household consumption remained resilient, rising 0.1 per cent in Q1 and 0.6 per cent in Q2 on the back of stronger employment conditions (+95,900 jobs in the first half of 2015).

“Despite the weak start to the year, there is good reason to believe that the worst is over. Monthly GDP was up sharply in June, providing positive momentum to start the second half of the year…it now appears likely that we will see a sharp rebound in Q3…” - TD Economics

Looking at price inflation, the national Consumer Price Index (CPI) grew 1.3 per cent year-over-year in July 2015, landing within the Bank of Canada’s target range of 1-to-3 per cent. Consumer prices in Ottawa edged up 1.4 per cent over the same period – a notch below the inflation rate at the provincial level (+1.5 per cent).

Source: Statistics Canada Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for July 2015, and Gross Domestic Product results for Canada for June 2015. Other sources cited in this section include TD Economics’ “Canadian GDP Q2” Commentary released September 1, 2015.

Labour Market

The Canadian economy added 6,600 jobs in July 2015, offsetting the 6,400 jobs lost in June. This month’s increase can be attributed to gains in part-time employment. The national unemployment rate held steady at 6.8 per cent for a fifth consecutive month.

While there has been much speculation about whether the Canadian economy is in recession, labour market signals since the beginning of the year seem to be bucking the GDP growth trend. For example, the national job market created 102,500 jobs in the first seven months of 2015, with full-time employment coming out strong (+119,300 jobs).

“Overall, employment has largely weathered the GDP growth storm so far this year… While many have been quick to label this year’s economic performance a recession, the job numbers just haven’t backed that up.” - BMO Financial Group

In Ottawa, the local labour market shed 2,400 jobs in July, marking a third consecutive month of decline. In contrast to the trend at the national level, the Ottawa economy lost 4,300 jobs since January 2015. Given that the overall size of the labour market also shrank over this period (-7,600 workers), the unemployment rate slipped from 6.6 per cent in January to 6.1 per cent in July.

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for July 2015 (custom data extraction, three-month moving average, seasonally adjusted). The data for individual economic sectors are not adjusted for seasonality. Other sources cited in this section include BMO Financial Group’s econoFacts report released on August 7, 2015.

Real Estate

Ottawa homebuilders began construction on 435 new housing units (i.e., starts) in July 2015, down from 772 units in June but up from 396 units in July of last year. Month-over-month, condominium starts saw the most pronounced decline, dropping to 68 units in July from 306 the previous month. Year-to-date, the market for new homes continues to trend below the same time last year (-15.9 per cent).

Looking at the resale market, Ottawa real estate agents sold 1,436 properties this July, down from 1,694 units in June and from 1,445 units in July 2014, but well above the five year average for the month (1,380 units). Despite the monthly drop, year-to-date home sales continue to outperform the same time last year (+4.1 per cent).

Looking at affordability, resale homes remain more competitively priced than newly built homes. The average price for a single-detached home on the resale market was $394,889 in July 2015, while the average newly-built single-detached home rang in at $527,935 for the same period. According to the Canada Mortgage and Housing Corporation, resale activity in July was concentrated in Orléans as the average price for the area is lower than the overall average for Ottawa.

“Sales by area followed the usual distribution with the majority of sales taking place in Orleans as the area’s average price remained significantly lower than the overall MLS® average price and the urban average.” - CMHC

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for July 2015. Other sources cited in this section include the OREB news release on July 2015 sales figures (August 6, 2015).

Construction

According to Statistics Canada, the City of Ottawa issued over $200.7 million in building permits in June 2015: $120.2 million in residential permits and $80.6 million in non-residential permits. Nearly 30 per cent of permits were issued for projects within the Greenbelt, while the remaining permits were almost evenly split between the East, West and South areas of the City.

Month-over-month, the value of permits issued in Ottawa edged up in June 2015 (+16.7 per cent), but remain below the same month last year (-18.5 per cent). As it has been described in the past, it is often difficult to establish trends in the construction industry on a month-over-month basis due to the highly volatile nature of this data. A year-to-date analysis, however, usually provides more insight into construction trends. In this regard, the City has issued $955 million in building permits in the first half of 2015, which is significantly below the same period in 2014 (-20.9 per cent).

Despite this downward trend, the Conference Board of Canada continues to predict the construction industry will fuel economic growth in Ottawa in 2015. Given that public sector construction projects (e.g., Ottawa on the Move, Ottawa Light Rail Transit) are not required to submit a request for a building permit, it can be helpful to look at employment as a gauge of how the industry is doing as a whole. In the 12 months to July 2015, this sector created 15,800 jobs in Ottawa, which seems to support the Conference Board’s prediction.

“Light-rail and other non-residential projects are spurring the construction industry.” - Conference Board of Canada

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for June 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allows for comparison to provincial and national figures. Other sources cited in this section include the Conference Board of Canada’s “Metropolitan Outlook” for Spring 2015.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Jul. 2014 | Jun. 2015 | Jul. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 2.1 | 0.9 | 1.4 | 0.5 | -0.7 | Down |

| Avg. Weekly Earnings ($) | 1,058 | 1,040 | 1,037 | -3 | -21 | Down |

Labour Force

| Indicator | Jul. 2014 | Jun. 2015 | Jul. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 570.7 | 567.3 | 564.8 | -2.5 | -5.9 | Down |

| Employed (‘000) | 534.0 | 532.5 | 530.1 | -2.4 | -3.9 | Down |

| Unemployed (‘000) | 36.7 | 34.8 | 34.7 | -0.1 | -2.0 | Down |

| Unemployment rate (%) | 6.4 | 6.1 | 6.1 | 0.0 | -0.3 | Down |

| Participation rate (%) | 70.1 | 68.9 | 68.5 | -0.4 | -1.6 | Down |

Real Estate

| Indicator | Jul. 2014 | Jun. 2015 | Jul. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 396 | 772 | 435 | -337 | 39 | Up |

| Average price - new homes ($) | 512,940 | 504,611 | 527,935 | 23,324 | 14,995 | Up |

| Average price - resale market ($) | 356,994 | 382,766 | 368,509 | -14,257 | 11,515 | Up |

Construction

| Indicator | Jun. 2014 | May 2015 | Jun. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 112,215 | 118,594 | 120,153 | 1,559 | 7,938 | Up |

| Non-Residential permits ($000) | 134,166 | 53,461 | 80,571 | 27,110 | -53,595 | Down |

| Industrial ($000) | 96 | 476 | 2,875 | 2,399 | 2,779 | Up |

| Commercial ($000) | 107,319 | 44,803 | 44,919 | 116 | -62,400 | Down |

| Institutional/Gov’t ($000) | 26,751 | 8,182 | 32,777 | 24,595 | 6,026 | Up |

Economic Development Update - October 2015

Monthly Highlights

- Economy. Ottawa’s economy is forecasted to grow 0.7 per cent in 2015, marking a fourth consecutive year of less than one per cent growth. That said, the local economy is poised to improve in 2016 (+1.6 per cent) as the construction and high-tech sectors continue to build momentum.

- Labour Market. The local labour market shed 900 jobs in August 2015 – a fourth consecutive monthly decline – bringing the unemployment rate up to 6.4 per cent from 6.1 per cent in July. While soft employment conditions in Ottawa can be mainly attributed to federal government downsizing, there are a few bright spots, such as the information and communication technology services sector which has created 16,400 jobs since 2010, that are expected to help bolster the economy in the years ahead.

- Real estate. Housing starts in Ottawa totalled 480 units in August 2015, down from 629 units started at this time last year. Soft employment conditions and lower than usual in-migration are some of the reasons why housing starts to date in 2015 are trending significantly lower than the same time last year (-17.3 per cent).

- Construction. Ottawa issued building permits totalling $243.3 million in July 2015 – a fourth consecutive month of growth in construction intentions. The total value of permits issued to date in 2015 ($1.2 billion), however, is lagging significantly behind the same time last year (-18.5 per cent). The outlook for the local construction sector is nonetheless positive, with several multi-million dollar projects slated for the next few years.

New and Noteworthy

- On November 20, 2015, Ottawa Festivals will be hosting its first Pitchfest + Expo event designed to inspire synergies between businesses and festival/event producers in the lead up to 2017.

- The City of Ottawa, in partnership with Ottawa Business Events, will be hosting the fourth annual Ottawa’s Economic Outlook luncheon event on October 27, 2015.

The Economy

Canadian Gross Domestic Product (GDP) grew 0.3 per cent in July 2015, following a gain of 0.4 per cent in June. The monthly increase was led primarily by the mining, quarrying, oil and gas extraction sector, which expanded 2.9 per cent. According to the BMO Financial Group, solid growth in June and July “suggests the economy rebounded firmly” after a weak first half of the year.

At the local level, the Conference Board of Canada’s fall edition of the Metropolitan Outlook predicts that Ottawa-Gatineau will mark a fourth consecutive year of nearly stagnant GDP growth in 2015 (+0.7 per cent), mainly as a result of federal government budget restrictions. That said, the Conference Board also predicts that the local economy will start improving in 2016 (+1.6 per cent) as austerity measures ease, and the construction and high-tech sectors continue to build momentum.

“...we expect things to start improving next year, as the worst of the job cuts in the federal public service appear to be over.” – Conference Board of Canada

The national Consumer Price Index (CPI) rose 1.3 per cent in the 12 months to August 2015 as a result of higher prices for food (+3.6 per cent). Unsurprisingly, the transportation component of the CPI, which includes gasoline, experienced a tenth month of decline, subtracting 2.3 per cent from the overall price level. Prices in Ottawa edged up 1.0 per cent over the same time period.

Source: Statistics Canada Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for August 2015, and Gross Domestic Product results for Canada for July 2015. Other sources cited in this section include BMO Financial Group’s econoFacts publication for September 30, 2015, and the Conference Board of Canada’s Metropolitan Outlook: Fall 2015 for Ottawa-Gatineau.

Labour Market

The Canadian economy added 12,000 jobs in August 2015, following an even smaller gain in July (+6,600 jobs). The overall size of the labour force (i.e., those who are employed and those who are actively looking for work) also increased in August, which resulted in a 0.2 per cent increase in the monthly unemployment rate (7.0 per cent, up from 6.8 per cent in July 2015). At the provincial level, Alberta and Saskatchewan saw the highest gains in employment (+4,700 jobs and +4,000 jobs, respectively), while Ontario and Quebec experienced the largest declines (-3,900 jobs and -2,000 jobs, respectively).

The Ottawa job market contracted for a fourth consecutive month in August 2015 (-900 jobs), leading to an increase in the unemployment rate to 6.4 per cent from 6.1 per cent in July. Over the last 12 months, Ottawa’s economy has shed 3,700 jobs, with the public administration sector seeing the largest drop in employment (-18,300 jobs).

On a more positive note, the Conference Board of Canada expects that federal public service employment will grow in 2016 – albeit modestly – as deficit-reduction measures begin to ease. The information and communication technology services sector, which has created 16,400 jobs since 2010, will also help spur the local job market, thanks largely to the continued expansion of local high-tech employers such as Ciena and Shopify.

“Given the recent success of several local companies, the outlook for ICT services remains strong.” – Conference Board of Canada

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for August 2015 (custom data extraction, three-month moving average, seasonally adjusted). The data for individual economic sectors are not adjusted for seasonality. Other sources cited in this section include the Conference Board of Canada’s Metropolitan Outlook: Fall 2015 for Ottawa-Gatineau.

Real Estate

According to the most recent Canada Mortgage and Housing Corporation (CMHC) figures, housing starts in Ottawa totalled 480 units in August 2015, down from 629 units started at this time last year – a decrease of 23.7 per cent. Declines were noted in every dwelling segment with the exception of single-detached dwellings, which grew by nearly 50 per cent.

In line with recent historical trends, housing starts were concentrated outside of the Greenbelt in August. The largest proportion of starts occurred in Nepean (20 per cent), followed closely by Kanata and Gloucester (18 per cent each).

Year-to-date, Ottawa’s new home market is also showing a decline with respect to the same time last year (-17.3 per cent). According to the Conference Board of Canada, the sluggish pace can be attributed in part to a soft employment market and dampened consumer confidence in the local economy.

“Despite enticingly low mortgage rates, the public sector job cuts, slower net in-migration, and sagging consumer confidence have combined to put a damper on residential investment.” – Conference Board of Canada.

On the resale front, home sales through the Ottawa Real Estate Board’s Multiple Listing System totalled 1,279 properties in August, up from 1,200 at the same time in 2014. In contrast to the trend in the new home market, year-to-date sales in 2015 are trending ahead of the same period last year (+4.4 per cent).

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for August 2015. Resale market data adapted from the OREB news release on August 2015 sales figures (September 3, 2015). Other sources cited in this section include the Conference Board of Canada’s Metropolitan Outlook: Fall 2015 for Ottawa-Gatineau.

Construction

According to the most recent data from Statistics Canada, Ottawa issued building permits totalling $243.3 million in July 2015: $121.3 million in residential permits and $122.0 million in non-residential permits. Commercial permits made up the bulk of the non-residential permits issued ($107.8 million).

The month of July marked a fourth consecutive month of growth in construction intentions in Ottawa. Nonetheless, the total value of permits issued to date in 2015 ($1.2 billion) is lagging significantly behind the same time last year (-18.5 per cent from $1.47 billion).

It is worth noting that major city-led projects, such as the LRT, are not required to apply for a building permit. This can help to explain why the trend in building permits is declining, despite the unprecedented levels of non-residential investment that Ottawa is currently experiencing.

In addition to the LRT, notable projects that are expected to sustain economic growth in the city in the years ahead include the expansion and renovation of the Rideau Centre ($360 million), the University of Ottawa Heart Institute ($200 million), the Government Conference Centre ($190 million), the National Arts Centre ($110 million), the Ottawa Art Gallery and Arts Court ($100 million), and the Canada Science and Technology Museum ($80.5 million).

“…a plethora of major projects will keep Ottawa-Gatineau’s non-residential construction sector busy for years.” – Conference Board of Canada

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for July 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allows for comparison to provincial and national figures. Other sources cited in this section include the Conference Board of Canada’s Metropolitan Outlook: Fall 2015 for Ottawa-Gatineau.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Aug. 2014 | Jul. 2015 | Aug. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 2.2 | 1.4 | 1.0 | -0.4 | -1.2 | Down |

| Avg. Weekly Earnings ($) | 1,051 | 1,037 | 1,035 | -2 | -16 | Down |

Labour Force

| Indicator | Aug. 2014 | Jul. 2015 | Aug. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 571.4 | 564.8 | 565.1 | 0.3 | -6.3 | Down |

| Employed (‘000) | 532.9 | 530.1 | 529.2 | -0.9 | -3.7 | Down |

| Unemployed (‘000) | 38.4 | 34.7 | 35.9 | 1.2 | -2.5 | Down |

| Unemployment rate (%) | 6.7 | 6.1 | 6.4 | 0.3 | -0.3 | Down |

| Participation rate (%) | 70.1 | 68.5 | 68.4 | -0.1 | -1.7 | Down |

Real Estate

| Indicator | Aug. 2014 | Jul. 2015 | Aug. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 629 | 435 | 480 | 45 | -149 | Down |

| Average price - new homes ($) | 511,936 | 516,305 | 554,181 | 37,876 | 42,245 | Up |

| Average price - resale market ($) | 359,110 | 368,509 | 352,578 | -15,931 | -6,532 | Down |

Construction

| Indicator | Jul. 2014 | Jun. 2015 | Jul. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 131,065 | 121,120 | 121,311 | 191 | -9,754 | Down |

| Non-Residential permits ($000) | 132,804 | 79,829 | 122,003 | 42,174 | -10,801 | Down |

| Industrial ($000) | 323 | 2,887 | 1,573 | -1,314 | 1,250 | Up |

| Commercial ($000) | 124,509 | 44,165 | 107,764 | 63,599 | -16,745 | Down |

| Institutional/Gov’t ($000) | 7,972 | 32,777 | 12,666 | -20,111 | 4,694 | Up |

Economic Development Update - November 2015

Monthly Highlights

- Economic Growth. The Bank of Canada predicts that the Canadian economy will grow modestly in 2015 (+1.1 per cent), before accelerating in 2016 and 2017 (+2.0 per cent and +2.4 per cent, respectively).

- Inflation. September 2015 marked the ninth consecutive month in which price inflation at the national and local level (1.0 per cent and 0.6 per cent, respectively) sat below the Bank of Canada’s target of 2 per cent.

- Labour Market. Following four months of decline in employment, Ottawa’s labour market added 1,000 jobs in September 2015, resulting in a drop in the unemployment rate to 6.2 per cent (-0.2 per cent from 6.4 per cent in August). Despite this month’s performance, the local workforce has shed 6,200 jobs in the last 12 months. Given the results of the recent federal election, however, there will be heightened interest in monitoring local labour market trends in the coming months as the new majority Liberal government lays out its plans.

- Real estate. New home construction totalled 442 units in September 2015, up slightly from the same period last year (+32 units). The year-over-year increase can be mainly attributed to gains in the rental segment (+137 units). On the resale front, Ottawa real estate agents sold 1,244 properties this month, marking the highest number of units sold on record for September.

- Construction. Ottawa construction intentions continue to lag compared to the same period in 2014. The value of building permits issued to date totalled $1.4 billion in August 2015, nearly 20 per cent behind the same time last year when permits totalled $1.7 billion.

New and Noteworthy

- The newly elected Liberal Prime Minister, Justin Trudeau and his Cabinet were sworn into power on November 4, 2015. Prime Minister Trudeau and his party campaigned on a promise to increase fiscal spending, particularly in the area of public infrastructure, as a way of supporting economic growth in Canada.

- The 2015 Immigrant Entrepreneur Award Recipients were honoured at a special breakfast event held as part of TiE Ottawa’s annual conference. This year’s recipients are: Dr. Nishith Goel of Cistel, Dr. Maria Rasouli of Escape Bicycle Tours and Mr. Moe Abbas of Ottawa General Contractors and Bumpn Inc.

The Economy

According to Statistics Canada, Canada’s economy grew 0.1 per cent in August 2015, after experiencing gains in June and July (+0.4 per cent and +0.3 per cent, respectively). This month’s growth can be mainly attributed to gains in retail trade (+0.6 per cent), manufacturing (+0.4 per cent), and mining, quarrying and oil and gas extraction (+0.4 per cent).

Looking ahead, the Bank of Canada expects the Canadian economy to grow modestly in 2015 (+1.1 per cent) before accelerating in 2016 and 2017 (+2.0 per cent and +2.5 per cent, respectively).

In terms of prices, the Canadian Consumer Price Index rose 1.0 per cent in the 12 months to September 2015. September marked the ninth consecutive month in which price inflation sat below the Bank of Canada’s target of 2 per cent. At the local level, Ottawa’s CPI rose 0.6 per cent over the same period.

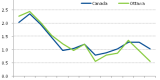

Figure 1 - Rate of Inflation (%), 2014-2015

Source: Statistics Canada Consumer Price Index results for the Ontario portion of the Ottawa-Gatineau CMA for September 2015, and Gross Domestic Product results for Canada for August 2015. Other sources cited in this section include the Bank of Canada’s Monetary Policy Report released on October 21, 2015.

Labour Market

The Canadian labour market experienced an increase in employment in September 2015, adding 12,100 jobs month-over-month. Job growth aside, the concurrent increase in the number of individuals actively looking for work resulted in a slight rise of the national unemployment rate to 7.1 per cent (+0.1 per cent from August).

Following four months of decline, the Ottawa labour market added 1,000 jobs in September, resulting in a slight decrease in the unemployment rate to 6.2 percent (-0.2 per cent from August). Despite this month’s gain, it is worth noting that the local economy has lost 6,200 jobs since September 2014.

Given the results of the recent federal election, there will be heightened interest in monitoring local labour market trends in the coming months as the new majority Liberal government lays out its plans for increased public spending.

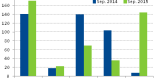

Figure 2 - Employment in the Ottawa CMA (thousands), 2014-2015

Source: Statistics Canada’s Labour Force Survey results for the Ontario portion of the Ottawa-Gatineau CMA for September 2015 (custom data extraction, three-month moving average, seasonally adjusted).

Real Estate

New home construction in Ottawa totalled 442 units in September 2015, down slightly from 480 units in August. Performance is slightly better on a year-over-year basis, with the Ottawa market adding 32 more units this month than in September 2014.

By dwelling type, rental starts experienced the largest increase year-over-year (+137 units), while row and condominium starts experienced the largest decline (-71 units and -68 units, respectively).

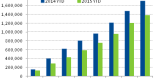

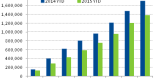

Figure 3 - Housing Starts by Dwelling Type, 2014-2015

On the resale front, Ottawa real estate agents sold 1,244 properties in September, up from 1,131 units at the same time last year. The Ottawa Real Estate Board (OREB) notes that “September marks the best September on record for the number of units sold in the Ottawa resale market.”

Source: New housing data from CMHC, “Starts and Completions Survey” and “Market Absorption Survey” results for the Ontario portion of the Ottawa-Gatineau CMA for September 2015. Other sources cited in this section include the OREB news release on September 2015 sales figures (October 5, 2015).

Construction

According to Statistics Canada, Ottawa issued $181.8 million in building permits in August 2015: $105.2 million in residential permits and $76.6 million in non-residential permits. Month-over-month, the value of permits declined significantly (-25.5 per cent), with non-residential permits experiencing the sharpest drop (-37.5 per cent).

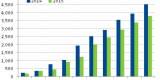

It is not unusual to see high volatility in the value of building permits issued by a municipality on a month-over-month basis. For this reason, it can be useful to look at the year-to-date trend to gain better insight into the overall strength of the local construction industry. To date in 2015, Ottawa issued building permits totalling $1.4 billion. By comparison, building permits for the same period in 2014 totalled $1.7 billion – a difference of nearly 20 per cent.

Figure 4 – Building Permits ($ thousands), 2014-2015

Source: Statistics Canada, Building Permits Survey results for the Ontario portion of the Ottawa-Gatineau CMA for August 2015 (seasonally adjusted). Please note that these figures may differ from City of Ottawa data on this topic. The data from Statistics Canada allows for comparison to provincial and national figures.

Tables: Monthly Key Economic Indicators for Ottawa

Economy

| Indicator | Sep. 2014 | Aug. 2015 | Sep. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Inflation Rate (%) | 2.3 | 1.0 | 0.6 | -0.4 | -1.7 | Down |

| Avg. Weekly Earnings ($) | 1,034 | 1,035 | 1,032 | -3 | -2 | Down |

Labour Force

| Indicator | Sep. 2014 | Aug. 2015 | Sep. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Labour force (‘000) | 574.9 | 565.1 | 565.0 | -0.1 | -9.9 | Down |

| Employed (‘000) | 536.4 | 529.2 | 530.2 | 1.0 | -6.2 | Down |

| Unemployed (‘000) | 38.5 | 35.9 | 34.8 | -1.1 | -3.7 | Down |

| Unemployment rate (%) | 6.7 | 6.4 | 6.2 | -0.2 | -0.5 | Down |

| Participation rate (%) | 70.4 | 68.4 | 68.4 | 0.0 | -2.0 | Down |

Real Estate

| Indicator | Sep. 2014 | Aug. 2015 | Sep. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Monthly starts (total # units) | 410 | 480 | 442 | -38 | 32 | Up |

| Average price - new homes ($) | 522,480 | 511,688 | 515,010 | 3,322 | -7,470 | Down |

| Average price - resale market ($) | 356,868 | 352,578 | 362,431 | 9,853 | 5,563 | Up |

Construction

| Indicator | Aug. 2014 | Jul. 2015 | Aug. 2015 | Change from last period | Year-over-year change | 12-month trend |

|---|---|---|---|---|---|---|

| Residential permits ($'000) | 152,753 | 121,327 | 105,220 | -16,107 | -47,533 | Down |

| Non-Residential permits ($000) | 83,845 | 122,547 | 76,555 | -45,992 | -7,290 | Down |

| Industrial ($000) | 283 | 1,584 | 1,382 | -202 | 1,099 | Up |

| Commercial ($000) | 51,564 | 108,297 | 35,548 | -72,749 | -16,016 | Down |

| Institutional/Gov’t ($000) | 31,998 | 12,666 | 39,625 | 26,959 | 7,627 | Up |

Economic Development Update - December 2015

Monthly Highlights

- Economic Growth. Canada’s economy grew 0.6 per cent in the third quarter of 2015 (+2.3 per cent annualized) on the back of a weaker loonie and strong U.S. demand for Canadian goods and services.

- Inflation. The national inflation rate sat at 1.0 per cent in October 2015, marking a tenth consecutive month in which price inflation sat below 2.0 per cent. Following this trend, the local inflation rate sat at 0.6 per cent, while the Ontario rate sat at 0.9 per cent.

- Labour Market. Canada added 44,400 jobs in October 2015 in large measure due to gains in the public administration sector. At the local level, Ottawa added 2,600 jobs over the same period, bringing the unemployment rate down to 6.1 per cent (-0,1 per cent from September) – well below the rate at the national and provincial levels (7.0 per cent and 6.8 per cent, respectively).