Key features

City of Ottawa Green Debentures share the same characteristics as conventional debentures and are ranked concurrently and equally in respect of payment of principal and interest with all other debentures of the City.

Eligible projects

The City of Ottawa has developed a Green Debenture Framework under which it issues Green Debentures. The Framework identifies eight eligible categories to which bond proceeds may be directed:

- renewable energy

- energy efficiency

- pollution prevention and control

- clean transportation

- sustainable water management

- sustainable management of natural resources

- climate change adaptation and resilience

- green buildings.

The net proceeds of each Green Debenture issued under the Framework will be used to finance, in whole or in part, capital projects that promote environmental sustainability across the City. Specific objectives for these projects will be to mitigate and adapt to the effects of climate change, reduce greenhouse gas (GHG) emissions, and promote the transition to a low-carbon economy.

Assurances

The City has engaged Sustainalytics, an independent sustainability rating firm, to provide a second opinion on its Green Debenture Framework and the framework’s environmental credentials as it relates to Green Bond Principles.

Alignment with green bond principles

Sustainalytics is of the view that the City of Ottawa’s Green Debenture Framework is aligned with the four pillars of the Green Bond Principles 2017, which addresses use of proceeds, process for project evaluation and selection, management of proceeds, and reporting. Based on the above considerations, Sustainalytics is of the view that the City of Ottawa’s Green Debenture Framework is robust and credible.

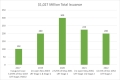

Green debenture issuance

City of Ottawa’s Inaugural Green Debenture issue in November 2017 marked the first Municipal Green Bond issue in the Canadian market. To date, Ottawa had five Green Bond issues. All Green Bonds were available through Ottawa’s syndicate group for placement with Canadian and international institutional investors. The Ottawa May 2051 Green Bond is included in the Bloomberg MSCI Green Bond Index.

With C$1,027 million of Green Bonds issued, Ottawa is now the second largest Canadian Municipal and fourth largest Canadian government issuer of Green Bonds.

| Year | Stage | Issuance |

|---|---|---|

| 2017 | LRT Stage 2 MOU (Inaugural Issue 3.259% of Nov 2047) | $102,000,000 |

| 2019 | LRT Stage 1 & Stage 2 (Re-open Nov 2047) | $200,000,000 |

| 2020 | LRT Stage 2 (2.525% of May 2051) | $300,000,000 |

| 2021 | LRT Stage 1 & Stage 2 (Re-open May 2051) | $225,000,000 |

| 2022 | LRT Stage 2 (4.115% of Dec 2052) | $200,000,000 |

Investor distribution

Well-diversified placements with Asset Managers, Insurance Funds, Pension Funds and Government Agencies.

| Investor Type | Distribution (%) |

|---|---|

| Bank/Retail | 1% |

| Government | 5% |

| Pension | 17% |

| Insurance | 20% |

| Asset Managers | 57% |

Investor location

Demand for the Ottawa Green Bond is primarily concentrated in Canada, with an average of 90% bonds placed domestically; however, interest from international accounts is growing and represented 17% of the 2021 issuance.

| Location | Issuance (%) |

|---|---|

| Canada | 90% |

| International | 10% |

Strong interest from green mandate investors

Investors who have demonstrated support for ESG, green investment practices and mandates represented 92% of overall sales.

| Investors | Distribution (%) |

|---|---|

| Investors with Green mandates and/or UN PRI Signatories | 92% |

| Other | 8% |

Use and management of proceeds

The net proceeds of all Green Debentures were allocated to the following projects in compliance with the City of Ottawa Green Debenture Framework and in accordance with the appropriate By-Laws.

| By-law # | Clean transportation project | Green bonds proceeds | Funds disbursed | Balance |

| 2017-355 | 908650 - LRT Stage 2 - RTG MOU | 102,000,000 | 102,000,000 | - |

| 102,000,000 | 102,000,000 | - | ||

| 2019-272 | 907926 - LRT Stage 2 | 153,300,000 | 153,300,000 | - |

| 905176 - LRT Stage 1 Confederation Line | 46,700,000 | 46,700,000 | - | |

| 200,000,000 | 200,000,000 | - | ||

| 2020-110 | 907926 - LRT Stage 2 | 300,000,000 | 300,000,000 | - |

| 300,000,000 | 300,000,000 | - | ||

| 2021-359 | 905176 - LRT Stage 1Confederation Line | 8,812,200 | 8,812,200 | - |

| 907926 - LRT Stage 2 | 216,187,800 | 216,187,800 | - | |

| 225,000,000 | 225,000,000 | - | ||

| 2022-166 | 907926 - LRT Stage 2 | 200,000,000 | 200,000,000 | - |

| 200,000,000 | 200,000,000 | - |

The proceeds were used to finance spending on the projects identified in the table. As of December 31, 2022, 100% of proceeds have been allocated to the project.

Green debenture project update

Project overview

The City of Ottawa’s LRT Confederation Line - Stage 1 project has provided a more accessible connection to the Ottawa’s downtown area. The LRT Stage 2 expansion will build on the City’s Confederation Line investment by extending light rail an additional 30 kilometres, bringing 70% of residents to within 5 kilometres from an LRT station and connecting the City’s communities to the east, west, and south. In March 2019, Ottawa City Council approved the Stage 2 Project. The LRT extension is not only part of an official, integrated land-use plan and the City’s Transportation Master Plan, it is also in line with Federal and Provincial commitments for transit expansion.

Estimated environmental benefits

The business case for this project identified the following benefits:

- Increased ridership: Total system ridership is expected to increase to 164 million trips per year as result of Stage 1 LRT. Stage 2 LRT is expected to increase ridership by additional 10 million plus trips per year by 2031

- Decreased congestion: majority of buses removed from downtown streets; reduction of approximately one sixth of total vehicle kilometres travelled by 2031

- Improved mobility: travel time savings and improved access from extended areas of the City

- Vehicle operating cost savings: fuel and maintenance

- Public health: benefits associated with reduction in harmful emissions as a result of replacing diesel buses with electric trains; reducing contributions to climate change; reducing the number of collisions; mobility options for those who rely on public transit for access to health care

- Land use: more compact urban form; increased clustering and accessibility

- Economic development: increased employment; GDP and tax contributions

- Environmental Benefits: the conversion to electric rail from diesel buses will result in a reduction in the greenhouse gases (GHGs) and critical air contaminants (CACs), which have direct implications for the overall sustainability of urban growth and direct consequences on the health of residents.

- It is estimated that Stage 1 – Confederation Line would reduce GHG emissions by 94,000 tonnes and CAC by 4,600 tonnes by 2031;

- Stage 2 would reduce the GHG emissions by over 110,000 tonnes and CAC by over 3,000 tonnes by 2048

Project Status Update

The City of Ottawa’s Rail Construction Program oversees the construction and implementation of the Stage 2 LRT project. Construction continues in all geographic areas of the project, and City staff are working closely with the contractors to manage any delays to the schedule.

Stage 1 LRT - The O-Train Confederation Line Light Rail Transit system opened in September 2019 providing high frequency train service between Blair and Tunney’s Pasture stations, and through downtown.

City staff are collecting performance information from different service areas; however, current data is influenced by travel patterns related to remote work arrangements in place and is difficult to compare with data from before LRT system opened. Transit ridership dropped to 14% of pre-COVID, April 2019, levels in April 2020, and has been recovering gradually, reaching 61% of usual volumes at end of December 2022.

As the effects of COVID-19 on ridership recede and the system becomes more reliable, more customers have resumed using public transit to return to on-site work and on-campus learning. City staff are monitoring the ridership numbers and trends and reporting to the City’s Transit Commission on a monthly basis.

Stage 2 LRT – Construction activities for Stage 2 commenced in 2019 and are currently well underway. Stage 2 will extend the current system farther south, east, and west, adding 44 kilometres of new rail and 24 new stations by 2026. There was significant progress made on Trillium Line South extension and Confederation Line East and West extensions in 2022. Various construction activities are completed or currently ongoing, such as modifications to highways, interchange ramps and intersections; road detours; utilities relocations; new bridges construction; construction of new drainage work; construction of new stations; construction of new parking lots at Park and Ride locations. Rideau Transit Group is providing 38 additional Alstom Citadis Spirit light rail vehicles to ensure that the expanded Stage 2 Confederation Line operates as a single, uniform service. The Rail Construction Program is monitoring the production of this expanded fleet with special attention being placed on ensuring that all hardware and software improvements and upgrades resulting from in-service experience of the Stage 1 are applied to the new vehicles.

Future issuance plans

The City of Ottawa remains committed to the Green Bond market. The City is also in the process of updating its Green Bond Framework. The update will include the expansion from Green to Sustainable Framework to allow for a greater breadth of potential bond offerings in the future. Subject to market conditions, Ottawa will continue issuing debentures under the Sustainable Framework going forward. The City is planning to issue $100 million Sustainable Debenture in 2024 and approximately $150 million in Sustainable Debentures annually from 2025 to 2027.

Contact Us

Finance and Corporate Services Department

100 Constellation Crescent

Ottawa, ON K2G 6J8

Tel: 613-580-2424

Mark Martin, Manager Treasury, ext. 21307

Vera Torkot, Senior Investment Officer, ext. 28400

Dan Bate, Senior Investment Officer, ext. 21310