Business Improvement Area Edition: Focus on Employment (Fall 2015)

Introduction

For the past several years, the Department of Economic Development and Innovation (EDI) has been providing thoughtful and consistent analysis of Ottawa’s economy and related markets through its monthly Economic Development Update. This fall, EDI will begin producing special editions of the Update, each of which will explore in greater detail different facets of the local economy.

The Business Improvement Area Edition: Focus on Employment is among the first of these special reports to be produced. This report will provide an overview of recent economic-related activity in Ottawa’s Business Improvement Areas (BIAs), with a special focus on the trends in employment in these districts. The report will also take the opportunity to draw attention to any notable activities currently being undertaken by the BIAs.

Highlights

Employment Profile:

- There were almost 110,000 jobs in Ottawa’s BIAs in 2012. This figure accounts for approximately 1 in 5 of all jobs enumerated in the city that year.

- Between 2006 and 2012, employment grew by close to nine per cent (8.8 per cent) in the BIAs, which is in line with the city-wide net increase of 8.7 per cent over this timeframe.

- Ottawa’s BIAs’ employ people in more than 20 different employment sectors. The sectors most represented in BIAs include: federal public administration, professional services, accommodation and food services, retail, and manufacturing.

New & Noteworthy:

- Representatives from Ottawa’s BIAs attended the 2015 International Downtown Association Conference in San Francisco to examine best practices in the management of business districts.

- The Ottawa Council of BIAs continues to be an effective forum for discussing issues affecting businesses in Ottawa, including economic development, police services, public health, planning and public works.

Background

There are currently 18 BIAs in Ottawa. BIAs come into existence when local businesses and property owners join together to improve, promote and undertake projects that result in a stronger and more competitive commercial main street or business district.

Through EDI, the City supports BIAs in a variety of ways, including: providing assistance in the formation and expansion of BIAs; delivering training and information sessions to BIA members; and, administrating two BIA funding programs, Research Funding Program and the Mural and Architectural Design Feature Funding Program.

EDI is also responsible for liaising with the volunteer-based Ottawa Council of Business Improvement Areas (OCOBIA) on issues impacting businesses in Ottawa. OCOBIA is now in its second term, and continues to be an effective forum for City staff and other community organizations to consult with BIAs.

Job Growth in BIAs

Approximately every 5 years, the City of Ottawa’s Planning, Real Estate and Economic Development Department strives to contact every employer in Ottawa to take part in an employment survey, the most recent of which was conducted in the latter half of 2012. For the purpose of this report, data for each BIA (based on 2015 boundaries) has been extracted from the 2012 Employment Survey. Please note that customized individual BIA data tables detailing the information discussed in this report can be made available upon request.

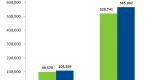

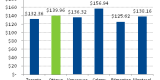

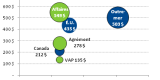

There were 108,349 jobs enumerated in Ottawa BIAs in 2012. These positions were held in more than 6,000 locations across the city. In total, jobs in BIAs accounted for nearly 1 in 5 (19.1 per cent) of the 565,997 jobs in Ottawa in 2012. In terms of employment growth, BIAs added a total of 8,779 jobs between 2006 and 2012. This represents an increase of 8.8 per cent, which is in line with the City-wide net increase of 8.7 per cent over this same timeframe (see Figure 1).

Figure 1: Job Growth, 2006-2012

When considering the following analysis, it is important to note that Ottawa’s 18 individual BIAs vary considerably in terms of their geographic size, and correspondingly, in terms of the number of businesses they contain and people they employ.

In 2012, the Barrhaven BIA had the most businesses of any BIA (n=755), followed closely by the Byward Market BIA (n=668). Between 2006 and 2012, the Barrhaven BIA also experienced the largest gain in the total number of businesses within its boundaries, adding 131 locations over this period.

Looking at employment figures, the Kanata North BIA had the most jobs in 2012 (n=22,500), followed by the Bank Street BIA (n=14,172). The Kanata North BIA also had the largest gain in terms of the number of employees (+3,200 from 2006 to 2012). Overall most BIAs had the same share of jobs in 2006 and 2012.

Employment Sector Profile of BIAs

The 2012 Employment Survey also examines employment by sector using the North American Industrial Classification System (NAICS) to classify all business locations in the City of Ottawa. There are a total of 22 major sector categories that are utilized. A list of these sector categories, including the types of businesses typically represented, is included at the end of this report.

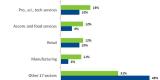

While all sectors are represented across Ottawa BIAs, there are five sectors that accounted for approximately 70 per cent of employment in BIAs in 2012, as depicted in Figure 2 below. These include: federal government public administration (18 per cent); professional, scientific, and technical services (16 per cent); accommodation and food services (12 per cent); retail (12 per cent); and manufacturing (11 per cent).

These same sectors accounted for less than half (42 per cent) of employment across the city as a whole. At the citywide level, there is proportionately more employment in the federal government and health care sectors.

Figure 2: Employment by Top Sectors 2012

As discussed in the previous section, the BIAs posted an increase of nearly 9,000 jobs between 2006 and 2012. Increases were noted in 13 of the 22 major industry sectors. The following sectors posted the largest employment gains in the BIAs between 2006 and 2012:

- Professional, scientific and technical services (+5,090 jobs);

- Federal government public administration (+2,527 jobs);

- Accommodation and Food Services (+1,646 jobs);

- Arts, Entertainment and Recreation (+797 jobs); and

- Health Care and Social Assistance (+785 jobs).

By comparison, only three employment categories experienced significant declines in the BIAs between 2006 and 2012. These include: administration and support/waste management and remediation (-2,748 jobs), information and cultural services (-777 jobs) and finance and insurance services (-519 jobs). It is important to remember that, despite these sector specific declines, overall employment in the BIAs rose between 2006 and 2012.

BIA News

Last year, Ottawa BIAs helped host the International Downtown Association’s (IDA) 60th Anniversary Conference and Tradeshow, which saw more than 500 delegates from around the world spend three days in Ottawa gaining insight into best practices for managing downtown intensification. Following the success of last year’s event, representatives from Ottawa’s BIAs attended the 2015 IDA Conference in San Francisco. The theme of this year’s conference – Bridge the Gap – examined how business districts deliver services and promote economic development in ever-evolving urban environments. As global competition for attracting businesses and talent increases, Ottawa’s BIAs continue to increase their capacity to build vibrant and livable communities for employers and employees alike.

Tables: Overview of Employment in Ottawa BIAs

Table 1: Employment in Ottawa BIAs, 2012

| BIA | Total number of jobs | Full-time jobs | Part-time jobs | Total number of locations |

|---|---|---|---|---|

| Kanata North BIA | 22,491 | 21,245 | 1,246 | 514 |

| Bank Street BIA | 15,376 | 14,172 | 1,204 | 489 |

| Byward Market BIA | 9,226 | 6,941 | 2,285 | 668 |

| Quartier Vanier BIA | 8,611 | 7,241 | 1,370 | 466 |

| Downtown Rideau BIA | 8,507 | 5,356 | 3,151 | 410 |

| Barrhaven BIA | 8,343 | 4,918 | 3,425 | 755 |

| Bells Corners BIA | 6,696 | 4,793 | 1,903 | 366 |

| Sparks Street BIA | 5,041 | 4,528 | 513 | 150 |

| Wellington West BIA | 4,646 | 3,445 | 1,201 | 522 |

| Preston Street BIA | 3,942 | 3,398 | 544 | 214 |

| Carp Road Corridor BIA | 3,712 | 3,143 | 569 | 220 |

| Glebe BIA | 3,614 | 2,235 | 1,379 | 309 |

| Heart of Orleans BIA | 3,288 | 1,998 | 1,290 | 385 |

| Westboro Village BIA | 2,263 | 1,348 | 915 | 218 |

| Manotick BIA | 1,252 | 772 | 480 | 139 |

| Somerset Street-Chinatown BIA | 705 | 433 | 272 | 133 |

| Carp Village BIA | 468 | 334 | 134 | 41 |

| Somerset Village BIA | 168 | 106 | 62 | 24 |

| Total | 108,349 | 86,406 | 21,943 | 6,023 |

Table 2: Employment by Business Sectors in Ottawa BIAs, 2012

| Sector | Total number of jobs | Full-time jobs | Part-time jobs | Share of total jobs | Total number of locations | Share of total locations |

|---|---|---|---|---|---|---|

| Federal Public Administration | 19,939 | 19,939 | 0 | 18% | 106 | 2% |

| Prof., Sci. and Technical Services | 16,935 | 16,121 | 814 | 16% | 935 | 16% |

| Retail | 13,186 | 6,144 | 7,042 | 12% | 1,184 | 20% |

| Accommodation and Food Services | 12,665 | 6,447 | 6,218 | 12% | 750 | 12% |

| Manufacturing | 11,585 | 11,292 | 293 | 11% | 186 | 3% |

| Other Services | 6,360 | 4,719 | 1,641 | 6% | 831 | 14% |

| Health Care and Social Assistance | 4,997 | 3,325 | 1,672 | 5% | 516 | 9% |

| Information and Cultural | 4,042 | 3,486 | 556 | 4% | 124 | 2% |

| Finance and Insurance | 3,102 | 2,611 | 491 | 3% | 227 | 4% |

| Construction | 2,635 | 2,290 | 345 | 2% | 262 | 4% |

| Admin & Support, Waste Mngt & Remediation | 2,631 | 2,002 | 629 | 2% | 188 | 3% |

| Education Services | 2,595 | 2,056 | 539 | 2% | 163 | 3% |

| Real Estate and Rental Leasing | 2,019 | 1,545 | 474 | 2% | 189 | 3% |

| Arts, Entertainment and Recreation | 1,886 | 1,218 | 668 | 2% | 139 | 2% |

| Wholesale | 838 | 719 | 119 | 1% | 97 | 2% |

| Provincial Public Administration | 769 | 764 | 5 | 1% | 18 | 0% |

| Local Public Administration | 751 | 602 | 149 | 1% | 13 | 0% |

| Transportation and Warehousing | 728 | 459 | 269 | 1% | 60 | 1% |

| Other Public Administration | 336 | 327 | 9 | 0% | 15 | 0% |

| Mngt of Companies and Enterprises | 171 | 171 | 0 | 0% | 6 | 0% |

| Primary | 155 | 152 | 3 | 0% | 9 | 0% |

| Utilities | 24 | 17 | 7 | 0% | 5 | 0% |

| Total | 108,349 | 86,406 | 21,943 | 100% | 6,023 | 100% |

Table 3: NAICS Employment Sectors

| Sector | Typical Occupation Examples |

|---|---|

| Federal Public Administration | All Federal Government Departments except Crown Corporations and Museums and Archives |

| Prof., Sci. and Technical Services | Legal, Accounting, Architectural, Engineering, Computer Systems, Management Consulting |

| Retail | Motor Vehicles, Furniture, Electronics, Building Material, Health and Personal Care, Clothing |

| Accommodation and Food Services | Hotels, Motels, B&Bs, Campgrounds, Food Services, Restaurants, Caterers, Bars, Taverns |

| Manufacturing | Food, Beverage, Clothing, Printing, Chemical, Plastics, Computer and Electronic Products |

| Other Services | Repair and Maintenance, Salons, Laundries, Membership Organizations |

| Health Care and Social Assistance | Hospitals, Offices of Doctors, Other Health Practitioners, Child Day-Care Services |

| Health Care and Social Assistance | Hospitals, Offices of Doctors, Other Health Practitioners, Child Day-Care Services |

| Information and Cultural | Publishing, Video Production and Distribution, Radio and Television Broadcasting |

| Finance and Insurance | Banks, Credit and Sales Financing, Securities and Brokerage Activities, Insurance Carriers |

| Construction | Land Subdivision and Development, Construction Management and Trade Contracting |

| Admin & Support, Waste Mngt & Remediation | Office Administration, Facilities Support, Waste Collection / Treatment and Disposal |

| Education Services | Elementary and Secondary Schools, Colleges and Universities, Other schools |

| Real Estate and Rental Leasing | Real Estate Offices, Rental and Leasing Services |

| Arts, Entertainment and Recreation | Performing Arts, Sports Teams, Sports Stadiums, Promoters, Museums, Amusement |

| Wholesale | Farm, Petroleum, Food, Beverage, Personal and Household Goods |

| Provincial Public Administration | Provincial Administration and Services |

| Local Public Administration | Municipal Administration and Services |

| Transportation and Warehousing | Air, Rail, Truck Transportation Services, Postal and Courier Services, Warehousing and Storage |

| Other Public Administration | Embassies and Consulates, Other Extra-Territorial Public Administration |

| Mngt of Companies and Enterprises | Management of Companies and Enterprises, Head Offices, Holding Companies |

| Primary | Crop and Animal Farming, Nursery and Horticulture, Forestry and Logging, Mining |

| Utilities | Hydro Generation and Distribution, Natural Gas Distribution, Water Supply and Sewage |

For additional information on the NAICS Employment Sectors, please consult Statistics Canada.

Tourism Edition: Focus on Hotel Performance

Introduction

For the past several years, the Department of Economic Development and Innovation (EDI) has been providing thoughtful and consistent analysis of Ottawa’s economy and related markets through its monthly Economic Development Update. This fall, EDI will begin producing special editions of the Update, each of which will explore in greater detail different facets of the local economy.

The Tourism Edition: Focus on Hotel Performance is the first of these special reports on tourism. This report will provide an in-depth look at how the hotel industry is performing in Ottawa and what the outlook is for this sector over the next few years.

Highlights

- The accommodation and food services sector, which comprises a majority of the city’s tourism business, is one of the largest and fastest growing industries in Ottawa.

- Ottawa hotels make significant annual contributions to the local economy in terms of employment, tax revenues to the City, and marketing of Ottawa as a tourism destination.

- Ottawa’s hotel industry is also among the most stable and profitable in Canada.

- With the celebrations of Canada’s 150th anniversary of confederation in Ottawa expected to attract 1.75 million additional visitors in 2017, outlook for this sector is positive.

New & Noteworthy

- In recent years, the area surrounding the Ottawa International Airport has become a centre for hotel growth, with the addition of several new properties including a Hampton Inn, a Hilton Garden Inn, and a Holiday Inn Express.

- Several new hotel developments are also slated to open in downtown Ottawa in the next couple of years, including: Germain Groupe’s ALT Hotel, a 148-room hotel located on Slater Street; the 200-room Andaz Ottawa Byward Market, the first of this Hyatt hotel brand in Canada; a 167-room Holiday Inn on St. Patrick Street; and a 303-room Hilton-brand complex on Queen Street.

- The Tourism Industry Association of Canada (TIAC), the only national organization representing the full cross-section of Canada's $88.5 billion tourism industry, is hosting its annual Tourism Congress in Ottawa, December 1/2, 2015.

Background

According to the City of Ottawa’s most recent Annual Development Report, the accommodation and food services sector - which comprises the majority of Ottawa tourism business – is one of the largest industries in Ottawa, employing more than 35,000 residents in 2014. It is also one of the fastest growing industries in the city, having expanded by 28 per cent between 2010 and 2014 (see Figure 1).

Figure 1: Growth in the Accommodation and Food Services Sector, 2010-2014

Hotels are a cornerstone of Ottawa’s accommodation and food services sector, and the city is home to most of the world’s major hotel operators (i.e., Starwood Hotels and Resorts, Wyndham Hotel Group, Marriott Hotels of Canada, Intercontinental Hotels Group, Hilton Canada, and Best Western International).

The Ottawa-Gatineau Hotel Association (OGHA), an association of hoteliers in the Ottawa-Gatineau region, reports that its member hotels are responsible for an estimated $125 million in annual salaries and over $80 million in taxes into the local economy.

More specifically, OGHA estimates that a large (400+ rooms), higher end member hotel can pay upwards of $1.7 million annually in property taxes. Even the smaller hotels (50+ rooms) are contributing more than $100,000 annually in property taxes paid to the city. Put another way, the OGHA estimates that, every hotel room can generate on average as much taxes as a typical Ottawa townhouse (from $1800-$3200 annually), meaning that a single hotel can represent the equivalent of a portion of a subdivision worth of revenue for the city.

In addition to the taxes generated, participating OGHA members contribute a destination marketing fee (DMF) – the equivalent of three per cent of their revenues from room fees – to the city’s main promotional body, Ottawa Tourism, to attract tourists to Ottawa.

Hotel Occupancy

One of the indicators that can be used to describe the performance of Ottawa’s hotel industry is the hotel occupancy rate, a measure of the number of rooms sold as a proportion of the total available inventory for a given period.

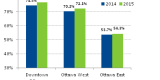

The hotel occupancy rate in Ottawa sat at 69.8 per cent in 2014, up 1.5 per cent from 2013. Downtown hotels had a somewhat higher occupancy rate on average in 2014 (73.7 per cent) than hotels in the west and east of the city (69.8 per cent and 54.7 per cent, respectively).

The overall occupancy rate in the first three quarters of 2015 sat at 71.6 per cent – a slight improvement over the 70.2 per cent rate for the same period last year (see Figure 2). While all areas of the city are experiencing higher occupancy rates to date, downtown hotels have thus far had the largest proportionate increase over 2014 (+2.1 per cent).

Figure 2: Occupancy Rate by Area in Ottawa, 2014-2015 (YTD)

(Chart source: PKF Consulting Inc., a CBRE Company with reproduction and use of information subject to PKF Disclaimer and Restrictions as detailed at www.pkfcanada.com.)

Ottawa has historically had one of the highest and most stable hotel occupancy rates in Canada. In comparison to Canada’s largest markets, Ottawa’s average occupancy rate between 2010 and 2014 was 69.2 per cent, which is higher than the greater metropolitan areas of Calgary (69.0 per cent), Vancouver (68.7 per cent), Toronto (67.3 per cent), Edmonton (66.0 per cent), and Montreal (66.2 per cent).

Average Daily Rates

Along with occupancy rate, the average daily rate (or ADR) is another one of the core indicators used to measure the performance of the hotel industry. This number represents the average rental income per paid occupied room in a given time period.

In 2014, the combined ADR of Ottawa hotels was $143.45, up 2.6 per cent (or an average of $3.80) over 2013 rates. Not surprisingly, the hotels in Ottawa’s downtown, which are close to many of the city’s tourism attractions, fetched an average daily rate that was about 20 per cent higher than hotels outside of the downtown core ($151.49 vs. $124.75).

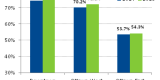

The Ottawa ADR for the first three-quarters of 2015 was $147.37, up from $142.13 for the same period last year. While hotels in all areas of the city are posting higher ADRs to date, those in Ottawa East have had the most growth over the same period in 2014 (+5.6 per cent compared to 2.9 per cent for hotels in Ottawa West and 4.2 per cent for downtown hotels).

Ottawa’s ADRs have grown steadily over the past several years, meaning that the industry as a whole is bringing in more revenue. In fact, Ottawa’s ADRs are among the highest rates in the country (see Figure 3). The only similarly sized metropolitan centre with a higher combined ADR for the period between 2011 and 2015 was greater Calgary ($156.94).

Figure 3: Combined 5-Year Average Daily Rates in Major Cities

(Chart source: PKF Consulting Inc., a CBRE Company with reproduction and use of information subject to PKF Disclaimer and Restrictions as detailed at www.pkfcanada.com.)

Hotel Revenue

The final and perhaps the most important measure of the financial health of the hotel industry is revenue per available room (also referred to as RevPAR). This metric is calculated by dividing a hotel's total guestroom revenue by the total number of available rooms at that property.

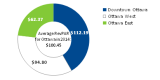

Ottawa’s RevPAR rate averaged $100.45 in 2014, which is up from $95.63 in 2013 (see Figure 4). Downtown hotels had a somewhat higher RevPAR on average in 2014 ($112.19) compared to hotels in the west and east ends of the city ($94.80 and $62.37, respectively).

Figure 4: Revenue per Available Room by Area in Ottawa, 2014

(Chart source: PKF Consulting Inc., a CBRE Company with reproduction and use of information subject to PKF Disclaimer and Restrictions as detailed at www.pkfcanada.com.)

Revenue rates are trending even higher in 2015. For the first three quarters of this year, Ottawa’s RevPAR averaged $105.87, which represents an increase of 5.8 per cent over the first three quarters of last year. In fact, RevPAR has risen across the city, with hotels in Ottawa’s downtown experiencing the highest growth in revenues (+7.3 percent).

A comparison of average RevPAR rates across major centres reveals that Ottawa is also one of the more profitable hotel markets in Canada. Ottawa’s average RevPAR between 2011 and 2014 was $94.84, ahead of other metropolitan centres like Montreal ($89.14), Toronto ($85.81), and Edmonton ($81.86).

Industry Outlook

According to the PKF Consulting and CBRE Hotels’ Outlook for the Canadian Lodging Sector 2015/2016, outlook for the Ottawa hotel industry is very positive, with all of the performance indicators examined in this report expected to improve in 2015 and 2016.

Looking ahead to 2017, the celebrations planned for Canada’s 150th anniversary of confederation in Ottawa are expected to attract an additional 1.75 million visitors to the city, which will undoubtedly have a positive impact on the hotel industry in that year. In recognition of the probable benefits to its industry, the OGHA has pledged $2.5 million to the Ottawa 2017 initiative, making it the first private sector organization to contribute funding to the not-for-profit Ottawa 2017 Bureau.

In anticipation of the growth in demand for accommodations, Ottawa will be expanding its already impressive catalogue of hotels with the addition of the Germaine Groupe’s ALT Hotel at 199 Slater Street (148 rooms) and the Hyatt Andaz at 321 Dalhousie Street (200 rooms) in 2016 and a Holiday Inn at 364 St. Patrick Street (167 rooms) and a Hilton-brand complex (303 rooms) at 361 Slater Street in 2017.

Another Germaine Groupe hotel is expected to form part of the Arts Court Redevelopment project, which broke ground in August 2015.

Tables: Overview of the Hotel Industry in Ottawa

Table 1: Hotel Occupancy Rate

| Geography | 2010 | 2011 | 2012 | 2013 | 2014 | 5-year average | 2014 Q1-Q3 | 2015 Q1-Q3 |

|---|---|---|---|---|---|---|---|---|

| Ottawa | 67.6% | 70.8% | 69.3% | 68.3% | 69.8% | 70.4% | 70.2% | 71.6% |

| Downtown Ottawa | 69.7% | 72.1% | 72.3% | 70.8% | 73.7% | 71.7% | 74.5% | 76.6% |

| Ottawa West | 61.3% | 67.3% | 69.1% | 69.5% | 69.8% | 67.4% | 70.2% | 72.1% |

| Ottawa East | 64.7% | 67.4% | 53.5% | 53.9% | 54.7% | 58.9% | 53.7% | 54.3% |

Table 2: Average Daily Rates

| Geography | 2010 | 2011 | 2012 | 2013 | 2014 | 5-year average | 2014 Q1-Q3 | 2015 Q1-Q3 |

|---|---|---|---|---|---|---|---|---|

| Ottawa | $133.13 | $135.62 | $141.14 | $139.65 | $143.45 | $138.60 | $142.13 | $147.36 |

| Downtown Ottawa | $136.79 | $139.75 | $146.83 | $145.21 | $151.49 | $144.01 | $150.25 | $156.82 |

| Ottawa West | $127.58 | $130.26 | $132.98 | $133.11 | $135.85 | $131.96 | $134.76 | $138.80 |

| Ottawa East | $110.31 | $108.99 | $113.99 | $113.88 | $113.65 | $112.16 | $111.19 | $117.74 |

Table 3: Revenue Per Available Room

| Geography | 2010 | 2011 | 2012 | 2013 | 2014 | 5-year average | 2014 Q1-Q3 | 2015 Q1-Q3 |

|---|---|---|---|---|---|---|---|---|

| Ottawa | $91.28 | $96.46 | $98.16 | $95.63 | $100.45 | $96.39 | $100.07 | $105.87 |

| Downtown Ottawa | $96.85 | $101.41 | $106.65 | $103.22 | $112.19 | $104.06 | $112.53 | $120.73 |

| Ottawa West | $78.96 | $87.74 | $91.94 | $92.46 | $94.80 | $89.18 | $94.58 | $100.18 |

| Ottawa East | $71.27 | $73.39 | $61.16 | $61.54 | $62.37 | $65.94 | $59.82 | $63.97 |

Capital Investment Track Edition

Introduction

For the past several years, the Department of Economic Development and Innovation (EDI) has been providing thoughtful and consistent analysis of Ottawa’s economy and related markets through its monthly Economic Development Update. This fall, EDI will begin producing special editions of the Update, each of which will explore in greater detail different facets of the local economy.

The Capital Investment Track Edition is among the first of these special reports to be produced. This report provides an overview of the Capital Investment Track (CIT) Program, including a brief description of the projects currently underway and their impact on the local economy.

Highlights

- There have been six confirmed CIT projects to date, each of which will meet the Program objectives of quality job creation and employment sector contribution upon completion.

- Several of the existing CIT’s will support the tourism industry, Ottawa’s fourth largest employment sector, with the creation of new accommodations and attractions.

- The city’s high tech capacity has also been bolstered by securing industry leaders like Sanmina and MXI technologies with CIT projects.

- Many of the existing CIT projects will enhance Ottawa’s retail offering, thereby minimizing the leakage of consumer spending in other markets.

- Altogether, these six projects are, upon completion, expected to contribute nearly $3 billion in investment and approximately 15,000 jobs to the Ottawa market.

Background

The City of Ottawa introduced the Capital Investment Track (CIT) Program in 2012 to guide investment projects through City requirements and processes (e.g., planning approvals, permitting, building code compliance, development charge determination, etc.).

The CIT Program is promoted to companies looking to either establish or expand their operations in Ottawa. CIT projects benefit from the dedicated service of an EDI Account Manager, who provides guidance and ensures that all City issues relating to a given project are resolved in a timely and effective manner.

Existing CIT Projects

There has been considerable interest in the CIT Program since its inception, however, only a select number of projects have met the necessary criteria for participation.

In order to qualify for the CIT Program, investment projects must be deemed a strategic priority by the City. Accordingly, projects are considered “strategic” when they achieve one or more of the following objectives:

- they create or preserve a large number of jobs in Ottawa;

- they create or preserve quality employment in the city (i.e., knowledge-based); and

- they contribute to the development of one of Ottawa’s employment sectors.

There have been six confirmed CIT projects to date, each of which will meet the aforementioned objectives of quality job creation and employment sector contribution upon completion. Chart 1 plots the current projects based on the scope of the different developments underway (i.e., the physical size of the projects), the monetary investments that are expected to be made, and the estimated impact on employment sector development (i.e., number of jobs created).

Figure 1: Comparison of Current CIT Projects

CIT Project Profiles

In this section, a short summary of each of the current CIT projects is provided.

- The Regional Group is responsible for CitiGate, Ottawa’s first master-planned prestigious business park development with a variety of retail, commercial, office and automotive uses planned. Servicing of the site was completed in 2014 and construction is now underway.

- The Zibi development is a world-class sustainable community and redevelopment project by Windmill Development Group and Dream Unlimited Corporation located in downtown Ottawa. Plans for this site include a boutique hotel, waterfront parks and a network of pedestrian and cycling paths providing public access to the Ottawa River.

- Taggart Realty Management is developing the Kanata West Business Park a commercial subdivision which will be home to office and industrial uses as well as a retail shopping component anchored by Cabela’s (a major outdoor goods retailer with sufficient draw to attract visitors from outside of the region). Confirmed land uses in the subdivision include an office building and training facility for the Carpenters Union, a logistics facility for UPS, and an orthodontic clinic. Further expressions of interest have been received from hotel users and large office and industrial users.

- Broccolini is relocating Sanmina and its Ottawa-based high-tech employees to a new site located in the Kanata North Business Park. The CIT was essential for ensuring that this international company remained in Ottawa, as opposed to relocating its workforce elsewhere in Canada or the world.

- This development by RNR Ottawa Inc. will include the renovation of existing office space to accommodate MXI Technologies, and at least one other technology company that is expanding in Ottawa. The project also involves the creation of new commercial, light industrial and lab space.

- This project by Claridge Homes involves the construction of a 200 room boutique-inspired hotel in Ottawa’s Byward Market. This property will be the first of the Andaz Hotel by Hyatt brand in Canada and is expected to open early in 2016.

Taken together, these six projects are expected to:

- add more than 15,000 jobs to Ottawa;

- contribute more than $3 billion in investments upon completion;

- support the tourism industry, Ottawa’s fourth largest employment sector, with the creation of new accommodations and attractions (e.g., Cabala’s destination retail experience);

- bolster the city’s high tech capacity by securing industry leaders like Sanmina and MXI technologies; and

- enhance Ottawa’s retail offering, thereby minimizing the leakage of consumer spending in other markets.

It is important to note that, given the large scale of these projects and the fact that most are still underway, the aforementioned estimated economic impacts are subject to change. Further details of the estimated economic impacts are included in Table 1 at the end of this document.

Table 1: Current CIT Projects and Estimated Economic Benefits*

| Project Name | Developer | Industries Supported | # of Jobs | Property Tax Uplift | Development Charges | Permit Fees | Total Potential Investment |

|---|---|---|---|---|---|---|---|

| CitiGate | The Regional Group | Technology, Retail | 11,000 | $2,000,000 | $25,000,000 | $2,000,000 | $600,000,000 |

| Zibi | Windmill Development Group & Dream Unlimited Corp. | Tourism, Retail | 3,000 | $1,500,000 | $6,000,000 | $750,000 | $1,500,000,000** |

| Kanata West Business Park | Taggart Realty Management | Tourism, Retail, Manufacturing | 5,500 | $10,000,000 | $45,000,000 | $5,000,000 | 1,000,000,000 |

| Sanmina | Broccolini | Technology | 420 | $300,000 | $800,000 | $100,000 | $22,000,000 |

| MXI Technologies | RNR Ottawa Inc. | Technology, Retail | 130 | $225,000 | $900,000 | $11,400 | $25,000,000 |

| Andaz Hotel by Hyatt | Claridge Homes | Tourism | 100 | $1,000,000 | $550,000 | $60,000 | $30,000,000 |

* The estimated economic impacts provided in this table are subject to change.

** Estimated value for Zibi is for the entire project (both Ottawa and Gatineau portions).

Tourism Edition: Visitor Profile

Introduction

For the past few years, the Department of Economic Development and Innovation (EDI) has been providing thoughtful and consistent analysis of Ottawa’s economy and related markets through its monthly Economic Development Update. In 2015, EDI began producing special editions of the Update, each of which explored in greater detail different facets of the local economy.

The Tourism Edition: Visitor Profile is the second special report focusing on the tourism sector. This report provides a snapshot of visitors to Ottawa-Gatineau in 2012 (the most recent year this information is available), with the intent of tracking these trends over time. Specifically, this report will profile visitors by origin, purpose, duration of trip, and individual spending.

Highlights

- Ottawa-Gatineau welcomed 10.5 million visitors in 2012, an increase of 5.6 per cent over 2011. More visitors make day trips to the city (5.6 million as opposed to the 4.9 million that stayed overnight).

- Of those staying overnight, a vast majority (86.2 per cent) visited from other cities within Canada. Less than 1 in 10 came from overseas (7.1 per cent) or the United States (6.7 per cent).

- In 2012, approximately half (50.9 per cent) of all overnight visitors to Ottawa-Gatineau came to visit friends and relatives (VFR), while about one-third (30.8 per cent) listed pleasure as the reason for their trip. The proportion of those visiting Ottawa for business purposes stood at 15.5 per cent.

- The number of “pleasure” visits saw the sharpest increase in 2012 (+42.1 per cent over 2011). Notably, convention visitors – a sub-category of business travel – also increased significantly in 2012 (+26.6 per cent over 2011 figures).

- From an economic impact perspective, visitors coming from overseas markets (Europe, Asia) and business travellers tend to be the most attractive types of visitors, as they tend to both stay longer and spend more than their counterparts.

New & Noteworthy

- Ottawa 2017 recently announced a partnership with the CIBC that will see the two organizations co-host the 150th anniversary of Canada’s confederation in Ottawa, a year-long celebration that is expected to increase the number of visitors to the city in 2017 by 1.75 million.

Background

Visitor statistics are some of the most commonly used metrics to describe the tourism industry.

In Canada, visitor statistics are primarily derived from two sources: the Travel Survey of Residents of Canada and the International Travel Survey, both of which are conducted by Statistics Canada on an annual basis. In partnership with federal, provincial and territorial tourism departments, the survey data is then customized by Research Resolutions and Consulting Ltd. to reflect spending and lodging in provinces, cities and other administrative areas.

The information in this snapshot is based on the customized survey data prepared for Ottawa Tourism in a report entitled, All Visitation to Canada’s Capital Region 2012, which summarizes the domestic and international tourism activity in the Ottawa-Gatineau Census Metropolitan Area (CMA) in 2012. More specifically, the report will examine the overall volume of travel (i.e., the number of visitors to the destination), the origin of visitors, the purpose and duration of trips to Ottawa-Gatineau, and the average spending patterns of visitors to the city.

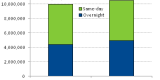

Visitor Volume

According to Statistics Canada, total visitation to Ottawa-Gatineau CMA in 2012 reached 10.5 million, which represents an increase of 5.6 per cent over the 9.9 million visitors to the city in 2011 (see Figure 1).

This growth was driven almost entirely by an increase in the number of “overnight visitors” to the city in 2012 (up 12.1 per cent to 4.9 million) as opposed to “same-day” visitors (up +0.5 per cent to 5.6 million).

Notably, Ottawa-Gatineau outstripped other Canadian cities – including Toronto and Montreal – in terms of the rate of growth in visitors to the city in 2012.

Figure 1 – Visitors to Ottawa-Gatineau, 2011-2012

Given the larger economic impact of overnight visits – and as per industry practice – the remainder of this report will focus on overnight visitors to Ottawa-Gatineau.

Visitor Origin

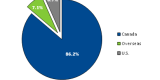

The term “visitor origin” refers to a visitor’s geographical place of residence. Statistics Canada segments its data into three broad categories to capture visitor origin: Canada, the United States and Overseas.

As shown in Figure 2, Canadians comprised the largest proportion of overnight visitors to Ottawa-Gatineau in 2012 (86.2 per cent), followed by overseas visitors (7.1 per cent) and visitors from the United States (6.7 per cent).

Figure 2 – Overnight Visitors to Ottawa-Gatineau by Origin, 2012

The total number of overnight visitors to Ottawa-Gatineau that came from within Canada reached 4.2 million in 2012 (+10.8 per cent from 2011). A vast majority (93.3 per cent) of domestic visitors were from Ontario and Quebec (n=3.9 million). Likewise, the largest city markets were Toronto (900,980 visitors) and Montreal (851,106 visitors).

In terms of the U.S. market, over 328,000 American visitors travelled to Ottawa-Gatineau for overnight stays in 2012 (+30.3 per cent from 2011). The top five U.S. markets to the capital region were: New York (51,100 visitors), California (27,900 visitors), Pennsylvania (19,700 visitors), Florida (19,500 visitors) and Massachusetts (18,400 visitors).

In 2012, more than 350,000 overnight visitors travelled to Ottawa-Gatineau from jurisdictions other than Canada and the U.S. (+12.7 per cent from 2011). The top five overseas markets were: the United Kingdom (56,000 visitors), France (40,300 visitors), China (30,100 visitors), Germany (26,900 visitors) and Australia (21,800 visitors).

Trip Purpose

Another way of examining visitor statistics is by trip purpose (i.e., the primary reason for travelling to a destination). Statistics Canada distinguishes between the following travel purposes: business, pleasure, and visiting friends and relatives (VFR).

In 2012, the most common reason provided for overnight travel to Ottawa-Gatineau was to visit with friends and relatives (50.9 per cent). Approximately 30.8 per cent of overnight visitors travelled for pleasure, while 15.5 per cent travelled for business. A very small proportion (2.8 per cent) provided another reason for their visit.

Figure 3 – Overnight Visitors to Ottawa-Gatineau by Trip Purpose, 2012

The number of “pleasure” visits saw the sharpest increase in 2012 (+42.1 per cent over 2011). An increase in convention travel in 2012 (+26.6 per cent) – which coincided with the first full year of operation of Shaw Centre – resulted in an overall slight rise in business travel to the capital (+6.3 per cent).

Visitor spending

One way to quantify the economic impact of the Ottawa-Gatineau tourism industry is by looking at the amount of money visitors spend on things such as accommodation, food and beverage, local transportation, recreation and entertainment, and retail shopping.

In 2012, overnight visitors spent $1.35 billion in total (compared to the $439 million spent by same day visitors) and stayed an average of 2.8 nights. Put another way, the average overnight visitor to Ottawa-Gatineau spent $243. It is important to note that this total includes all overnight visitors, many of which do not stay in paid accommodations.

In terms of the different segments of travellers, overseas visitors tended to stay longer and spend more than their Canadian and American counterparts. Likewise, when it comes to the different reasons for travel, those visiting for business tend to outspend and outstay those travelling for pleasure or to visit friends and relatives (see Figure 4).

Figure 4 – Traveller Segments by Average Visitor Spending and Length of Stay, 2012

Visitor Outlook

The City of Ottawa recognizes that the tourism industry is one of the most important economic drivers for the city. As such, a concerted effort has been made in recent years to expand Ottawa’s tourism offerings and enhance the visitor experience, all with the intent of increasing the number of visitors to and tourism spending in the city.

In 2011, for example, the City partnered with Ottawa Tourism to create Events Ottawa, a major event office responsible for proactively targeting and attracting a diverse set of major events to Ottawa. By 2018, it is anticipated that the combination of bids won by this office will result in an influx of close to $57 million into Ottawa’s economy.

Looking ahead, the celebrations planned for the 150th anniversary of Canada’s confederation in 2017 are also expected to attract additional visitors to Ottawa. By offering a variety of cultural, sporting, social and business events, the celebrations will enhance the tourist experience and elevate Ottawa’s reputation as a world-class tourism destination over the longer term.

Lastly, the Department of Economic Development and Innovation has received broad support for its strategic update, Partnerships for Innovation, which identifies a number of other initiatives to attract additional visitors and increase tourism spending in Ottawa (e.g., support for international convention attraction, investing further in tourism attraction).

Tables: Overview of Visitor Spending

Table 1: Total Visitors to Ottawa-Gatineau, 2012

| Visitor Type | Number of Visitors | % of Total Visitors | 2011/2012 % Change | Average Length of Stay (days) | Average Spending ($) |

|---|---|---|---|---|---|

| Same-Day Visitors | 5,599,900 | 53.3 | +0.5 | - | 78 |

| Overnight Visitors | 4,915,100 | 46.7 | +12.1 | 2.8 | 243 |

| Total | 10,515,000 | 100.0 | +5.6 | - | - |

Table 2: Overnight Visitors to Ottawa-Gatineau by Origin, 2012

| Visitor Origin | Number of Visitors | % of Total Visitors | 2011/2012 % Change | Average Length of Stay (days) | Average Spending ($) |

|---|---|---|---|---|---|

| Canada | 4,236,500 | 86.2 | +10.8 | 2.5 | 212 |

| United States | 328,400 | 6.7 | +30.3 | 3.1 | 435 |

| Overseas | 350,210 | 7.1 | +12.7 | 6.3 | 503 |

Table 3: Overnight Visitors to Ottawa-Gatineau by Trip Purpose, 2012

| Trip Purpose | Number of Visitors | % of Total Visitors | 2011/2012 % Change | Average Length of Stay (days) | Average Spending ($) |

|---|---|---|---|---|---|

| Business | 761,700 | 15.5 | +6.3 | 3.6 | 549 |

| Pleasure | 1,514,300 | 30.8 | +42.1 | 2.5 | 278 |

| VFR | 2,502,000 | 50.9 | +5.3 | 2.8 | 135 |